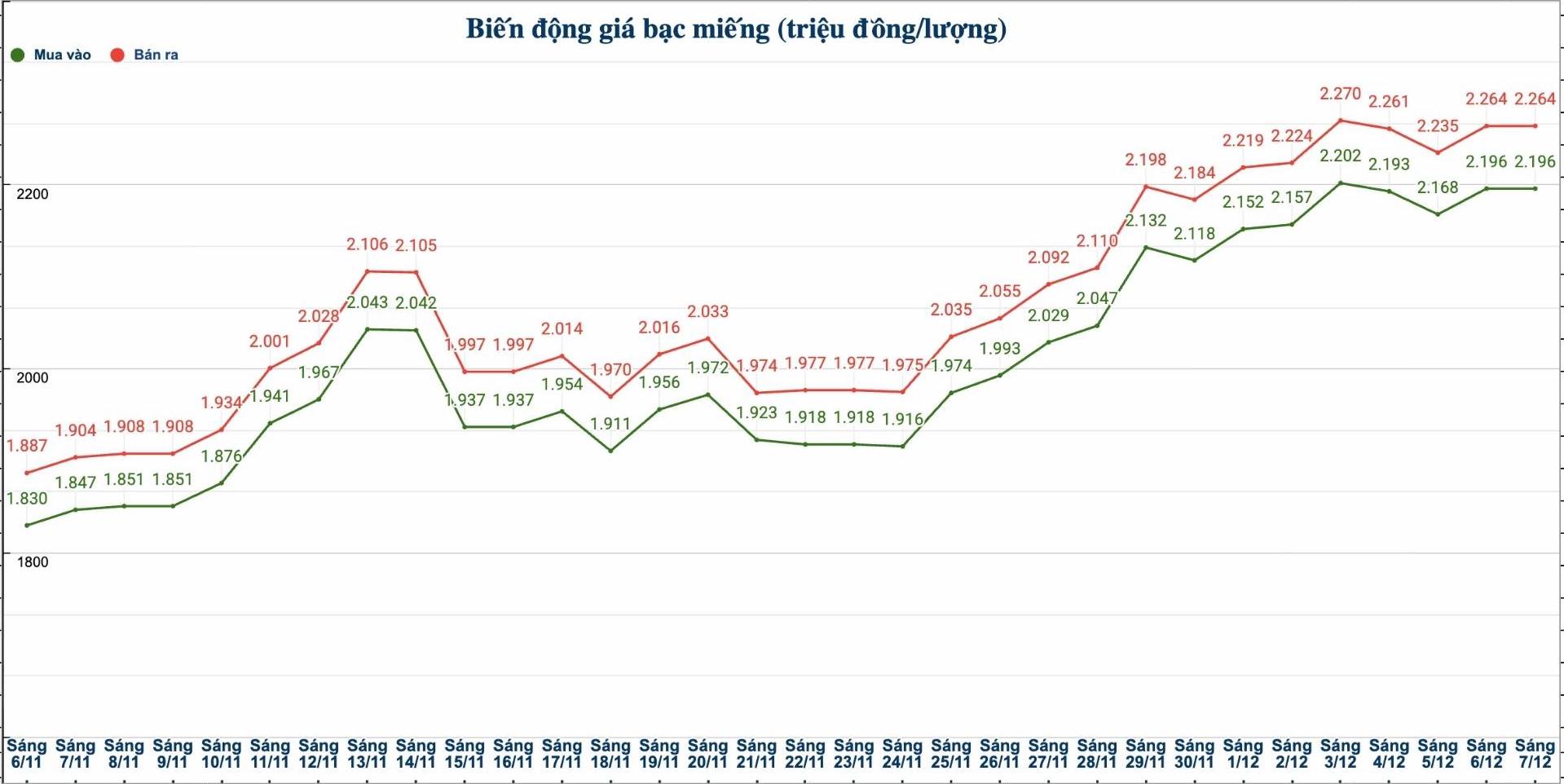

As of 13:20 on December 7, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND2.194 - 2.244 million/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 57.590 - 59.340 million VND/kg (buy - sell).

In the previous trading session (morning of November 7, 2025), the price of Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 48.494 - 49.844 million VND/kg (buy - sell).

Thus, if buying 999 999 Ancarat 999 (1kg) of 2025 silver bars at Ancarat Golden Rooster Company on November 7 and selling them this morning (December 7), buyers will make a profit of VND7.746 million/kg.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND2.196 - 2.264 million/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 58.559 - 60.373 million VND/kg (buy - sell).

In the previous trading session (morning of November 7, 2025), the price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 49.253 - 50.773 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on November 7 and selling it this morning (December 7), buyers will make a profit of VND 7.786 million/kg.

