According to Article 3 of the Law on Personal Income Tax 2007, income subject to personal income tax includes:

- Income from business.

- Income from wages.

- Income from capital investment.

- Income from capital transfers.

- Income from real estate transfers.

- Income from winning prizes.

- copyright income.

- Income from commercial franchises.

- Income from inheritance is securities, capital in economic organizations, business establishments, real estate and other assets that must be registered for ownership or use.

- Income from receiving gifts is securities, capital in economic organizations, business establishments, real estate and other assets that must be registered for ownership or use.

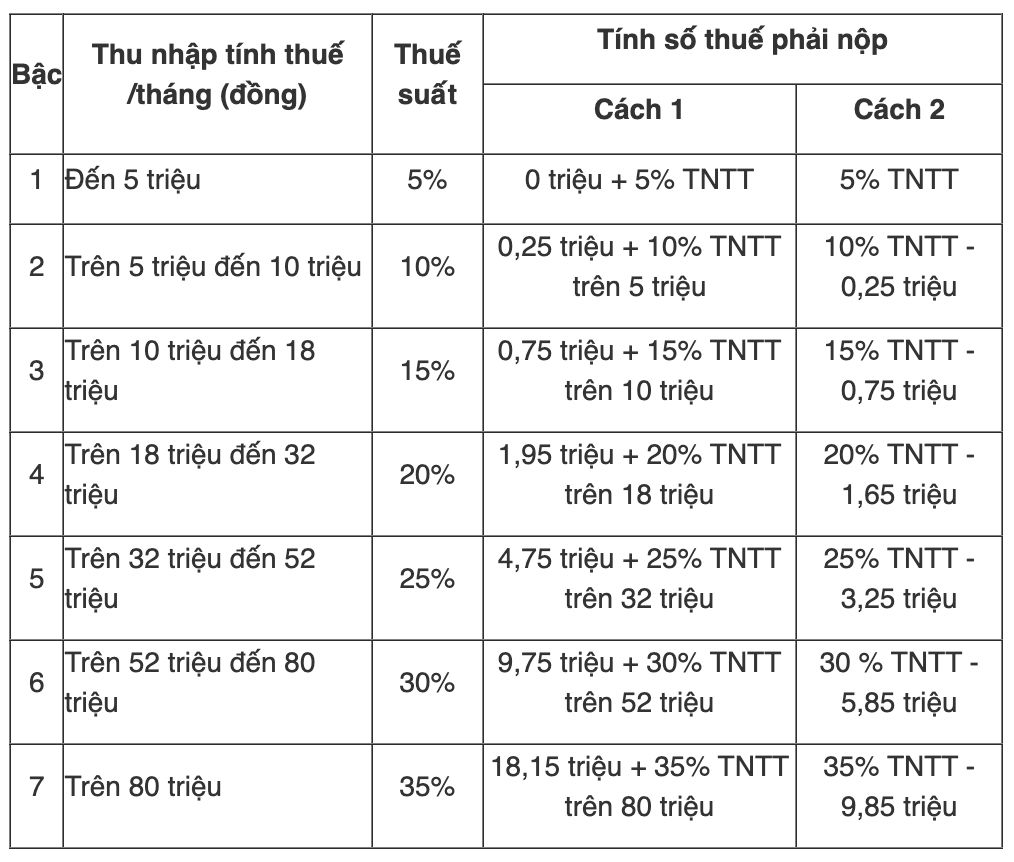

How to calculate personal income tax from current wages

The basis for calculating tax on income from wages is income for tax calculation and tax rate, specifically as follows:

personal income tax payable = Taxable income x Tax rate

In which:

Taxable income = Taxable income - Reductions.

Taxable income = Total income - Exempted expenses.

Or you can also apply the shortened method according to Appendix: 01/PL-TNCN issued with Circular 111/2013/TT-BTC as follows: