Domestic silver price

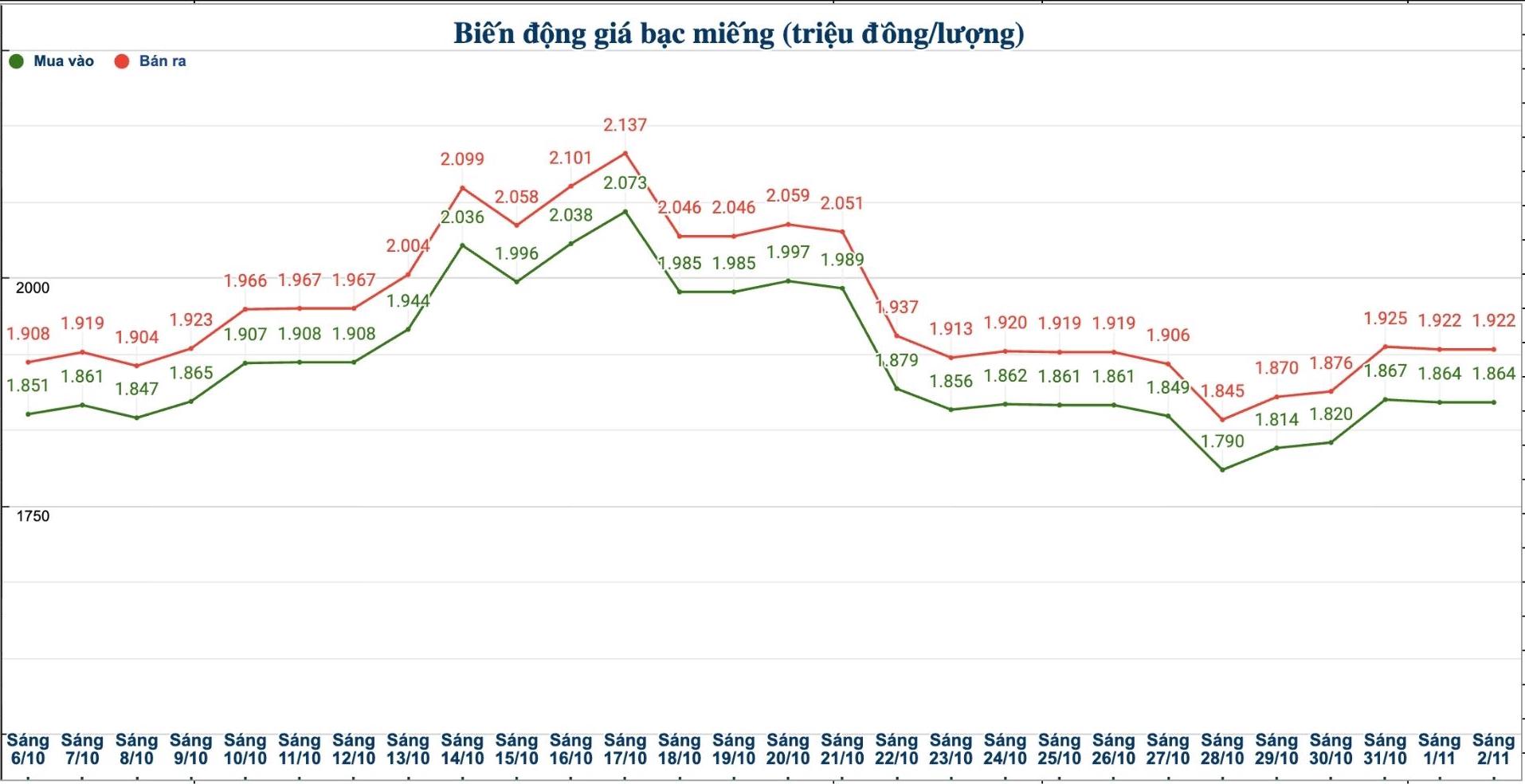

As of 9:45 a.m. on November 2, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND1.863 - 1.905 million/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Metallurgy Company was listed at 48.940 - 50.350 million VND/kg (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 gold bars of the One Thanh Viet, Binh Da, and Quoc Giay Company Limited of Saigon Thuong Tin Bank (Sacombank-SBJ) was listed at VND1.881 - 1.929 million/tael (buy - sell); unchanged in both directions compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.864 - 1.922 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 49.706 - 51.253 million VND/kg (buy - sell); unchanged in both directions compared to yesterday morning.

