From being the "boss" of surplus money with a series of incentives

In each field, the concept of bossing is defined completely differently. With personal finance, "becoming a boss" is when a person knows how to take control of their own surplus, knows how to deposit savings at the right time, chooses the right place to make a steady profit every day. To make that journey easier and more exciting, Cake has deployed many attractive incentives at the same time.

Accordingly, from November 12 to December 31, 2025, Cake by VPBank Digital Bank will launch the program "Saving challenge: Having a job as a "boss", having a day to receive an iPhone", bringing a large number of prizes including 50 iPhones 17 and 50,000 lucky money directly into the account, with a total value of up to 1.5 billion VND.

Specifically, with each savings value from VND 5,000,000, a minimum term of 3 months, customers receive a chance to open lucky envelopes. With each envelope, customers have the opportunity to win an iPhone 17 or a direct bonus into their account. Each customer receives a maximum of 10 trips for a savings book.

The more savings books are opened, with a large deposit value, the more customers have the opportunity to open lucky envelopes and own a series of attractive gifts.

At the same time, Cake also launched an additional promotion to offer online savings interest rates. Customers who open a savings book for the first time for a term of 6 months will immediately receive an interest rate incentive plus 0.6%/year, applicable to all deposit values. For customers who have made a deposit on Cake, when opening a new deposit of VND20 million or more, they will also receive an additional direct interest rate of up to 0.6%. With this promotion, without having to deposit a large amount of money, customers can still enjoy the highest interest rate at the top of the market when opening online savings books on Cake.

A series of new incentive programs from Cake has made the deposit market even more vibrant. In fact, since the beginning of October, the deposit market has recorded a bustling time when many banks simultaneously increased savings interest rates. To date, Cake is one of the digital banking banks with attractive interest rates for online savings products, with a 6-month term of 6.3% and a 12-month term of up to 6.5%.

To "securate" surplus with multi-layered security

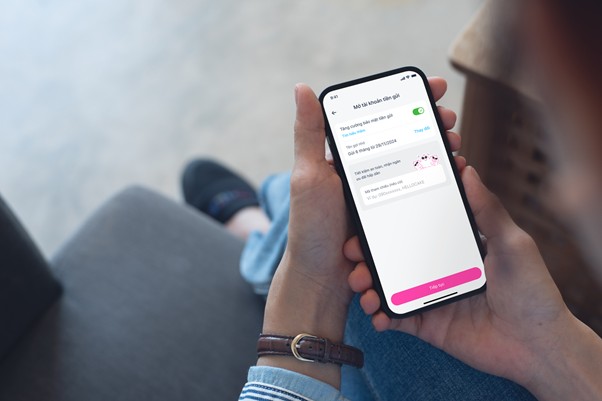

In addition to attractive interest rates, Cake also invests heavily in modern security solutions to protect all outstanding loans of customers. In Vietnam, Cake is the first digital bank to launch the feature "Enhancing deposit security with keywords".

When opening a savings account and selecting this additional feature, the system will provide a row of keyword characters to the account holder. Even when an account is illegally accessed, hackers cannot "attack" the savings book without a secret code.

Cake is also a leader in security standards, the first digital bank in Southeast Asia to meet ISO/IEC 30107-3 level 2 - a high level in facial authentication, PCI DSS 4.0 level 1 - in card data security, FIDO2...

Sharing about the savings challenge Having worked as a "boss", having a day to receive an iPhone with multi-layered security features, a representative of Cake by VPBank Digital Bank said that Cake wants to bring an interesting, profitable online savings experience but still absolutely safe.