Domestic silver price

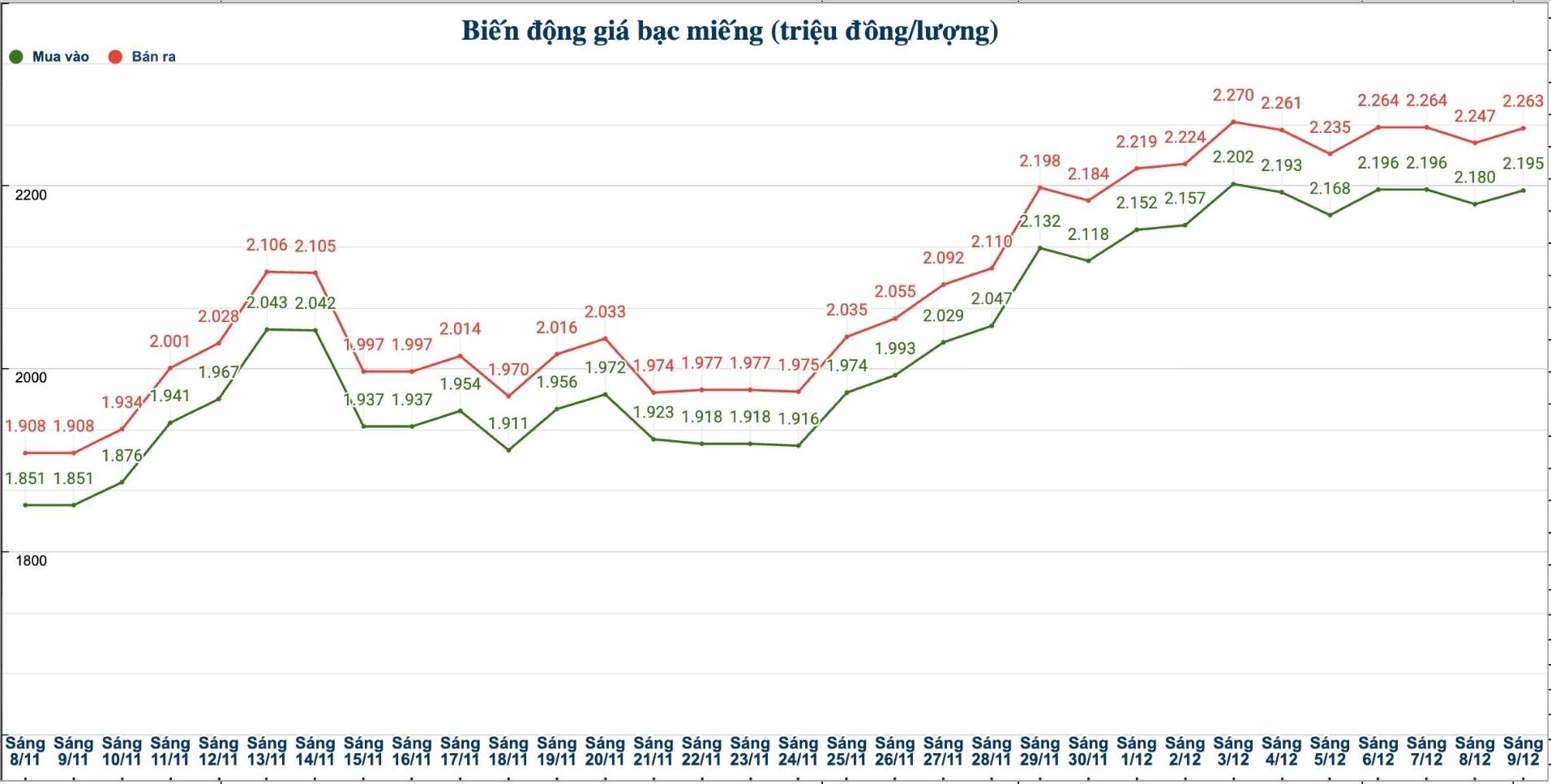

As of 10:40 a.m. on December 9, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2.192 - 2.242 million/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 57.536 - 59.2860 million VND/kg (buy - sell).

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND 2.142 - VND 2.196 million/tael (buy - sell); an increase of VND 3,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2.195 - VND 2.263 million/tael (buy - sell); an increase of VND 15,000/tael for buying and an increase of VND 16,000/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 58.533 - 60.346 million VND/kg (buy - sell); an increase of 400,000 VND/kg for buying and an increase of 427,000 VND/kg for selling compared to yesterday morning.