World silver price

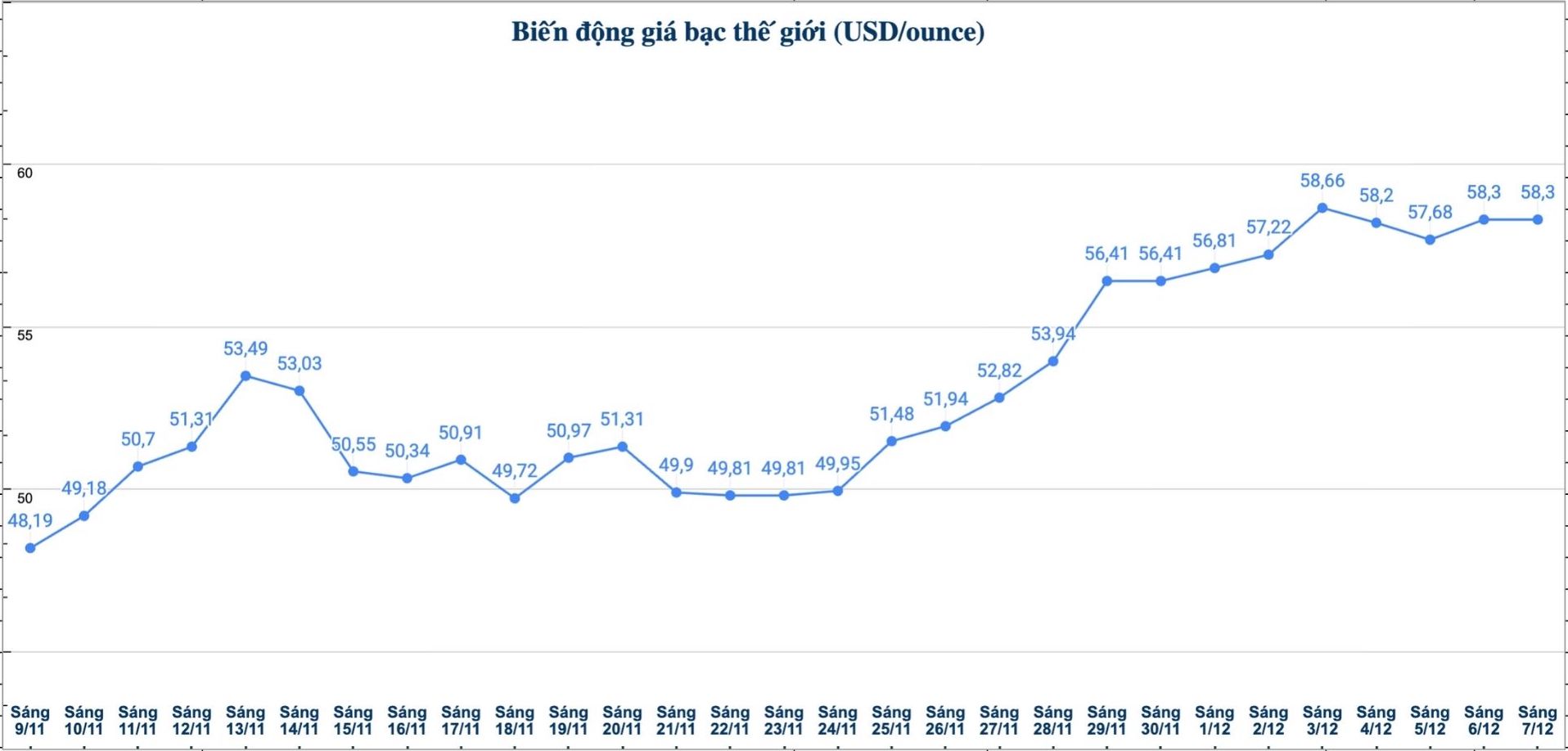

On the world market, as of 13:20 on December 7 (Vietnam time), the world silver price was listed at 58.3 USD/ounce.

Causes and predictions

This week's silver rally is supported by expectations that the US Federal Reserve (Fed) will cut interest rates by 25 basis points next week, along with stable industrial demand.

According to precious metals analyst James Hyerczyk at FX Empire, weak labor market data also reinforced expectations of a Fed rate easing.

"Newly released figures show that the US labor market continues to weaken. The ADP reported that the private sector lost 32,000 jobs in November - the sharpest decline in more than two years. These signals make the market believe that the Fed needs to maintain a "softer" policy to support growth," he said.

In addition, the core PCE index - the Fed's preferred inflation measure - increased by 0.2% monthly and 2.8% annually, generally in line with forecasts and showing that inflation is cooling down. This data supports the possibility of the Fed cutting interest rates at the next meeting, although not strong enough to open a faster easing cycle in 2026.

James Hyerczyk said that since the beginning of the year, silver prices have increased by 98% due to a prolonged shortage of supply and strong demand from the solar energy industry - a sector forecast to continue to set records in 2025. This continued to support silver's gains.

"The silver market still has room to increase in the short term thanks to expectations of the Fed cutting interest rates at the upcoming meeting, along with the weakening of the USD, thereby increasing the attractiveness of this precious metal" - James Hyerczyk commented.

See more news related to silver prices HERE...