Entering a period of profound fluctuations in the global financial system, gold is considered a safe haven, promising to open a new chapter for investors.

In recent months, world gold prices have continuously broken seemingly insurmountable price points. Not just a speculative fever or a reaction to inflation, this increase reflects a global strategic repositioning.

Central banks in many countries are quietly hoarding gold, emphasizing the message that the current monetary system is entering a period of profound transformation.

Investors are not just buying gold as a metal; they are positioning outside the USD-dependent monetary system.

The US dollar system has dominated almost every international trade for the past 50 years, but signs of cracks have emerged.

Russia has been excluded from the international payment system SWIFT, China has issued oil contracts in yuan, many central banks have increased gold purchases to unprecedented highs in decades. These are long-term strategic steps, not short-term responses.

The difference of the current gold price increase is the structural and institutional nature. In the past, gold price increases often came from individual investors seeking shelter, but this time the central bank and the national fund are the main purchasing forces.

Mr. Gary S. Wagner - a gold market analyst for the past 25 years, a writer at Kitco News - said that gold has broken the peak continuously, not falling sharply or reacting excessively, showing that this is not a bubble of speculation but a re-evaluation based on real risk.

According to Mr. Wagner, for gold, investors need to think long-term like running a marathon, not having to play quarterly or follow medium-term policy fluctuations. The US dollar remains the dominant currency, but rivals such as the yuan, the Euro or the expected BRICS common currency are only limited alternatives. Gold, on the other hand, is above all political and inflationary risks and is likened to a "eagle" flying high in the race of legal tender currencies.

Recent indicators further strengthen confidence in gold: Prices remain around $4,200/ounce, US gold ETFs increased strongly, trading volume set a record of08 billion USD/day in October, up more than 50% compared to the previous month. physical demand for gold in stores and online, especially in the US, has also increased sharply, reflecting consumer confidence.

Despite the temporary end of the US government shutdown, the financial and political risk environment is still persistent, making gold continue to be seen as a safe asset, promising to increase in price in the coming months. UBS analysts predict gold could hit $4,700 an ounce if political uncertainty or finances increase.

The new chapter or new cycle of gold is not only a record price peak but also a step towards a long-term strategic role, where gold becomes a valuable preservative asset in the context of a volatile world.

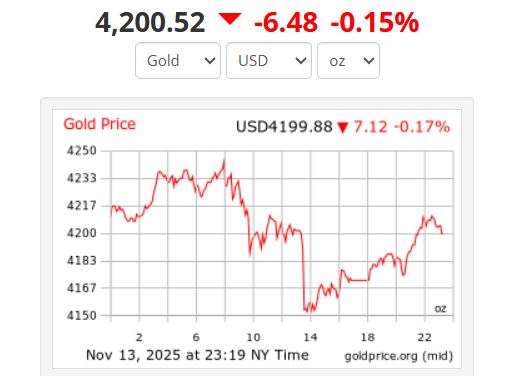

The world gold price at 11:19 on November 14, Vietnam time, was trading at 4,200,52 USD/ounce.

Regarding domestic gold prices, the price of SJC gold bars at 9:46 a.m. on November 14 was at 152.2 - 153.7 million VND/tael (buy - sell).

The price of 9999 Bao Tin Minh Chau gold rings is at 150.9 - 153.9 million VND/tael (buy - sell).

Global instability continues to be a catalyst for gold prices

Technical analysis shows that technical buying activity is dominating this week as short-term technical signals from gold and silver have shown a clear uptrend. The US government's reopening today also supports the precious metals market. The resumption of US economic data disclosure could create conditions for the Federal Reserve (Fed) to make a decision to cut interest rates in December.

In the coming time, gold price forecasts are likely to be supported by increased geopolitical tensions in some regions, including Asia. Analysts say that global instability is always a catalyst for gold prices to often tend to increase in the case of cash flow reaching for safe assets.