World silver price

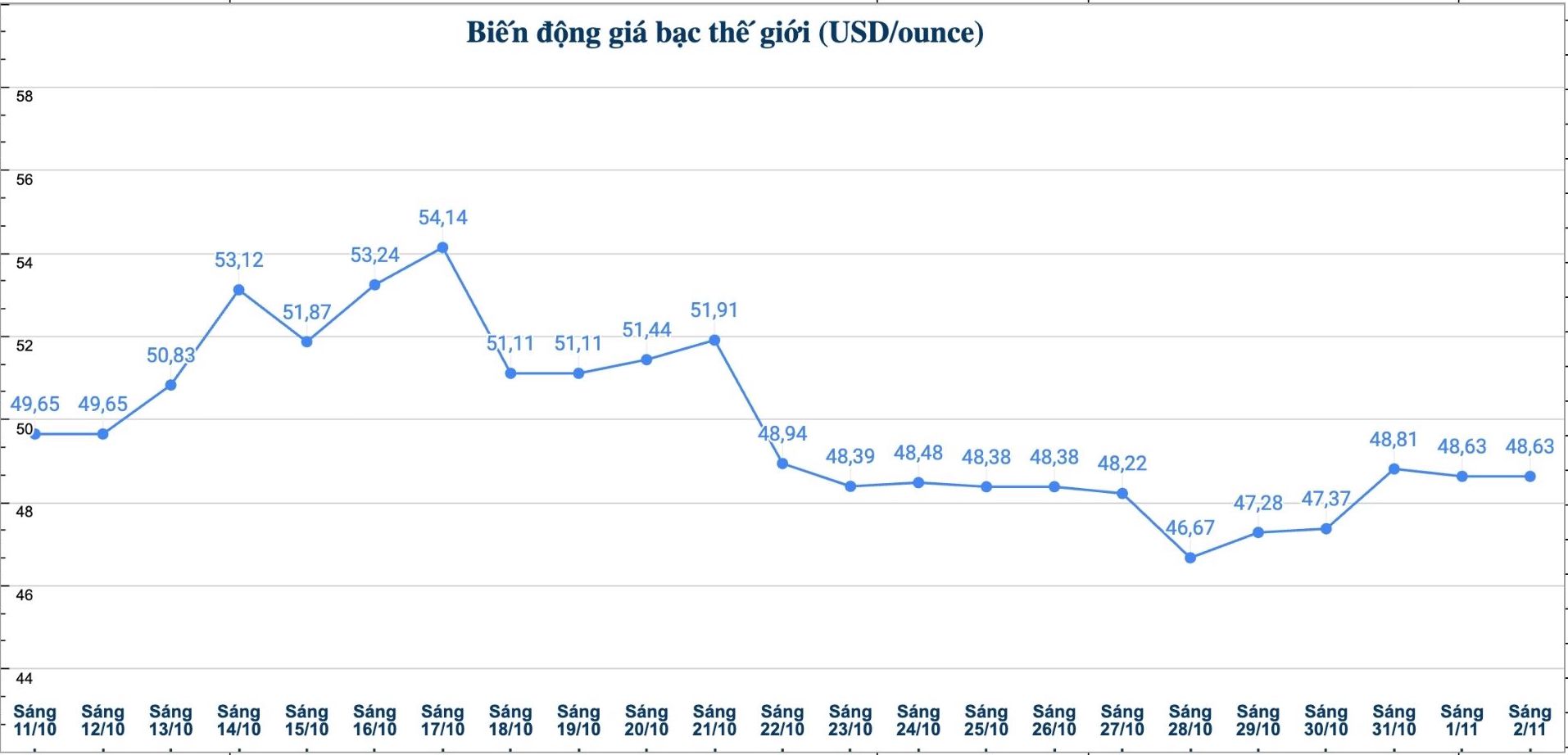

On the world market, as of 9:45 a.m. on November 2 (Vietnam time), the world silver price was listed at 48.63 USD/ounce; unchanged from yesterday morning.

Causes and predictions

Silver is stagnant around $49/ounce after unsuccessful bids to increase prices. If the zone cannot be held, silver prices could fall to $47 an ounce or even fall as low as $42 an ounce, according to precious metals expert Christopher Lewis (FX Empire).

He said that the market is currently quite volatile and may be forming a peak model in the context of weakening retail investor sentiment.

"During the weekend session, silver recorded a slight negative performance after recovery efforts on Friday. The $49/ounce level continues to be a strong resistance zone that prevents prices from breaking out" - Christopher Lewis said.

According to him, the price turning from this area opens up the risk of falling to the $47/ounce zone in the short term.

Christopher Lewis added that when trading volume increases sharply when prices peak and then both prices and volumes decrease, it shows that investors are gradually losing interest in the market.

"The question now is whether silver will continue to fall into a gloomy trading state. Only when prices surpass $50 an ounce, market sentiment will improve," he said.

Meanwhile, Christopher Lewis believes that the current range shows that the sideways trend is still dominant.

"Siliver, unlike gold, seems to have been pushed too high in the excitement wave of individual investors about two weeks ago. At the present time, the risk of silver falling is assessed higher than the possibility of increasing, although counterfeiting is still quite difficult" - Christopher Lewis analyzed.

See more news related to silver prices HERE...