Banks firmly consolidate their position

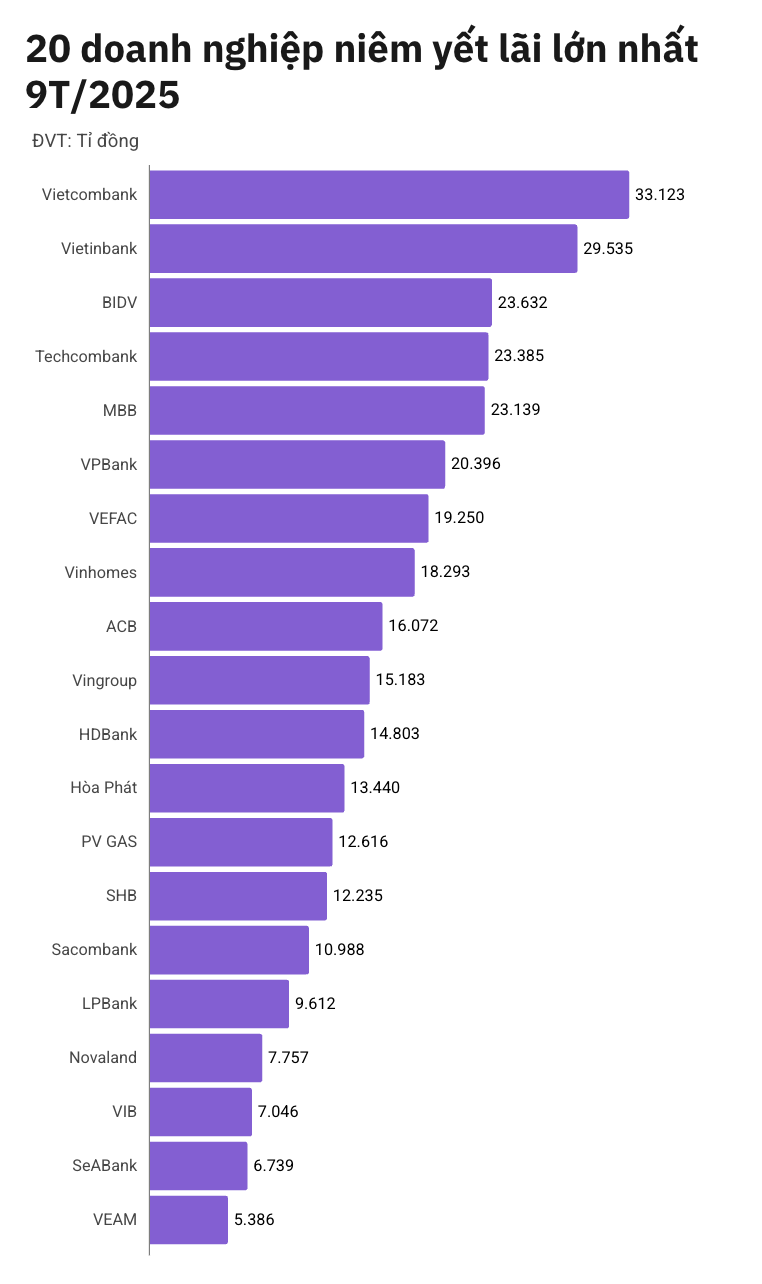

According to the record on November 2, the banking industry continues to contribute the largest pre-tax profit (PIT) contribution, accounting for more than half of the Top 20 enterprises listing the largest interest rates in the first 9 months of 2025.

Vietcombank and VietinBank maintain their absolute leading position. Vietcombank's 9T/2025 LNTT reached 33,123 billion VND, and VietinBank reached 29,535 billion VND. This profit scale is many times greater than that of any other enterprise in the industry.

VPBank showed impressive growth in the third quarter, helping the bank rise strongly. VPBank's 9T/2025 LNTT reached VND 20,396 billion, surpassing Techcombank and other joint stock commercial banks in the Top 10 in accumulated profits.

The scale difference is still very obvious when Vietcombank's 9th quarter 2025 profit (33.23 billion VND) is nearly 20,000 billion VND higher than that of enterprises such as PV GAS (12.616 billion VND) or SHB (12.235 billion VND).

In the list, there are 10 enterprises with profits over VND 15,000 billion. Notably, there are up to 7 banks in this group.

