The busiest dividend season in many years

While many industries are tightening spending, the banking industry has had the busiest dividend season in many years, with tens of thousands of billions of VND poured into shareholders' pockets - especially owners who own large amounts of stocks. Some bank leaders expect to receive hundreds of billions of VND in cash, only from dividends distributed in the second quarter of 2025.

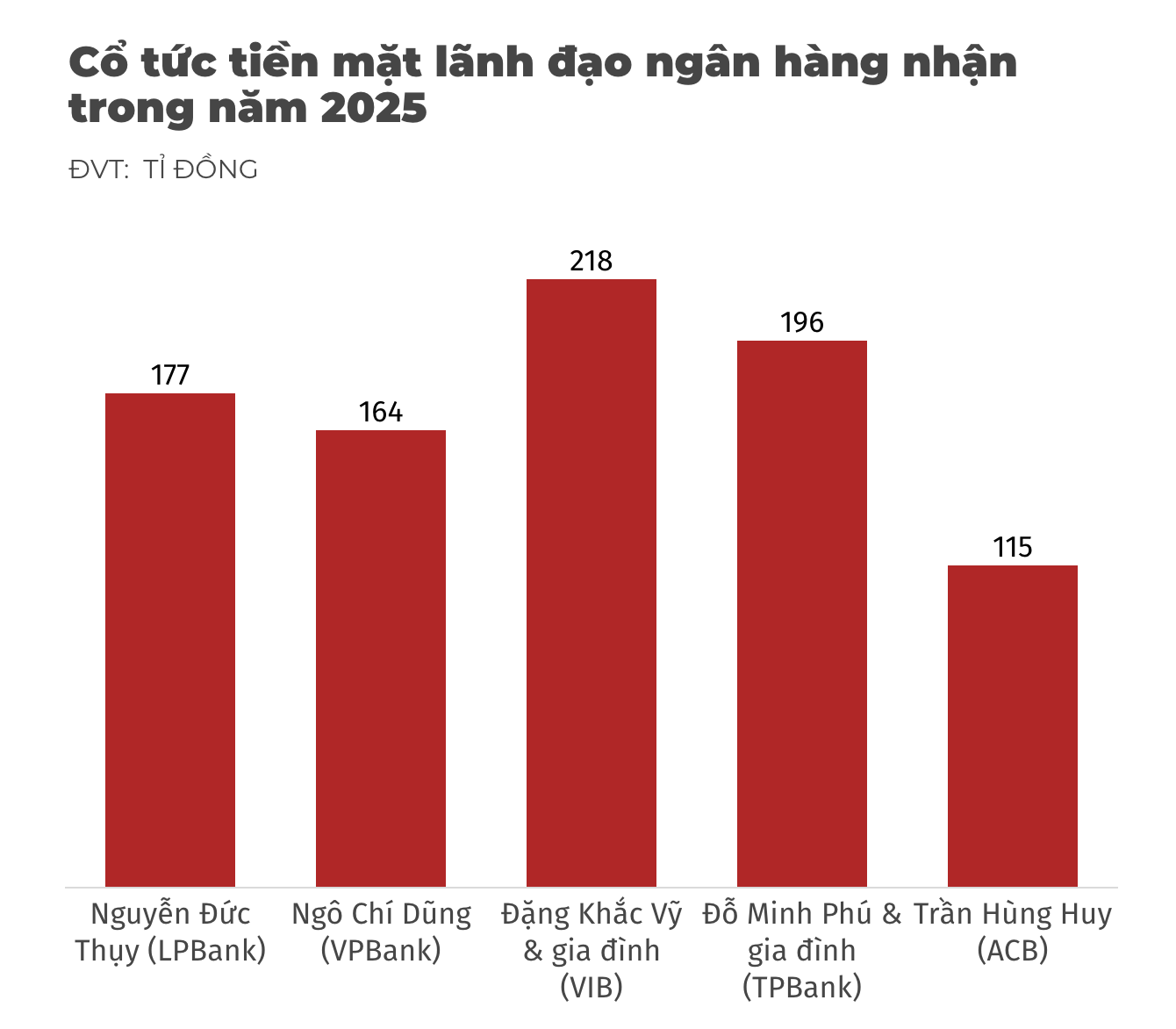

Leading the list is Mr. Nguyen Duc Thuy - Chairman of the Board of Directors of Loc Phat Commercial Joint Stock Bank (LPBank). With a plan to divide cash dividends at a rate of 25%, equivalent to VND2,500/share, LPBank is currently the bank that divides the highest dividend in the whole industry this year. Mr. Thuy - who owns more than 70.7 million LPB shares - is estimated to receive about 177 billion VND in cash after this dividend.

Next is Mr. Ngo Chi Dung - Chairman of the Board of Directors of VPBank. With the ownership of 328 million VPB shares, Mr. Dung will receive about 164 billion VND in cash from the 5% dividend that VPBank implemented in May. Mr. Dung's wife and mother - major shareholders at VPBank - also expect to earn hundreds of billions of VND if dividends are calculated.

At Vietnam International Commercial Joint Stock Bank (VIB), Mr. Dang Khac Vy - Chairman of the Board of Directors - along with his wife and son currently hold a total of about 311 million VIB shares. With a cash dividend ratio of 7%, equivalent to 700 VND/share, Mr. Vy's family of shareholders can receive more than 218 billion VND in cash this year.

Another familiar face on the list is Mr. Do Minh Phu - Chairman of the Board of Directors of TPBank. Along with his family, Mr. Phu is holding nearly 196 million TPB shares. With a cash dividend ratio of 10%, he and his relatives can receive about 196 billion VND.

No less notable is Mr. Tran Hung Huy - Chairman of the Board of Directors of Asia Commercial Joint Stock Bank (ACB). Owning about 115 million ACB shares, Mr. Huy expects to receive about 115 billion VND in the 2025 dividend.

More than VND33,000 billion in cash dividends will be "poured" into the market

According to statistics from published plans, the total amount of cash dividends that banks plan to pay in 2025 will reach more than VND33,000 billion - the largest figure in the past 5 years.

In addition to the above leaders, many other banks also announced cash dividends this year, such as Techcombank (10%), HDBank (maximum 15%), MB (3%), SHB (5%), OCB (7%)... Of which, Techcombank plans to spend more than VND 7,000 billion in dividends to shareholders, while VIB and TPBank also both spend over VND 2,000 billion each side. This is the first year in many years that the banking industry has simultaneously returned to the cash dividend distribution policy, instead of focusing all profits on increasing charter capital as in the previous period.

The dividend payment is a legal financial activity, demonstrating the recovery of the banking industry after the period of being required to retain profits to handle bad debts and ensure the safety of the system.

However, in the eyes of a small group of investors, it is worth discussing the huge difference between common shareholders owning a few thousand shares and "owners" holding hundreds of millions of shares, receiving hundreds of billions of VND in dividends after just one division.

A financial - banking expert said that the dividend policy is a legitimate right of shareholders. However, banks should also harmoniously calculate between rewarding shareholders and keeping profits to enhance financial capacity, especially in the context of many old loans that have not been completely handled, significant potential bad debts and the requirement to increase capital according to Basel II and Basel III standards is still a great pressure.