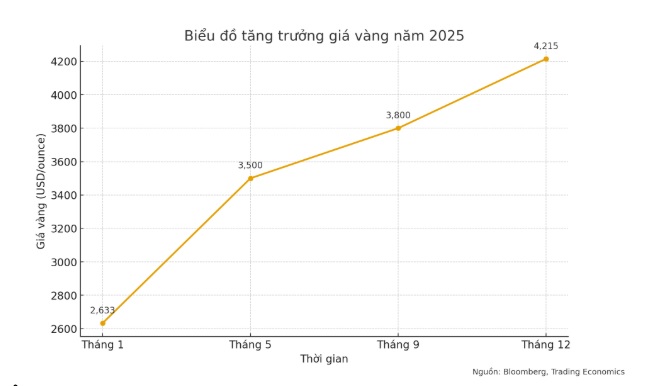

In the past 11 months, world gold prices have had the most spectacular increase in more than a decade. Comprehensive data from Bloomberg and Trading Economics shows that spot gold opens in 2025 at $2,633/ounce. As of December 2, the price had reached 4,215 USD/ounce; the futures contract on COMEX was also at 4,247 USD/ounce. Thus, in less than 12 months, each ounce of gold has increased by more than 1,580 USD, equivalent to nearly 60%.

In the first quarter, gold prices fluctuated in the range of 2,6002,800 USD/ounce, reflecting investors' cautious sentiment towards high interest rate policies. Entering the second quarter, the situation reversed significantly as the US dollar weakened and US bond yields cooled down, pushing prices above 3,500 USD/ounce in May - an increase of more than 33% compared to the beginning of the year. By the end of the third quarter, prices approached 3,800 USD/ounce, recording an increase of nearly 45% compared to the beginning of the year.

The most notable milestone occurred in October, when gold prices surpassed the threshold of 4,000 USD/ounce for the first time in history and quickly peaked at 4,381.21 USD/ounce, according to German Bank data. TheStreet described it as a global hitch-and-run, as major investment funds simultaneously increased their gold holdings in their portfolios. Compared to the beginning of the year, prices at this time have increased by more than 1,700 USD/ounce, reflecting a rare breakthrough since the pandemic.

The World Gold Council (WGC)'s third quarter report recorded central banks net buying more than 800 tonnes of gold, the highest in 50 years, while global mining output increased by only 1%.Capital flows into gold ETFs also hit their highest level since 2020.The strong supply-demand balance has caused world gold prices to maintain a stable increase in the fourth quarter, despite short-term adjustments.

By early December, gold held its price base around $4,2004,250/ounce, nearly 60% higher than the beginning of the year and nearly one and a half times higher than the 2024 average.According to the ratio, each quarter in 2024, the average gold price increased by about 1215%, the third quarter recorded the strongest increase - more than 20%.

In the latest forecast, Deutsche Bank estimates that gold prices in 2026 will average 4,450 USD/ounce, with a range of 3,9504,950 USD/ounce.International analysts say that the increase in gold in 2024 - from 2,630 to more than 4,200 USD/ounce - is not only a result of short-term fluctuations, but also marks a new valuation cycle of the world's leading safe-haven asset.