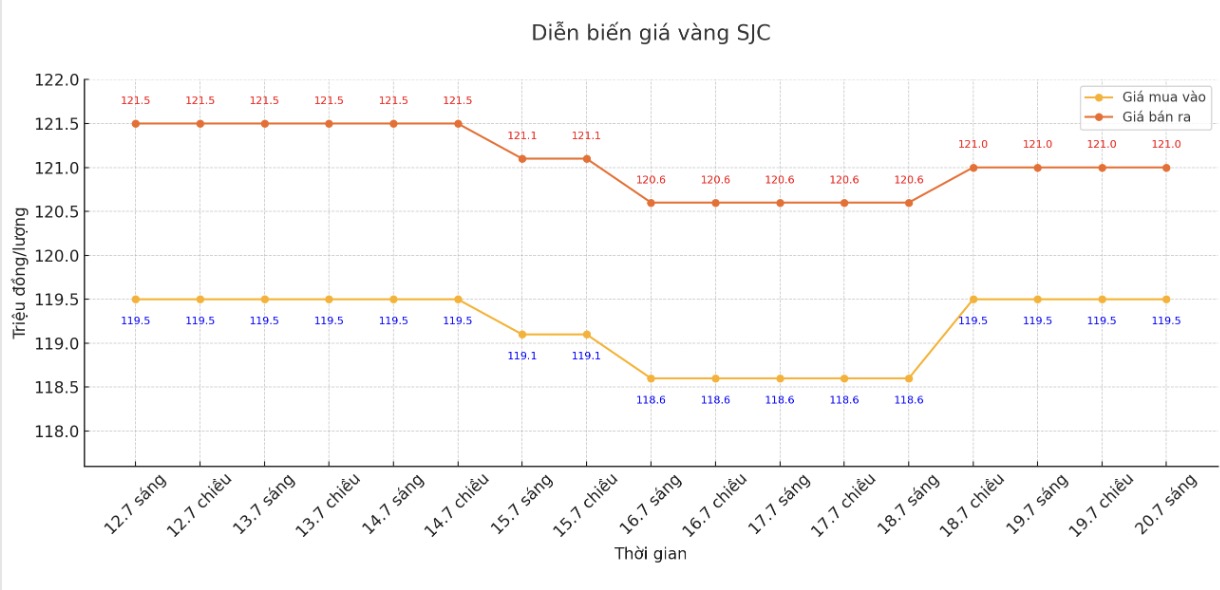

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 119.5-121 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (July 13, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC remained the same for buying and decreased by 500,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.5-121 million/tael (buy in - sell out).

Compared to a week ago, the price of SJC gold bars was kept unchanged by Bao Tin Minh Chau for buying and decreased by 500,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

If buying SJC gold at Bao Tin Minh Chau and Saigon Jewelry Company SJC in the session of July 13 and selling it in today's session (July 20), buyers will lose 2 million VND/tael.

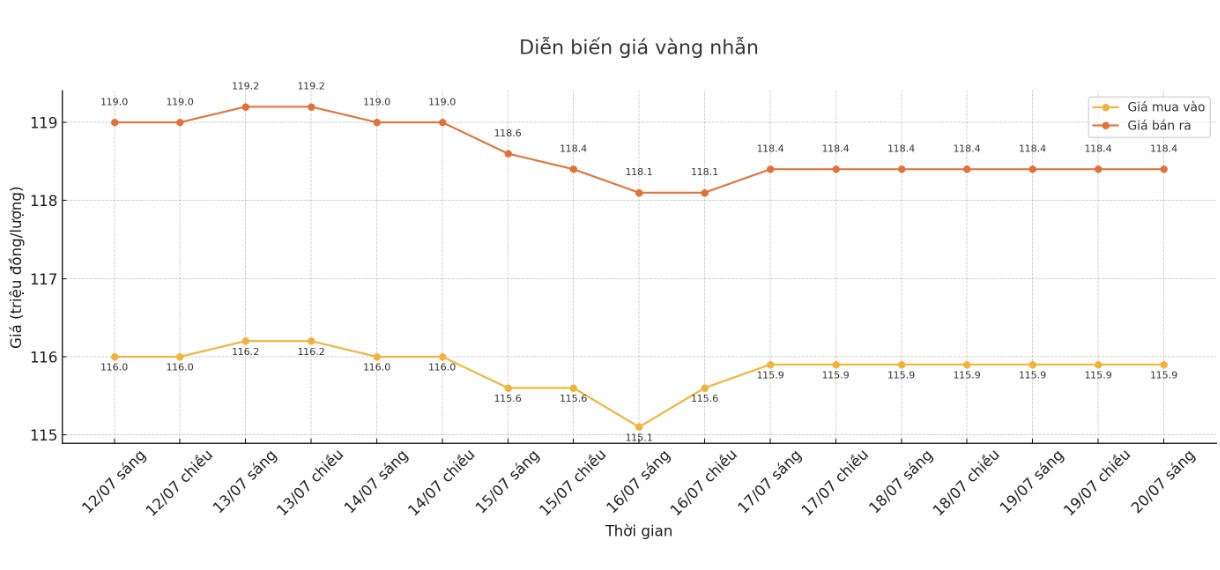

9999 gold ring price

This afternoon, Bao Tin Minh Chau listed the price of gold rings at 116.1-119.1 million VND/tael (buy - sell); down 100,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.8-117.8 million VND/tael (buy - sell), down 400,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of July 13 and selling in today's session (July 20), buyers at Bao Tin Minh Chau will lose 3.1 million VND/tael, while the loss when buying in Phu Quy is 3.4 million VND/tael.

