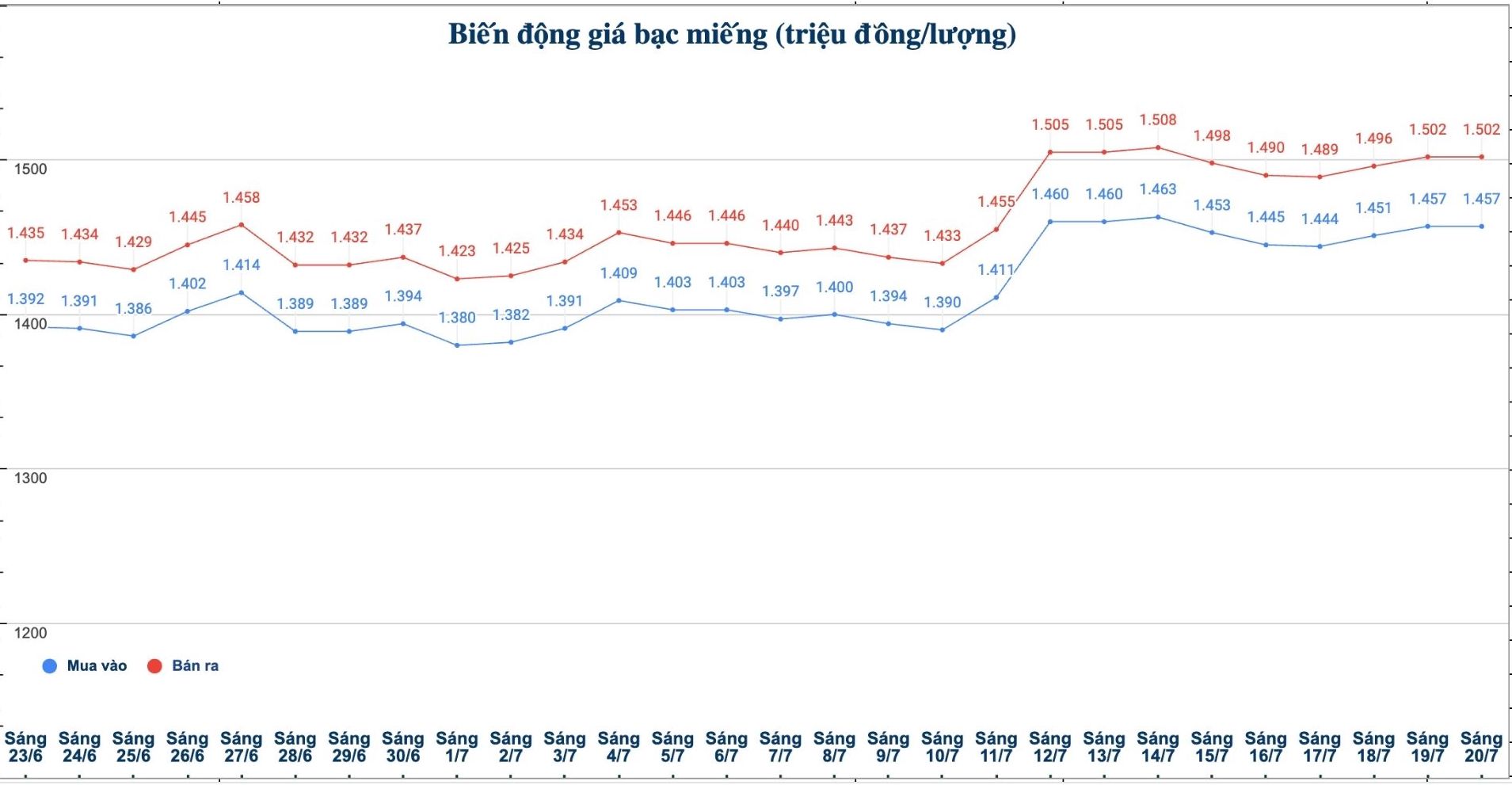

Domestic silver price

As of 9:40 a.m. on July 20, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.457 - 1.502 million/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.457 - 1.502 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 38.853 - 40.053 million VND/kg (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

In the trading session last week (morning of July 13, 2025), the price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 38,933 - 40.133 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on July 13 and selling it this morning (July 20), buyers will lose 1.28 million VND/kg.

World silver price

On the world market, as of 9:42 a.m. on July 20 (Vietnam time), the world silver price was listed at 38.165 USD/ounce.

Causes and predictions

Silver prices remained high in the weekend trading session, continuing the upward trend thanks to a slight decrease in Treasury bond yields and a weakening USD. The need to seek safe-haven assets is still supported by tariff instability, dovish comments from the US Federal Reserve (FED) and weak labor market signals. All of these factors help silver prices maintain a stable trend near key resistance levels.

The US dollar weakened after falling bond yields and trading fluctuations due to mixed US inflation data, political pressure on Fed Chairman Jerome Powell and escalating trade tensions, said market analyst James Hyerczyk. Although consumer prices have increased slightly, the producer price index has remained stable, creating opposing views on interest rate expectations".

James Hyerczyk added that the USD-esilient correlation prompted silver's rally over the weekend, as precious metals investors took advantage of the weakness of the greenback after the bond market re-evaluated in a dovish direction.

"The decline in the US dollar due to falling bond yields has increased the attractiveness of silver as a hedge against currency depreciation risks.

If the Fed continues to make dovish decisions or the labor market data weakens, it could open up new upside opportunities for silver, especially given the high sensitivity of silver to the monetary policy cycle and industrial demand," James Hyerczyk emphasized.

See more news related to silver prices HERE...