Income over 100 million VND subject to a 35% tax rate is not appropriate

Receiving comments from National Assembly deputies and reviewing the Economic and Financial Committee on the draft Law on Personal Income Tax, the Government said that it has adjusted the progressive tax table in the draft Law on Personal Income Tax (PIT), in which the tax rate of 15% (at level 2) was adjusted down to 10% and the tax rate of 25% (at level 3) was adjusted down to 20%.

With the new tax rate as above, all individuals who are currently paying taxes at all levels will have their tax obligations reduced compared to the current tax rate. Regarding the highest tax rate of 35% at level 5, the Ministry of Finance believes this is a reasonable proposal, because it is an average tax rate, not too high or low compared to other countries in the world as well as in the ASEAN region. In addition, the case of adjusting the rate to 35% to 30% will be considered a tax reduction policy for the rich.

However, keeping the highest tax rate at 35%, applied to an income of over 100 million VND is still controversial. Many opinions say that the 35% tax rate is too high if applied to an income threshold of over 100 million VND.

Ms. Nguyen Thu Ha (38 years old) - an IT employee in Hanoi - shared that the 35% tax rate makes many highly skilled workers feel pressured: "High income means living expenses, raising children, studying, and housing have also increased. When 100 million VND was considered the highest income threshold to apply the highest tax rate of 35%, many people felt unfair and had no motivation to work more because the more income increased, the tax would be lost too much".

Mr. Tran Quang Minh (45 years old) - a marketing director in Hanoi - said that taxing too high in the context of increasing urban living costs can easily cause high-quality workers to move abroad: "I used to work in a developed country before returning to Vietnam. There, income tax is also high, but the highest tax threshold is far from 100 million VND. If the tax policy is tightened too strongly, it will be difficult for Vietnam to retain good people".

should refer to the high tax income of Southeast Asian countries

Mr. Le Van Tuan - Director of Keytas Tax Accounting Company Limited - commented: "The 35% tax rate is too high, while the threshold of 100 million VND is too low".

