Domestic silver price

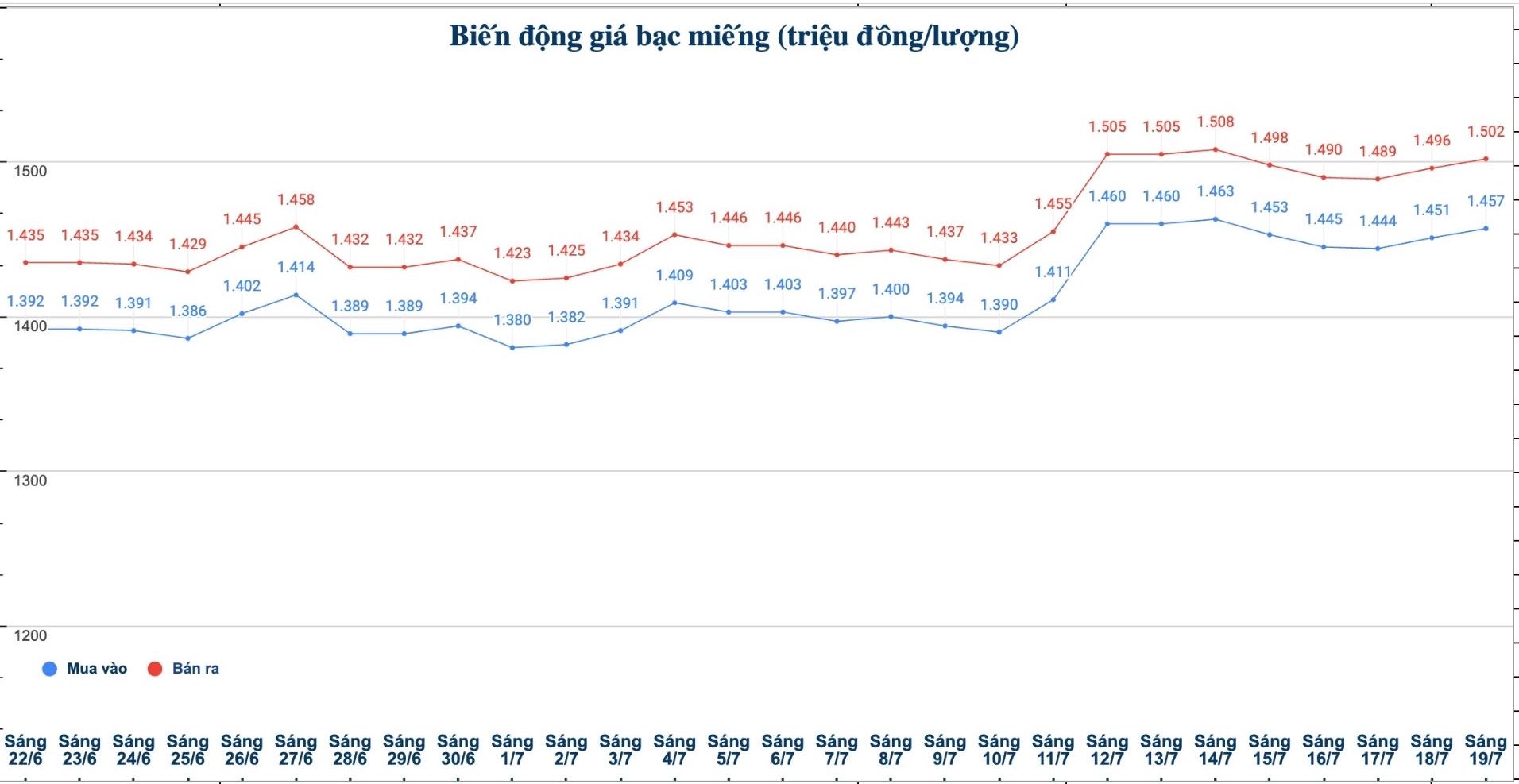

As of 9:40 a.m. on July 19, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.457 - VND1.502 million/tael (buy - sell); an increase of VND6,000/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.457 - 1.502 million VND/tael (buy - sell); an increase of 6,000 VND/tael for both buying and selling compared to yesterday morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 38.853 - 40.053 million VND/kg (buy - sell); an increase of 160,000 VND/kg in both buying and selling directions compared to yesterday morning.

