Expectations of a Fed rate cut are putting pressure on the USD, as the Fed prepares to enter a policy meeting this week.

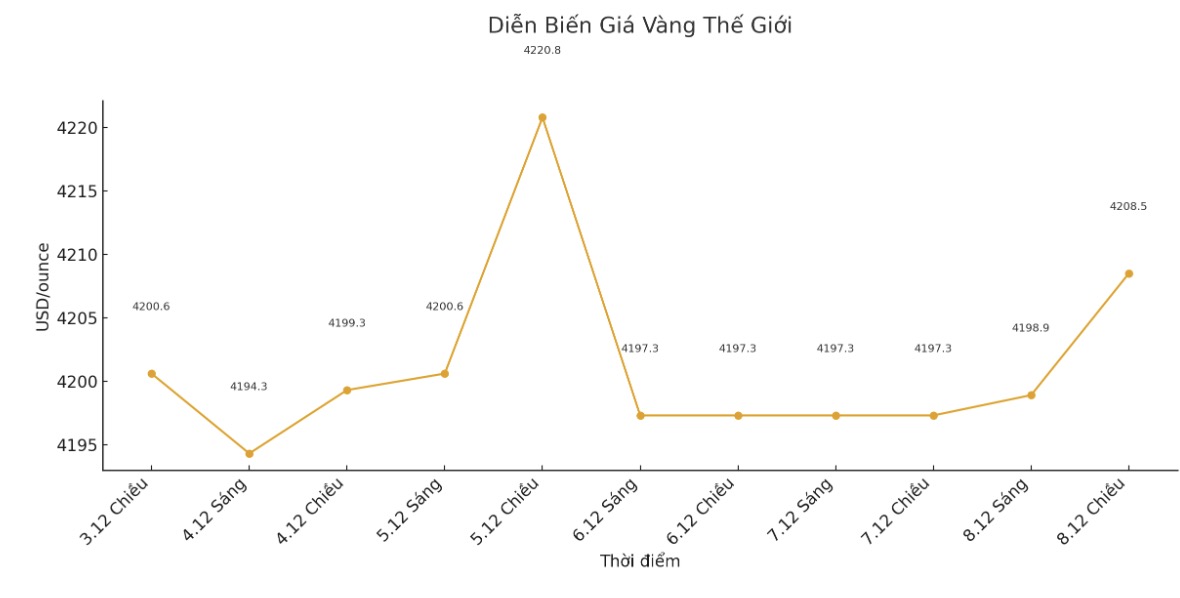

Spot gold increased 0.3% to $4,209.43/ounce at 8:51 GMT. Meanwhile, US gold futures for December fell slightly by 0.1% to $4,239.40/ounce.

The USD (.DXY) index decreased slightly, fluctuating near a one-month low reached on December 4, thereby making USD-denominated gold cheaper for foreign investors.

Gold is benefiting from the weakening of the US dollar and the market expecting the Fed to cut interest rates this week, said Giovanni Staunovo, an analyst at UBS.

Data released last week showed that US consumer spending increased moderately in September. This reflects the slowing economic growth amid escalating costs and a weakening labor market, as private sector jobs recorded their sharpest decline in more than two and a half years in November.

According to CME's FedWatch tool, the market is pricing in the possibility of an 87% chance that the Fed will cut interest rates by 25 basis points at the policy meeting on December 9-10, after weak economic data were released and many Fed officials signaled a dovish stance.

Lower interest rates typically boost demand for non-yielding assets like gold.

We still expect more rate cuts next year, which could push gold prices to $4,500/ounce, Staunovo added.

Silver rose 0.3% to 58.43 USD/ounce, after setting a record peak of 59.32 USD in the session last weekend.

Siliver is benefiting from supportive factors such as gold. In addition, expectations of improved industrial demand thanks to monetary and fiscal stimulus have also helped silver outperform gold in recent weeks," said Mr. Staunovo.

This white metal has doubled in value this year, thanks to a supply deficit and the US being classified as a strategic mineral.

In other precious metals, platinum rose 0.6% to $1,650.9/ounce, while palladium rose 1% to $1,471.26/ounce.

See more news related to gold prices HERE...