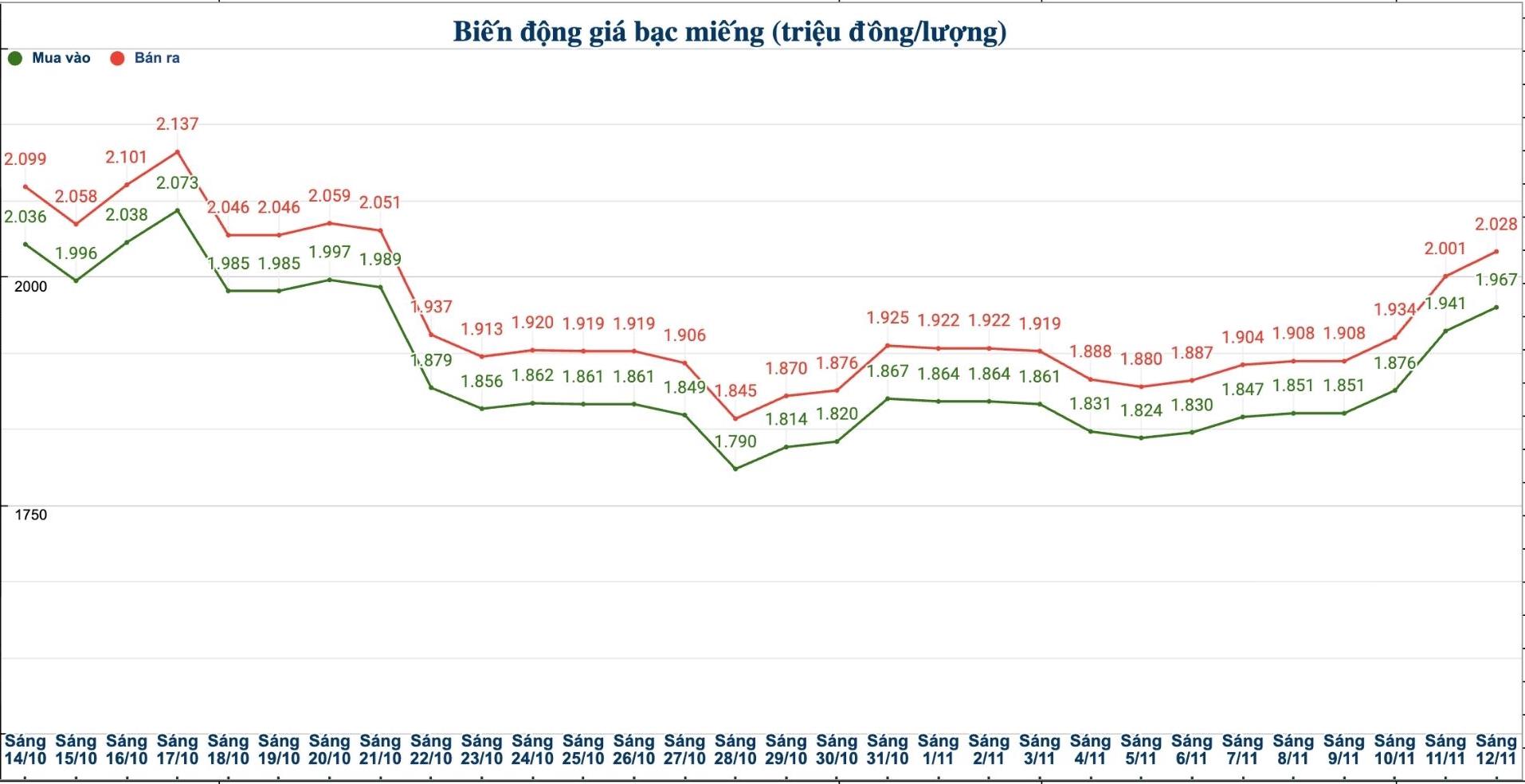

Domestic silver price

As of 9:30 a.m. on November 12, the price of 999 Phuc Loc 999 gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Co., Ltd. (Sacombank-SBJ) was listed at 1,950 - 1.998 million VND/tael (buy - sell); increased by 21,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.967 - 2.028 million VND/tael (buy - sell); an increase of 26,000 VND/tael for buying and an increase of 27,000 VND/tael for selling compared to yesterday morning.

The price of 999 (1kg) gold bars at Phu Quy Jewelry Group was listed at 52.453 - 54.079 million VND/kg (buy - sell); an increase of 694,000 VND/kg for buying and an increase of 720,000 VND/kg for selling compared to yesterday morning.