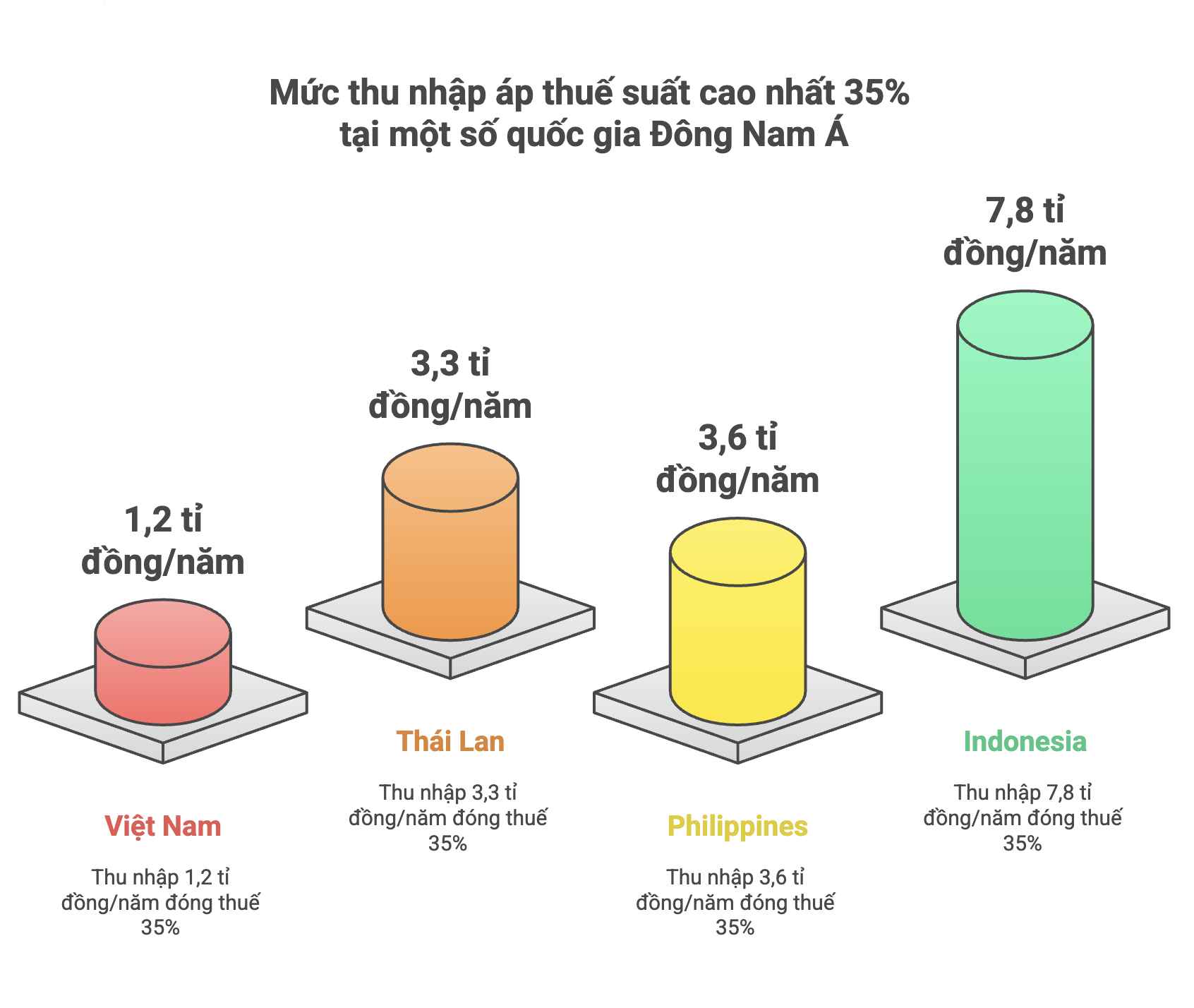

Mr. Tuan analyzed: To easily visualize, we can look at the reality of countries similar to Vietnam in Southeast Asia, and see: Vietnam's highest tax rate is 35% for taxable income over 1.2 billion VND/year; Thailand's highest tax rate is 35% for taxable income over 3.32 billion VND/year (over 4 million Bath); the highest tax rate in the Philippines is 35% for taxable income over 3.6 billion VND/year (over 8 million Peso); Indonesia's highest tax rate is 35% for taxable income over 7.8 billion VND/year (over 5 billion IDR).