World silver price

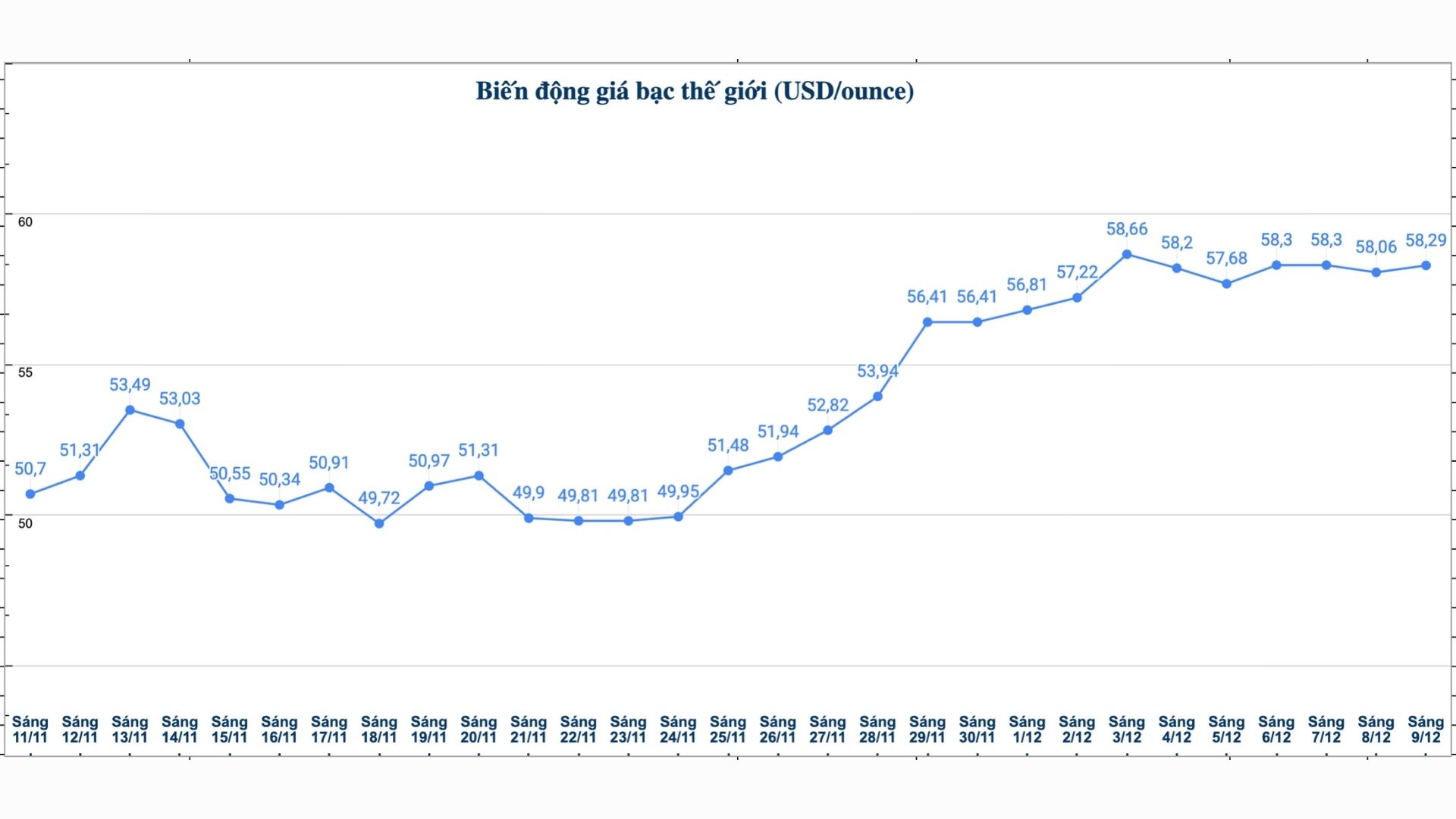

On the world market, as of 10:45 a.m. on December 9 (Vietnam time), the world silver price was listed at 58.29 USD/ounce; up 0.23 USD compared to yesterday morning.

Causes and predictions

According to precious metals analyst James Hyerczyk at FX Empire, silver prices are approaching record highs, driven by strong buying from ETFs, tightening supply.

"In the first four days of December, ETFs have attracted the most silver since July, even as prices are approaching record highs. This strong buying volume not only tightens supply but also shows an accumulation trend" - he said.

James Hyerczyk added that silver is not only an investment metal, but also an important raw material in solar energy production, accounting for about 20% of annual output. The renewable energy industry is expanding rapidly, causing industrial demand to remain stable. When prices decrease, industrial buyers often participate, helping to prevent sharp declines.

" Meanwhile, the market is at risk of falling for the fourth consecutive year, with inventories at their lowest level in many years. When supply is limited, even small increases in demand have a big impact on prices, explaining why silver prices have doubled this year," he said.

The expert said that loose monetary conditions also support silver prices, because this metal is both an industrial raw material and a valuable reserve tool. "If central banks maintain loose policy and fiscal stimulus measures, demand will continue to increase. In addition, geopolitical risks also promote cash flow to silver as a cheaper risk-off option than gold" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...