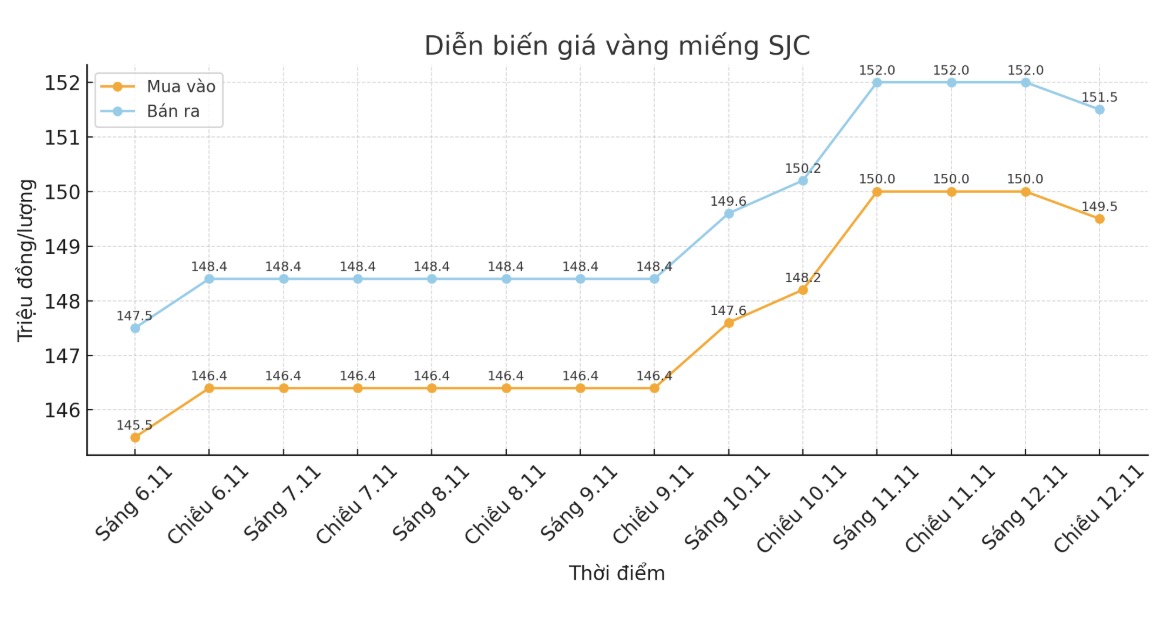

SJC gold bar price

As of 5:25 p.m., DOJI Group listed the price of SJC gold bars at VND 149.5-151.5 million/tael (buy in - sell out), down VND 500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 150-151.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 148.5-151.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

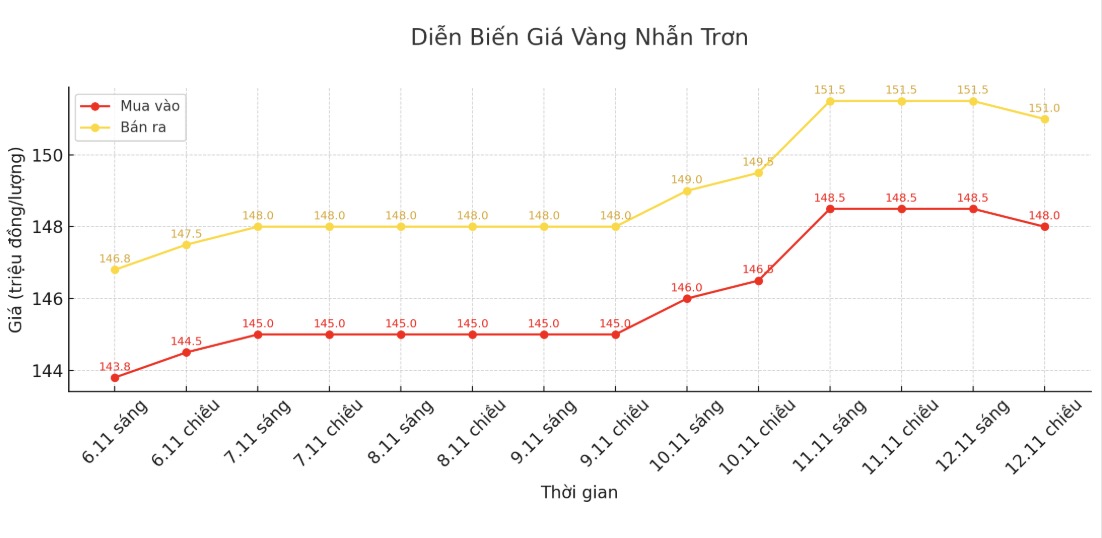

9999 gold ring price

As of 5:25 p.m., DOJI Group listed the price of gold rings at 148-151 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 148.8-151.8 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 148.2-151.2 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

