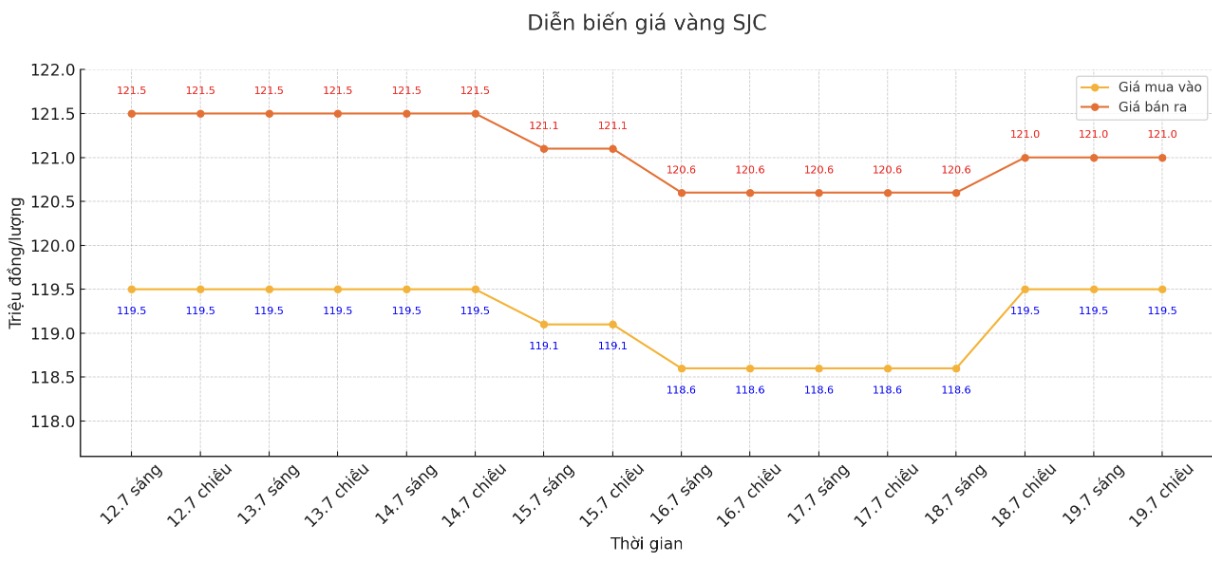

SJC gold bar price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.5-121 million/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.5-121 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.5-121 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 118.721 million VND/tael (buy - sell); increased by 300,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

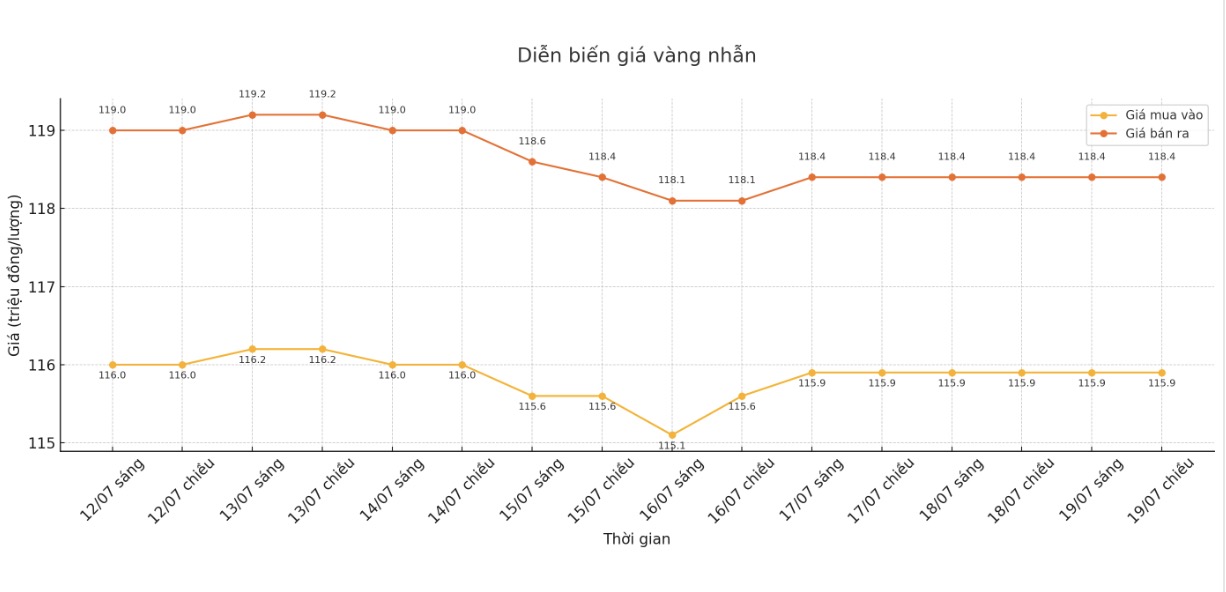

9999 gold ring price

As of 5:00 p.m., DOJI Group listed the price of gold rings at 115.9-118.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.1-119.1 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.8-117.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

