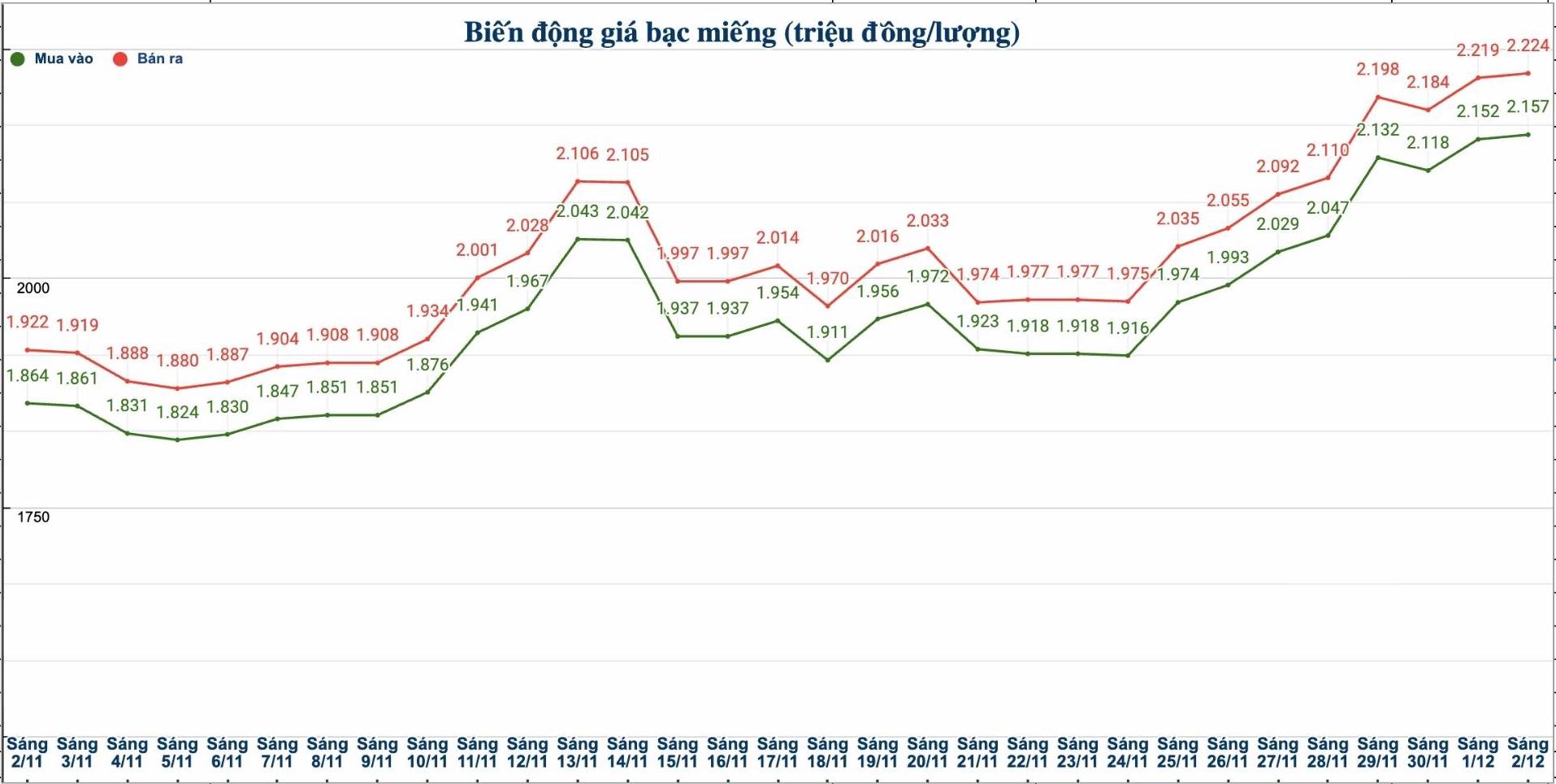

Domestic silver price

As of 10:35 a.m. on December 2, the price of 999 Phuc Loc Gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND2.106 - VND2.157 million/tael (buy - sell); an increase of VND12,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2.157 - 2.224 million/tael (buy - sell); increased by VND 5,000/tael in both directions compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 57.519 - 59.306 million VND/kg (buy - sell); an increase of 133,000 VND/kg in both directions compared to yesterday morning.