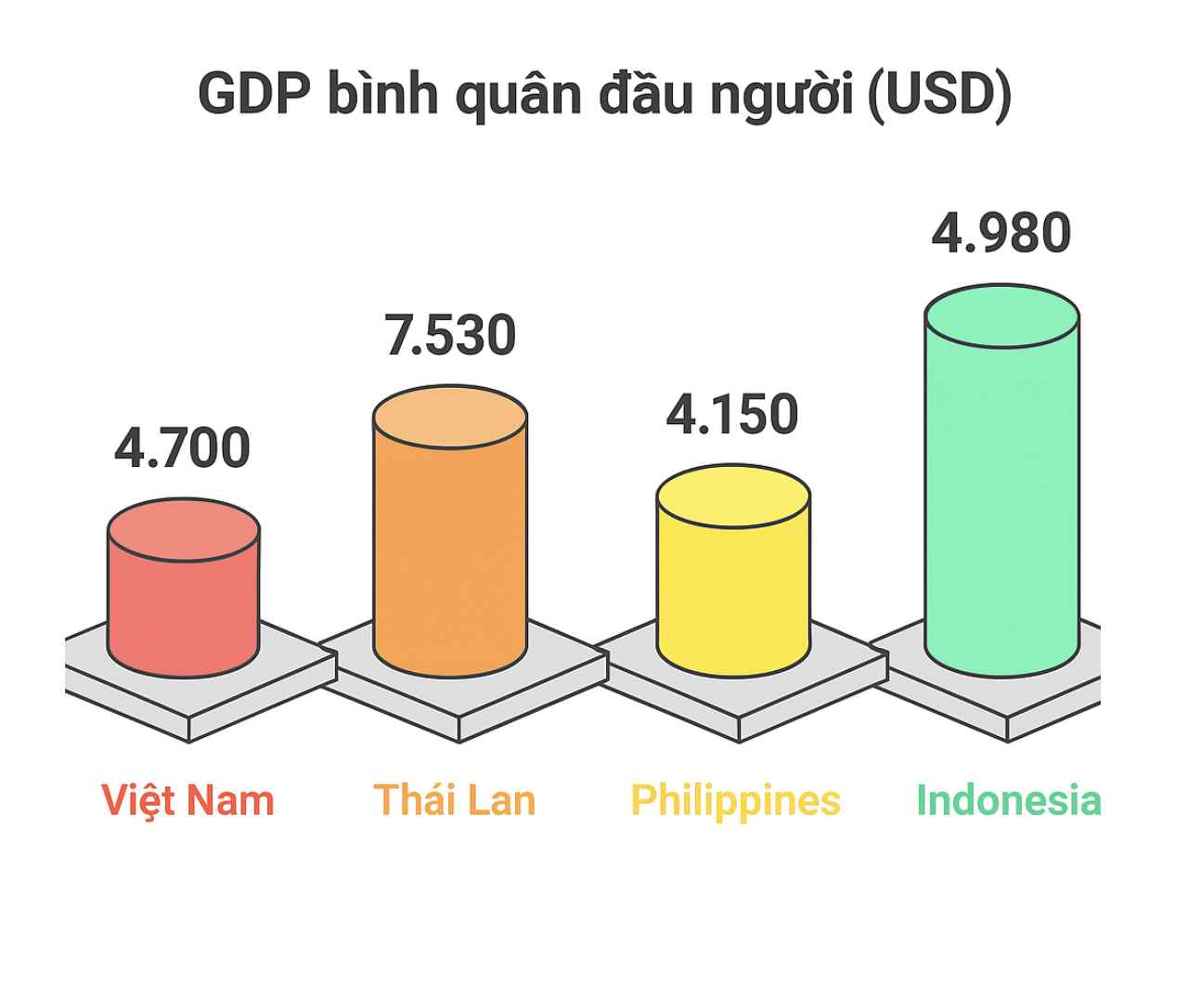

Meanwhile, Vietnam's GDP per capita is 4,700 USD, Thailand reached 7,530 USD, the Philippines reached 4,150 USD, Indonesia 4,980 USD. If we compare Vietnam's GDP per capita with the Philippines and Indonesia, we will see that the highest tax threshold in the Philippines is 3 times higher than Vietnam, and the highest tax threshold in Indonesia is 6.5 times higher than Vietnam.

If comparing Vietnam's GDP per capita with Thailand, the GDP per capita of Thailand is 1.6 times higher than Vietnam, but Thailand's highest tax rate is 2.76 times higher than Vietnam's.

Mr. Tuan emphasized that the real problem with the tax rate table according to the new proposal is: The 35% tax rate is too high compared to the tax calculation threshold of over 100 million VND.

Reducing tax rates, increasing maximum taxable income threshold

From the above analysis, Mr. Tuan proposed: One is to reduce the highest tax rate to 25% corresponding to the tax calculation threshold of 100 million VND. In case you want to keep the 35% rate, you need to increase the highest tax rate threshold to over 200 million VND/month.

According to Mr. Tuan, maintaining the tax rate of 35% but applying it right from the income threshold of over 100 million VND/month makes it difficult for Vietnam to attract high-quality workers and also does not create much motivation to work for the group of experts and highly qualified human resources.

"Therefore, we need to consider the overall benefits of the country, rather than the revenue of a tax. When workers reduce their personal income tax, they have more money to increase spending and contribute to other taxes. Or attracting high-quality labor groups to Vietnam also helps increase the number of taxpayers, making up for the shortage when increasing the tax calculation threshold higher. Another benefit that we also need to consider is the value of high-quality human resources. Thanks to the intelligence of this group of subjects, they can create different values and competitiveness of an entire country. That is a very unpredictable benefit" - Keytas representative recommended.