Vingroup leads 9-month accumulated profit in the non-financial group

In the non-financial sector, the recovery of the manufacturing industry and the stability of multi-industry corporations are bright spots.

Vinhomes (18,293 billion VND) and Vingroup (15,183 billion VND) are still the two non-financial enterprises with the highest accumulated 9-month profits in the market.

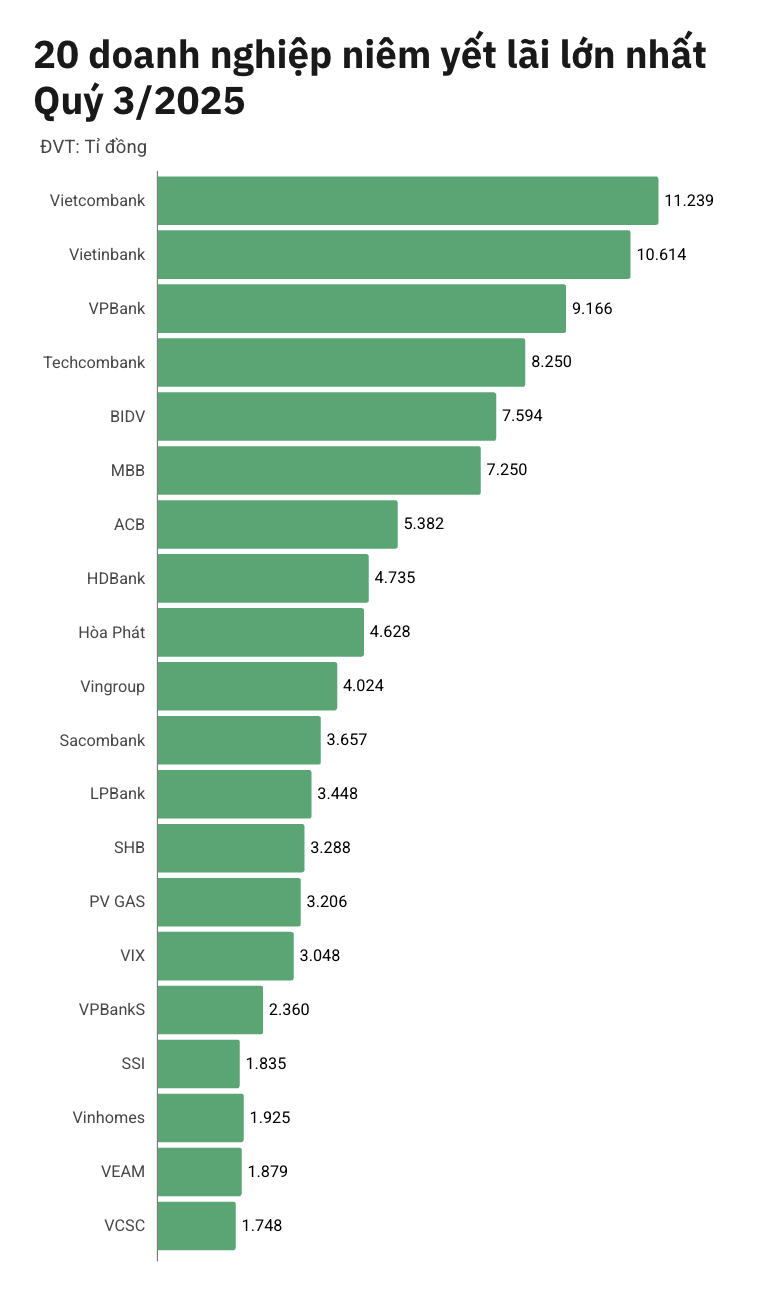

Hoa Phat was the brightest star in the third quarter. With the third quarter's net profit reaching VND 4,628 billion - the highest quarterly profit in the non-financial group - this Steel Group has increased its total net profit in the third quarter of 2025 to VND 13,440 billion. This result helps HPG maintain a solid position in the Top 12, only behind Vingroup and Vinhomes in the non-financial sector in accumulated profits.

However, if comparing the profit performance in the third quarter alone, Hoa Phat (VND4,628 billion) surpassed both Vingroup (VND4,024 billion) and Vinhomes (VND1,925 billion).