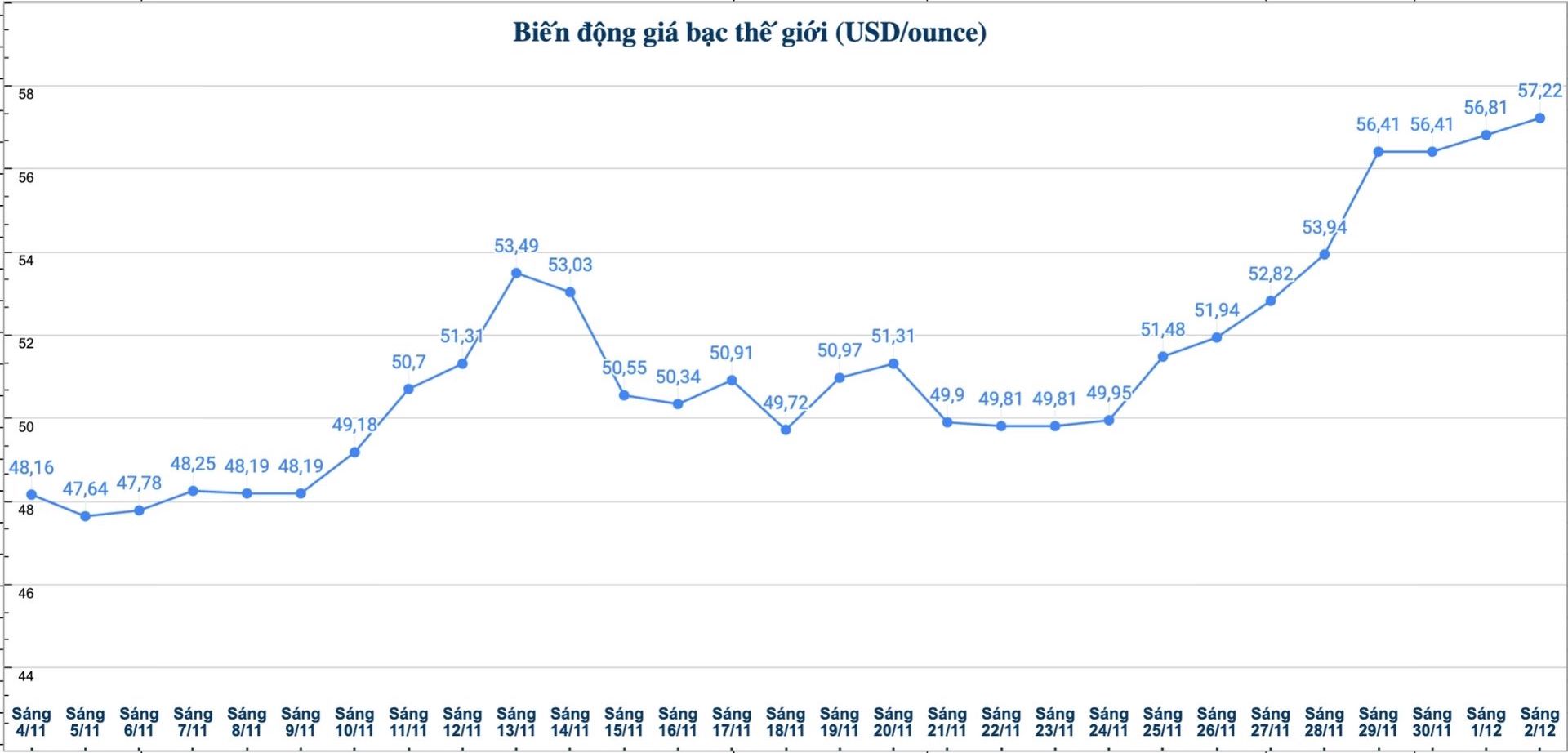

World silver price

On the world market, as of 10:35 a.m. on December 2 (Vietnam time), the world silver price was listed at 57.22 USD/ounce; up 0.41 USD compared to yesterday morning.

Causes and predictions

Silver prices continue to increase in today's trading session (Tuesday). According to precious metals analyst Christopher Lewis at FX Empire, the market is showing signs of slowing down after a long unusually strong rally.

He noted that investors should not chase the market at this time, because the developments are still gloomy, trading volume is weak and there is a possibility of a sharp correction before considering new buying positions.

"Silver prices have risen nearly 14% in the past two days alone - an unusual increase, especially as trading volumes are not really impressive," Christopher Lewis said.

He stressed that while concerns about material silver shortages still exist, the silver market is more fragile than the gold market, which has not seen similar fluctuations.

"In the current context, investors should consider buying cautiously. Those who are not yet involved should observe the market first, and can wait for prices to stabilize before making a decision" - Christopher Lewis emphasized.

He also noted that although we should not sell counterfeit money at the moment, in the future, there may be the largest opportunity to sell counterfeit money ever. "In the short term, if this increase continues, gold could become a more feasible choice for investors, in the context of silver still having many potential risks of price fluctuations and liquidity" - Christopher Lewis expressed his opinion.

See more news related to silver prices HERE...