Impact of interest rate increase on the real estate market

On December 9, 2025, Batdongsan.com.vn held the Vietnam Real Estate Conference - VRES 2025 in Hanoi. At the event, Mr. Nguyen Quoc Anh - Deputy General Director of Batdongsan.com.vn - said that in the last quarter of the year, interest rates began to increase as many commercial banks recorded a decrease in deposit volume, pushing 12-month deposit interest rates to 5.3-5.5%/year.

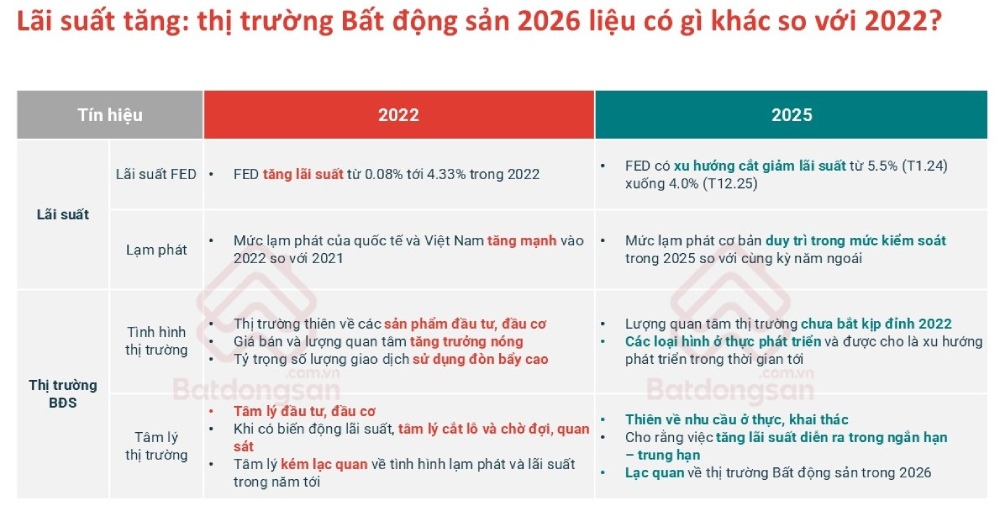

Mr. Nguyen Quoc Anh said that to properly assess the impact of the year-end interest rate increase, it is necessary to put this phenomenon in correlation with the 2022 period.

From a market perspective, he emphasized the clear difference between the two times of interest rate increase. In 2022, the real estate market will be "hot" when speculative products will dominate. In particular, the large proportion of transactions using financial leverage makes the market fragile, so when interest rates suddenly increase, many investors are no longer able to pay interest, liquidity decreases sharply and land is almost "frozen".

Meanwhile, Mr. Quoc Anh sees the market in 2025 as much "calmer", with a clear shift to products associated with real housing needs. Although the level of interest in buying and selling has not returned to the peak of 2022, cash flow is currently focusing on transparent legal products, reflecting the cautious psychology of investors after the 2022 shock as well as the more sustainable development trend of the market.

According to the Deputy General Director of Batdongsan.com.vn, the new legal corridor from the revised Land Law and Real Estate Business Law helps increase transparency and improve project implementation procedures. Land prices in 2025 in many localities are still lower than the 2022 peak, helping the market maintain stability and reduce risks.

He said that there are currently no signs of widespread land fever, the main hot spots are related to the story of merging administrative boundaries, while transactions are still concentrated in apartments and private houses in large cities.

In the short term, the market may be explored, but in the medium and long term, the recovery cycle has started since 2024 and there is still a lot of room. I think 2026 will be the time when the market will clearly differentiate and enter a more stable orbit. A stressful scenario like 2022 is unlikely to repeat, he said.

High housing prices create pressure, young people shift their strategy

Mr. Le Bao Long - Marketing Director of Batdongsan.com.vn - commented that the high real estate prices are creating great pressure on the ability of young people to own a house. However, instead of falling into a optimistic mentality, many people are proactively changing their financial strategies and allocating resources more flexibly to get closer to their settlement goals.

A survey by Batdongsan.com.vn with more than 1,000 consumers shows that the market records a clear differentiation in psychology and behavior of the 18-44 age group, reflected in prominent trends.

For those who are renting a house, especially young families, the goal of owning a place to live is still very clear. Up to 93% of married people with children surveyed said they aim to buy a house in the next 5 years, despite admitting that prices are still a big barrier. Many people choose to increase their income by working part-time, managing spending more closely or accumulating through savings.

More notably, the demand for home ownership in Ho Chi Minh City in the next 5 years will reach 81%, significantly higher than in Hanoi (69%), according to data from Batdongsan.com.vn. This difference mainly comes from the supply of low-cost apartments. In Ho Chi Minh City, the apartment segment under 3 billion VND accounts for 21-31% of total supply, while Hanoi only accounts for about 10%.

The supply of soft prices helps young people and middle-income families in Ho Chi Minh City have easier access to housing, thereby maintaining a high ownership demand rate. On the contrary, the Hanoi market is leaning towards the mid-range and high-end segments, with a common price range of 5-10 billion VND. This pushes ownership costs far beyond the financial capacity of most buyers, causing the demand for future home purchase plans to decrease significantly.

Mr. Long commented that, in addition to personal efforts, simplifying social housing procedures, transparency of conditions and expanding appropriate supply will help this group shorten the distance to the dream of settling down.