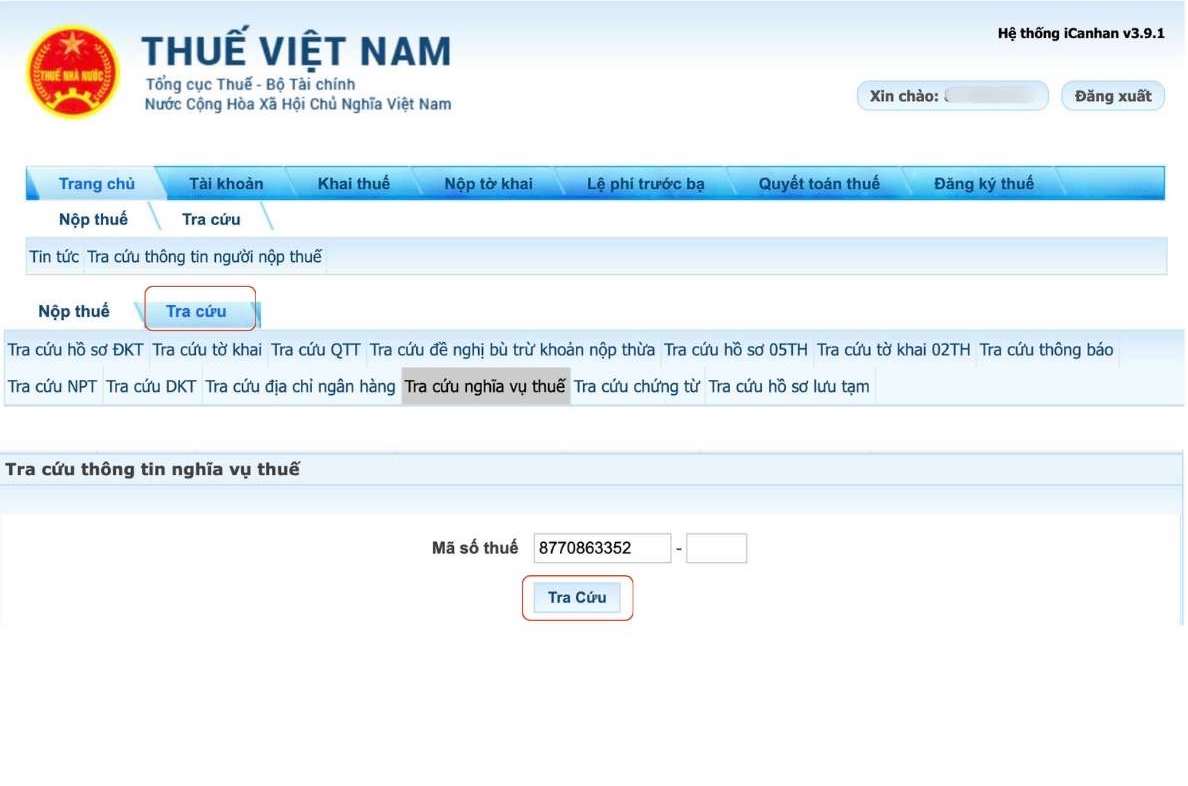

Method 1: Users look up on the General Department of Taxation's website

Step 1: Log in through the Electronic Information Portal of the General Department of Taxation

Taxpayers access the General Department of Taxation's website https://thuedientu.gdt.gov.vn/, select Personal and select Login.

Users can log in with the Ministry of Public Security's Electronic Identification account or with the Electronic Tax account. In case there is no account, the taxpayer must register with the tax code information and his/her citizen identification number.

If the taxpayer logs in using the Ministry of Public Security's Electronic Identification Account, users can scan the QR code to log in.

Step 2: Select Search and then select Search tax obligations

Section I. Payments payable, paid, still payable, excess payable, exempted, deferred, refunded, refunded, still refunded.

Section II. The remaining amounts payable, excess, and refunded have been recorded in the tax management application system.

At this step, taxpayers can look up information including the amount of tax paid (reversed), the amount of tax payable...