Refining the sudden profit group

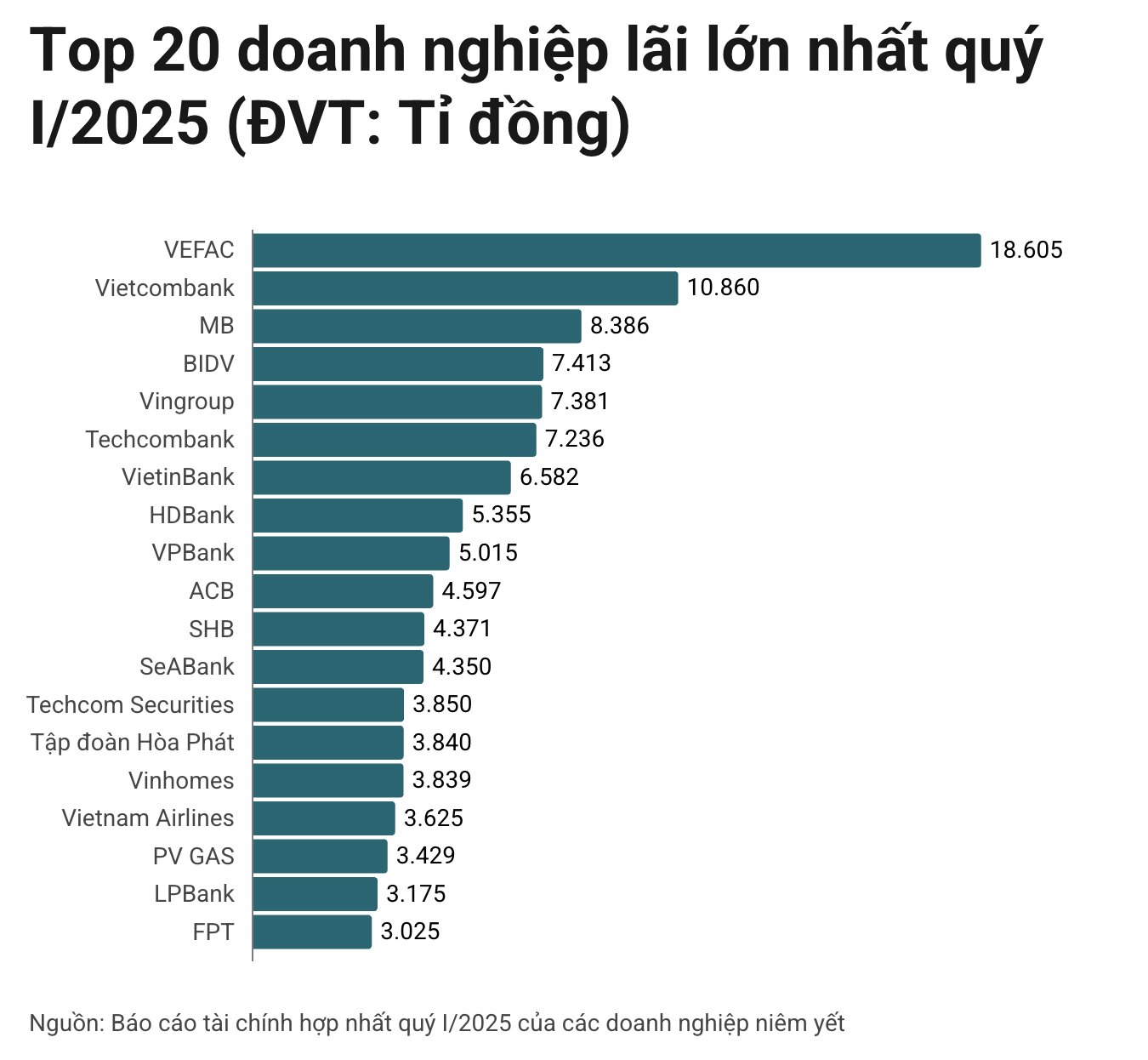

Data 9T/2025 also shows strong screening for businesses with remarkable profits from the first quarter. Vietnam Exhibition Association Central Joint Stock Company (VEFAC) - a business of billionaire Pham Nhat Vuong, although it once held the top position thanks to revenue from project transfers in the first quarter, has now no longer maintained its position in the Top 20 in the third quarter of 2025.

Representatives from the Aviation (Vietnam Airlines) and Technology (FPT) sectors also could not maintain their position in the Top 20 LNTT accumulated, giving way to the acceleration of securities companies such as VIX and SSI.