Saving interest rate at HDBank today

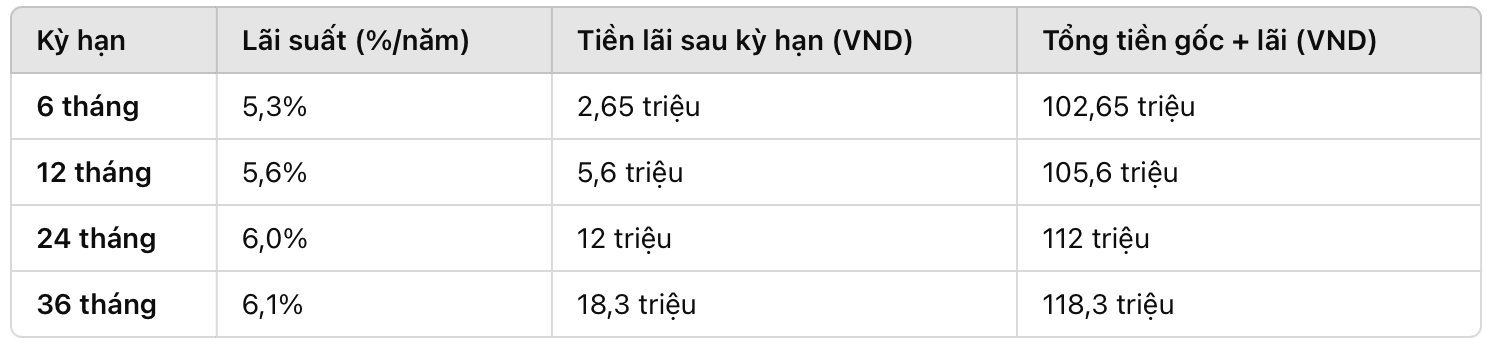

Saving interest rates at HDBank are having a difference depending on the term. As noted on 9.2.2025, HDBank applied the highest interest rate of 6.1%/year for 36 -month term and 5.6%/year for 12 -month term. If you send 100 million VND, customers will receive different interests depending on the term.

12 -month term:

Interest amount = 100 million × 5.6% = 5.6 million.

Total amount after 1 year: 105.6 million.

36 -month term:

The interest amount per year = 100 million × 6.1% = 6.1 million.

Total interest after 3 years = 18.3 million.

The total amount of both principal and interest after 3 years: 118.3 million.

Compare HDBank interest rates with other banks (12 months term)

Savings at HDBank helps customers receive higher profits than Big 4 group but still lower than MSB or Kienlongbank.

Note when saving

Interest rates may vary from time to time, customers should update directly from the bank.

Select the appropriate term to avoid losing profits when withdrawing before drought.

If sent online, may have higher interest rates.

Customers can contact HDBank or visit the official website to update the latest interest rate.