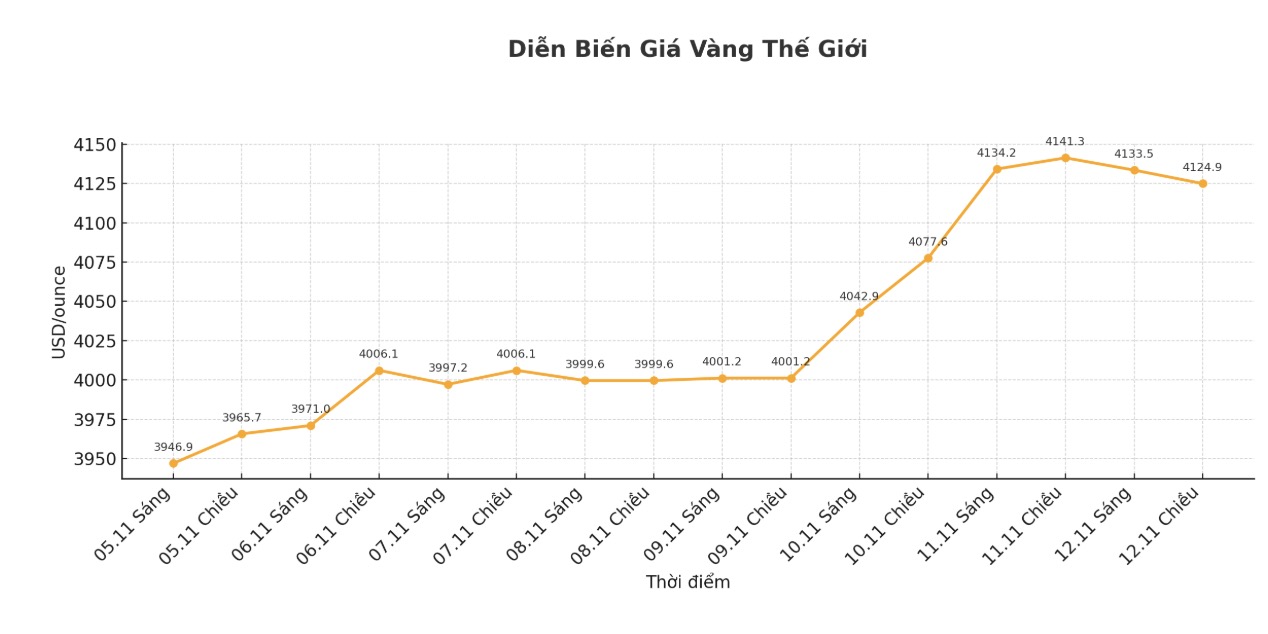

World gold price

The world gold price was listed at 5:23 p.m., at 4,124.9 USD/ounce, down 16.4 USD compared to a day ago.

Gold price forecast

Gold prices fell slightly in the trading session on Wednesday, under pressure from the recovery of the USD and profit-taking activities after the precious metal climbed to a nearly three-week high in the previous session, thanks to expectations that the US Federal Reserve (FED) will cut interest rates next month.

The recent weakening of the US dollar has supported gold and silver well, both of which have recorded gains this week, said Tim Waterer, chief market analyst at KCM Trade. It seems that "regular order" has returned to gold, as the precious metal holds steady above $4,100 and is heading for higher levels, if US economic data continues to support the possibility of monetary policy easing."

According to Ms. Hebe Chan, an analyst at Vantage Markets (Melbourne), the recent recovery of gold prices exceeding the 4,100 USD/ounce mark reflects the potential uncertainty under the optimism surrounding the US government's reopening.

The chain effects of the longest government shutdown in US history may have left a lasting impression, maintaining safe-haven demand for gold despite the overall market sentiment being more positive, she said.

USD Index (.DXY) rose 0.1% against other major currencies, ending a streak of five consecutive sessions of decline, making gold less attractive to investors holding other currencies.

The US Senate approved a federal budget restoration deal on Monday, following a record-long closure that left millions without food subsidies, hundreds of thousands of federal employees unpaid, disrupted air transportation and delayed release of economic data.

According to CME Group's FedWatch tool, investors are currently pricing in a 68% chance that the Fed will cut interest rates by another 25 basis points next month, up from 64% in the previous session.

Gold - a non-interest-bearing asset often benefits in a low interest rate environment and when the global economy is unstable.

Fed Governor Stephen Miran said on Monday that a 50 basis point cut would be reasonable for the December session, as inflation is cooling while the unemployment rate continues to rise.

SPDR Gold Trust - the world's largest gold ETF - said its gold holdings increased by 0.41% to 1,046.36 tons on Tuesday, compared to 1,042.06 tons on Monday.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...