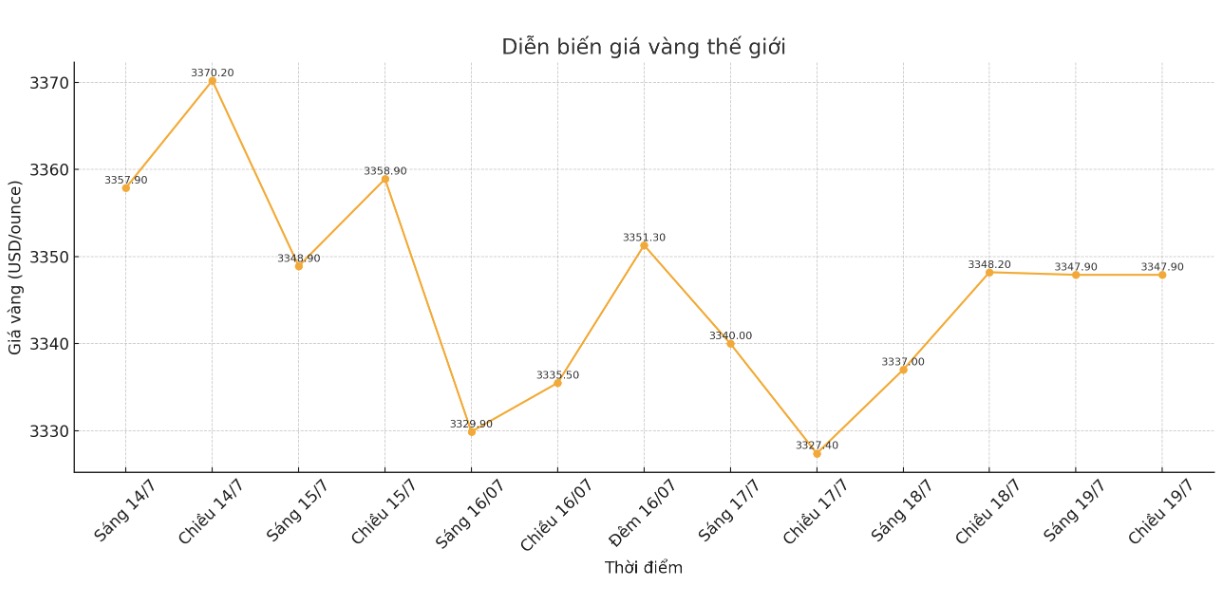

World gold price

The world gold price was listed at 5:00 p.m. at 3,347.9 USD/ounce, unchanged from 1 day ago.

Gold price forecast

World gold prices have been held in a narrow range around 3,240 - 3,446 USD/ounce for many weeks, despite a series of economic and geopolitical fluctuations.

Analysts say that gold is lacking a strong enough catalyst to create a breakthrough, in the context of the USD maintaining its strength and the monetary policy of the US Federal Reserve (FED) has not changed.

Christopher Vecchio - Head of Strategy at Tastylive.com - commented that gold still shows impressive resilience when staying firmly above the support level of 3,300 USD/ounce, despite pressure from the USD. However, short-term profit-taking and the mentality of waiting for new policies from the FED make it difficult for prices to increase higher.

The USD is still a factor that holds back gold's increase. The relationship between these two types of assets makes investors prioritize USD - the yielding capital - over unyielding gold. As long as the Fed has not shown any signs of cutting interest rates, the USD will remain strong and gold will find it difficult to escape the tug-of-war state.

In addition, US economic data such as GDP, consumption and labor market are still positive, not creating pressure for the Fed to loosen policy. In the short term, Fed Chairman Jerome Powell's statements in Washington or the move from the European Central Bank (ECB) could have an indirect impact on gold prices via exchange rate channels.

An expected scenario being mentioned by investors is the possibility of Mr. Donald Trump replacing the Fed Chairman if re-elected. A new Fed leader following the puppet trend could reverse monetary policy, creating an opportunity for gold prices to break out. However, institutional constraints make it difficult for this change to happen in the short term.

Gold investors are patiently waiting for a "fire" strong enough to escape the current price range. Without major fluctuations from the US economy or policy changes, the possibility of gold price increase is still very fragile.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...