World silver price

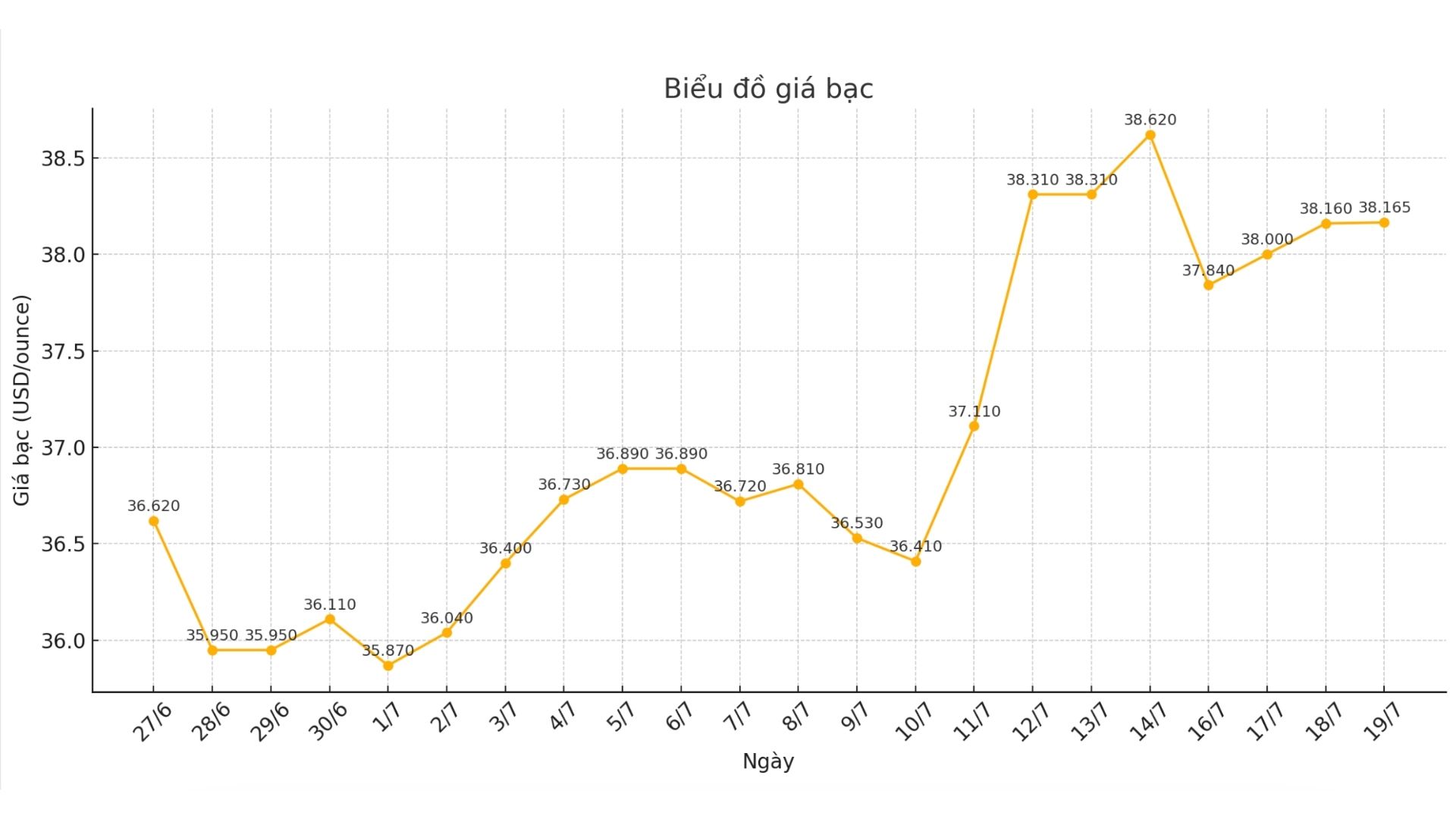

On the world market, as of 9:42 a.m. on July 19 (Vietnam time), the world silver price was listed at 38.165 USD/ounce.

Causes and predictions

Silver prices continue to break out. The increase was driven by a solid recovery from the support zone of 37.50 USD/ounce, driven by a weak USD, stable gold prices and tense geopolitical factors.

Although it is often more volatile than gold, silver prices still follow the trend of this precious metal, said market analyst James Hyerczyk. The continued recovery of gold is a supporting platform for silver, especially when expectations of a US interest rate cut are currently only moderate."

He said that the sharp increase in US retail sales and the decrease in unemployment claims have increased expectations that the US Federal Reserve (FED) will take strong measures to ease policy.

"Currently, the market is predicting that about 45 basis points of interest rates will be cut in the rest of the year, down slightly from the previous 50 point level. This has kept Treasury yields high, limiting the increase in gold and silver.

However, the decline in the USD index has helped reduce pressure on the USD-denominated metals group," said James Hyerczyk.

In addition, global tensions continue to maintain safe-haven demand - supporting the metal market - as investors seek to prevent geopolitical risks.

"Investors should pay attention to new economic data and statements from the FED to orient the market. During this time, the main trend is still to increase as silver remains above the 37.50 USD/ounce mark" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...