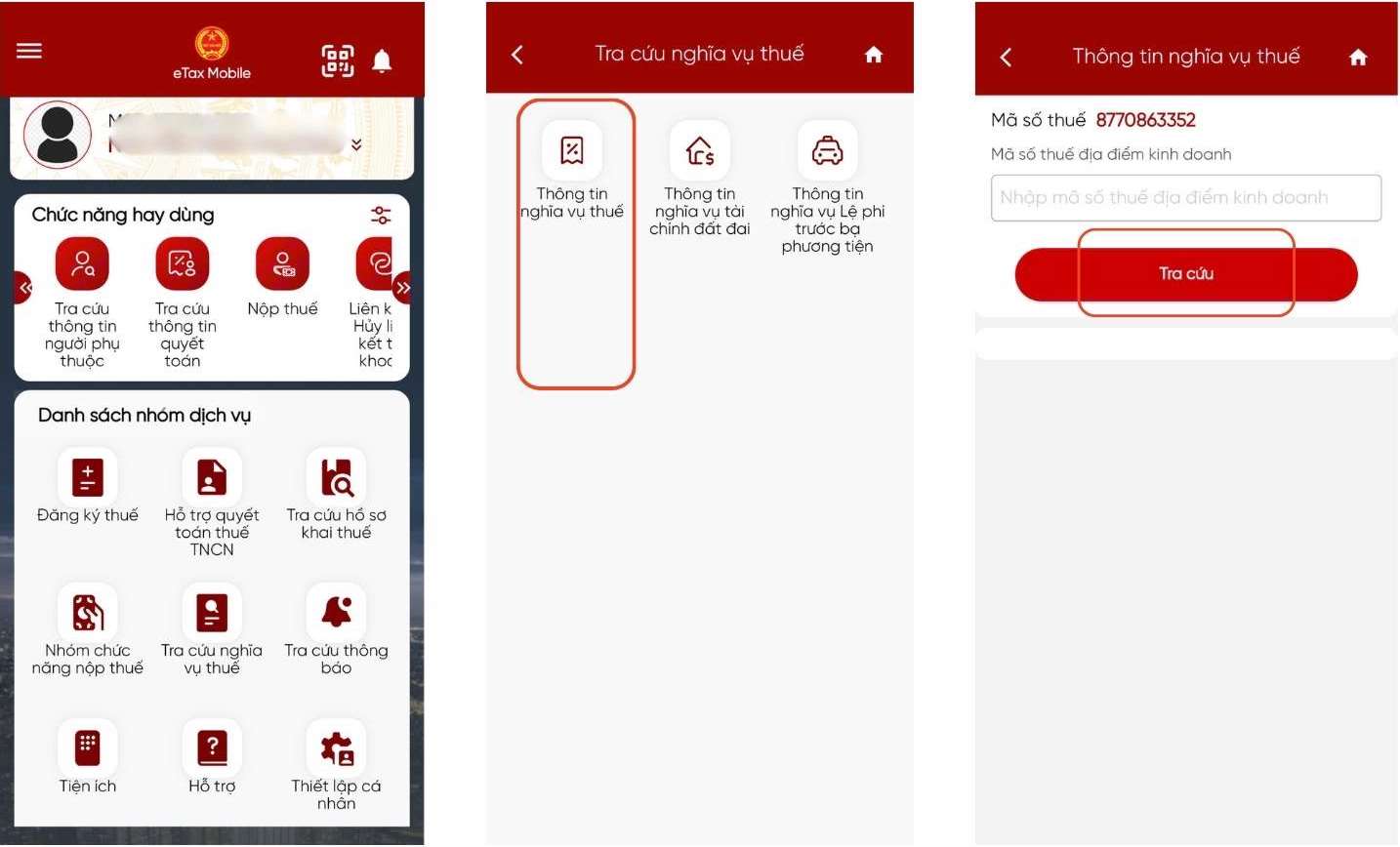

Method 2: Look up on the eTax Mobile phone application

Step 1: Log in with a registered account. In case there is no account, users can register with tax code information and their citizen identification number.

Step 2: Select Search tax obligations and then select All tax obligations and do a Search.

Here, the System displays two items:

Section I. Payments payable, paid, still payable, excess payable, exempted, deferred, refunded, refunded, still refunded.

Section II. The remaining amounts payable, excess, and refunded have been recorded in the tax management application system.

In this step, taxpayers can click on the detailed view button to check whether they are eligible for a tax refund or have to pay additional taxes and specify the amount in both items.

Method 3: Look up by invoice that has paid personal income tax

After the employee checks the information and pays personal income tax at the tax authority, he/she will receive a receipt confirming that he/she has paid personal income tax. Workers can look up the information on the invoice and compare when errors occur.