According to Ms. Tran Ngoc Thuy Vy - Analyst at Mirae Asset Vietnam Securities Company, if FTSE Russell announced the upgrading of Vietnam from a "berside market" to a "secondary emerging market" in the September 2025 review, capital flows from ETFs using the FTSE Emerging Markets Index as a reference could disburse up to 621.8 million USD into the Vietnamese stock market.

Mirae Asset estimates that Vietnam's allocation share in the FTSE Emerging Markets basket could reach about 0.7%. With this proportion, Vanguard FTSE Emerging Markets ETF alone has a scale of nearly 83 billion USD, and can invest 581 million USD in Vietnamese stocks.

In addition, many other funds such as Vanguard FTSE Emerging Markets UCITS ETF ( London), Vanguard All Cap Index ETF ( Canada) and ETFs in the UK and Australia... can also disburse with a total value of up to tens of millions of USD.

Ms. Vy believes that the figure of 621.8 million USD does not include other active capital flows, and in fact can be higher if Vietnam is officially added to the index and maintains a stable proportion in the restructuring period of the portfolios of funds.

As of July 11, 2025, the capitalization of the Vietnamese market reached 238 billion USD, equivalent to or higher than some countries that have been classified by FTSE as emerging markets such as Chile (187 billion USD), Qatar (168 billion USD). This is one of the important bases for FTSE to consider allocating a reasonable proportion in the basket of emerging indicators.

Mirae Asset cited data from FTSE showing that, as of June 30, 2025, countries such as the Philippines, Chile, Romania, Hungary or Iceland all have a lower proportion of 1% in the FTSE Emerging Markets Index, whether capitalized at the same or lower than Vietnam. Therefore, the 0.7% allocation given by Mirae Asset is based on practical practice.

The history of upgraded markets shows a clear positive impact on capitalization and liquidity. For example, Qatar increased by more than 45% last year when it was upgraded by FTSE (20132014), Saudi Arabia increased by 23% from March 2017 to March 2018, Romania increased by 18% from September 2018 to September 2019. In the long term, the capitalization of these markets will continue to grow after being officially added to the index basket.

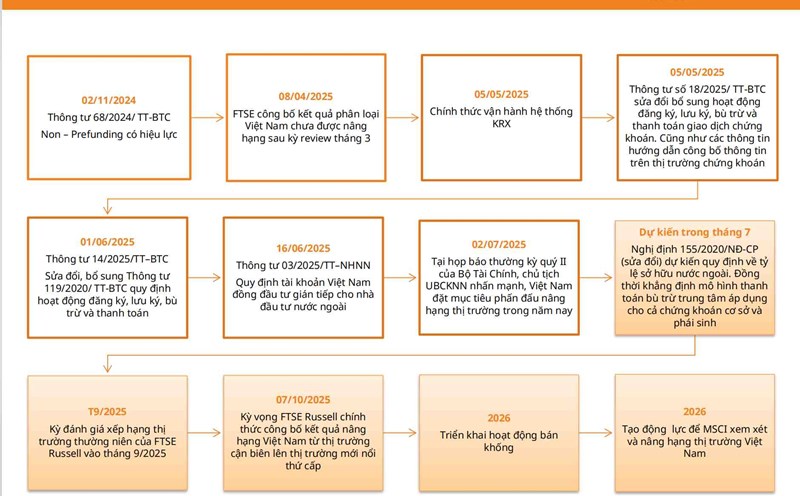

If FTSE announces the upgrade in September 2025, the Vietnamese market will officially be disbursed ETF capital from March 2026 - the time when FTSE indices are restructured. However, according to Mirae Asset, markets in other countries often start to grow before the announcement time, when investor expectations are formed.