On the evening of December 2, the National Assembly Standing Committee held its 52nd session to give opinions on the explanation, acceptance, and revision of draft laws, including the Law on Personal Income Tax (amended).

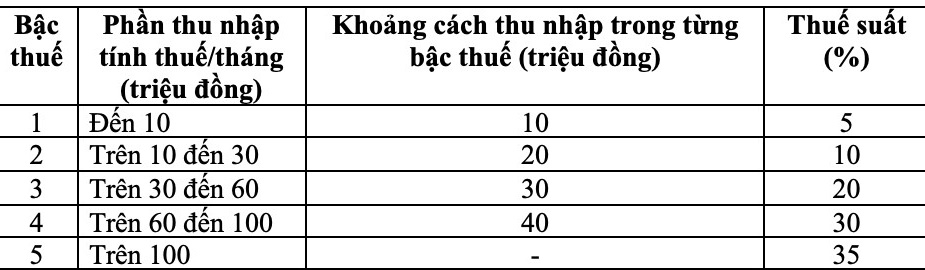

In the latest draft submitted to the National Assembly, the Government still maintains the 5-level tax rate table as planned in early November. The highest rate is still 35%, with an income of over 100 million VND per month (after deducting family deductions and dependents).

According to the Government, the highest tax rate of 35% is reasonable, at an "average level, not too high or low" compared to other countries in the world. Some countries in the region such as Thailand, Indonesia, and the Philippines are also applying the highest personal income tax rate of 35%, while China is 45%.

In the new draft, the Government will adjust 2 tax levels, in which the tax rate of level 2 (taxable income of 10-30 million VND/month) will be reduced from 15% to 10%. The tax rate of level 3 (taxable income over 30 to 60 million VND/month) is reduced to 20%.

With this new tax rate, according to the Government, the new tax rate helps individuals reduce the amount of money they have to pay, while overcoming the current situation of tax rates skyrocketing between levels.

In previous discussion sessions, many delegates wondered about the reasonableness of the plan to adjust the corresponding collection threshold and tax rate.

Specifically, the distance between levels has different degrees of difference. According to the tax table submitted in early November, levels 1, 2 and 3 are up to 10%, while levels 4 and 5 are only 5% different.

Therefore, the delegate was concerned that people with income at level 2 and 3 would be subject to higher tax pressure than the current regulations, while this is the group that accounts for the majority of those subject to personal income tax.

Some opinions also suggest considering only stipulating the highest tax rate of 25% or 30%.

In the review report, Chairman of the Economic and Financial Committee Phan Van Mai assessed that the Government has accepted and adjusted the tax rate in the individual's progressive tax table to ensure reasonableness.

The National Assembly is expected to vote to pass the Law on Personal Income Tax (amended) on December 10, and take effect from July 1, 2026.

Increase taxable threshold for business households to 500 million VND

The Government's report said that, on the basis of listening and accepting in the spirit of openness, the Government proposed to adjust the level of revenue not subject to personal income tax from 200 million VND/year to 500 million VND/year.

This rate of VND 500 million/year is also the rate deducted before paying tax at the rate of revenue.

For example, individuals or business households distributing and supplying goods with a revenue of VND1 billion/year and unable to determine the cost must only pay personal income tax for the part exceeding VND500 million, with a tax rate of 0.5%. The tax payable is 2.5 million VND/year.

According to data from the tax industry, as of October 2025, there are more than 2.54 million households doing regular business. With the above revenue threshold, about 2.3 million business households will not have to pay tax. The total reduced tax amount (including personal income tax and value added tax) is about 11,800 billion VND.

The Government also proposes to add regulations for individuals and business households with a revenue of over VND500 million to VND3 billion/year to apply tax based on income (revenue - cost) to ensure tax collection in accordance with the nature of income tax and apply a tax rate of 15%.