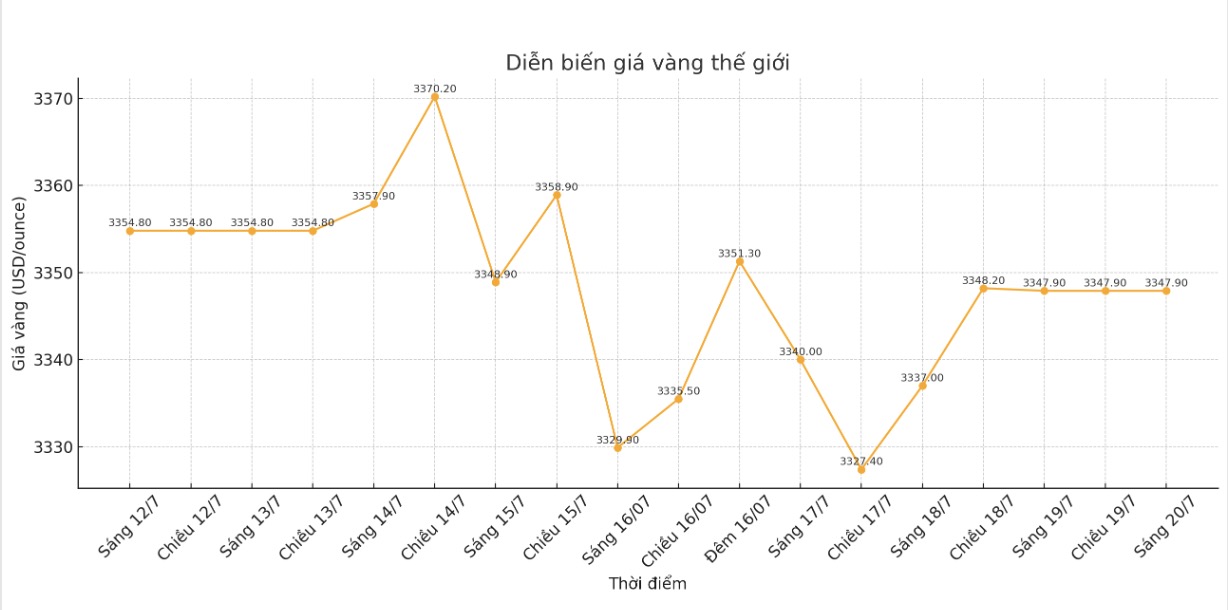

World gold price

At the end of the trading session of the week, the world gold price was listed at 3,347.9 USD/ounce, down 6.9 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

Naeem Aslam - Investment Director at Zaye Capital Markets said that the USD is finding support as the Federal Reserve (FED) is expected to maintain a neutral stance throughout the summer. Unless economic data falls sharply, the Fed will find it difficult to cut interest rates. This means that the USD is likely to appreciate. This is not a favorable scenario for gold prices.

Lukman Otunuga - senior market analyst at FXTM commented that gold prices are currently fluctuating in a fairly narrow range, with support at 3,290 USD/ounce and resistance at 3,370 USD/ounce.

Amid escalating trade tensions, President Trump's pressure to cut interest rates and strong US economic data, gold is lacking a clear driver to break out.

Looking beyond short-term fluctuations, analysts warn of a persistent discord between President Trump and Chairman Powell. This tense relationship could create significant fluctuations in the financial market, even overshadowing short-term trends in gold prices in the future.

Sean Lusk - Director of Trade Risk Prevention at Walsh Trading - said that the tension between US President Donald Trump and Jerome Powell is the main factor that helps gold prices remain at the current high level, despite the market seemingly ready for a correction.

Regarding monetary policy, Mr. Lusk predicted that the Fed would not cut interest rates at the July meeting, and would not rush to make this move afterwards.

Regarding factors driving gold prices in the short and medium term, Mr. Lusk expressed skepticism about the possibility of this precious metal increasing sharply. "In the past two and a half years, central banks have bought. But do they need to continue buying when the stock market is performing better than expected?" - Sean Lusk said.

Notable US economic data next week

The economic calendar next week will revolve around the interest rate decision of the European Central Bank (ECB), along with a series of data on manufacturing and housing expected to be released.

Federal Reserve Chairman Jerome Powell will give an opening speech at an event in Washington, D.C. While he is uncertain to mention recent criticism from President Donald Trump, investors will still be watching closely.

There will be a report on existing US home sales in June on Wednesday. By Thursday, the market will receive a series of important information including the ECB's monetary policy decision, preliminary PMI data from S&P, US weekly jobless claims and new home sales.

The last notable data of the week is the US long-term orders report for June, released on Friday morning.

See more news related to gold prices HERE...