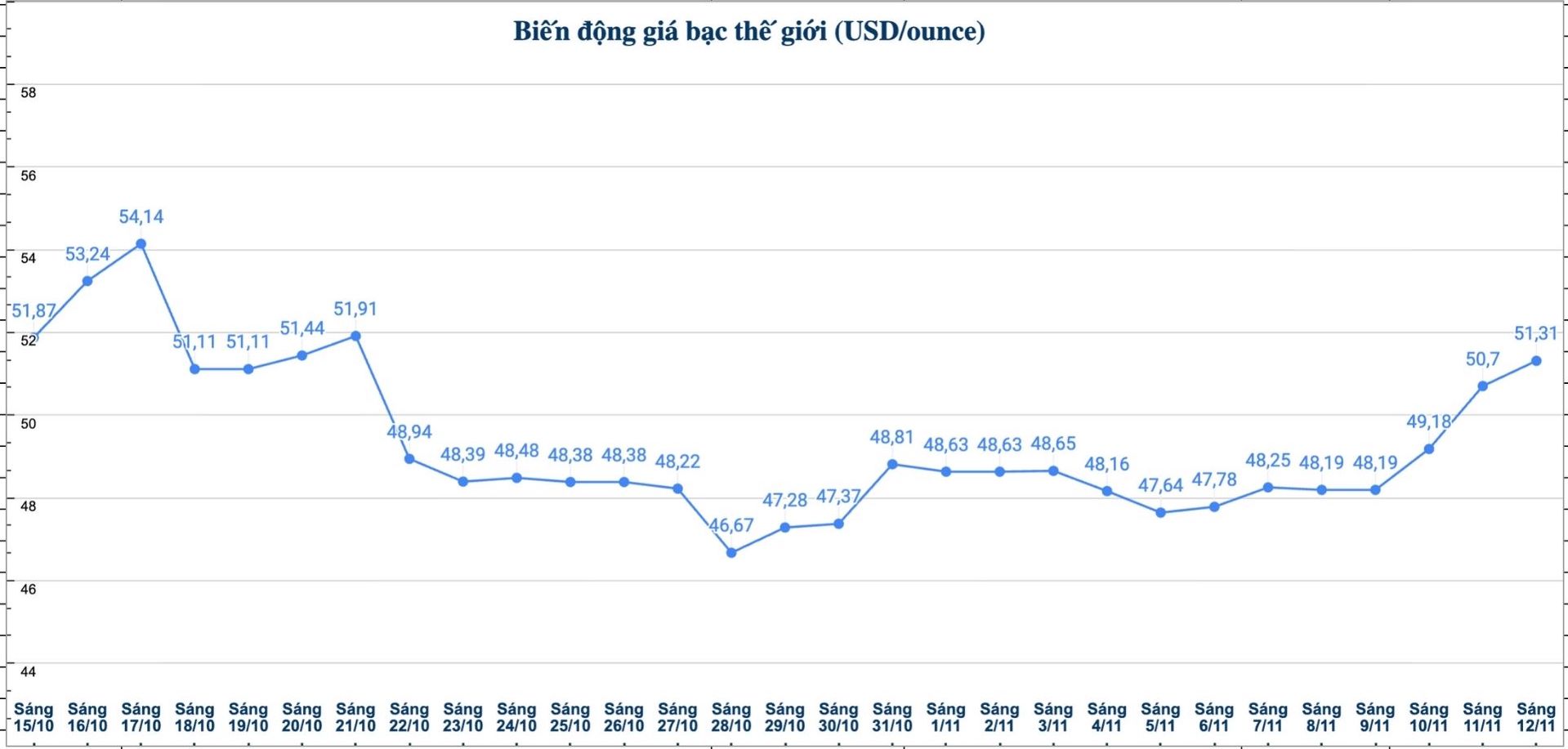

World silver price

On the world market, as of 9:39 a.m. on November 12 (Vietnam time), the world silver price was listed at 51.31 USD/ounce; up 0.61 USD compared to yesterday morning.

Causes and predictions

Spot silver prices are still maintaining their upward momentum since the first session of the week. According to precious metals analyst James Hyerczyk at FX Empire, the price range of 50.02 - 51.07 USD/ounce is currently becoming the main area of tug-of-war between buyers and sellers.

"Buyers are showing strong interest, but the market has not shown any clear signs of a breakthrough," he said.

However, James Hyerczyk believes that silver prices are being supported largely by market sentiment surrounding the possibility of the US Federal Reserve (FED) cutting interest rates. Meanwhile, the latest weekly employment data from the ADP showed the private sector lost an average of 11,250 jobs per week in the four weeks ended October 25, contrary to a monthly report showing an increase of 42,000 jobs in October.

"As the temporary US government shutdown has delayed official data, traders are relying on alternative sources as reported by the ADP. These weaker-than-expected figures increase the likelihood that the Fed could start cutting rates as early as December," said James Hyerczyk.

He added that the continued decline of the US dollar also created a reassuring force for silver. "If the US dollar continues to weaken, precious metals such as silver and gold will have more upward momentum. Gold is currently holding steady in the resistance zone, helping to maintain the upward momentum for silver" - James Hyerczyk analyzed.

See more news related to silver prices HERE...