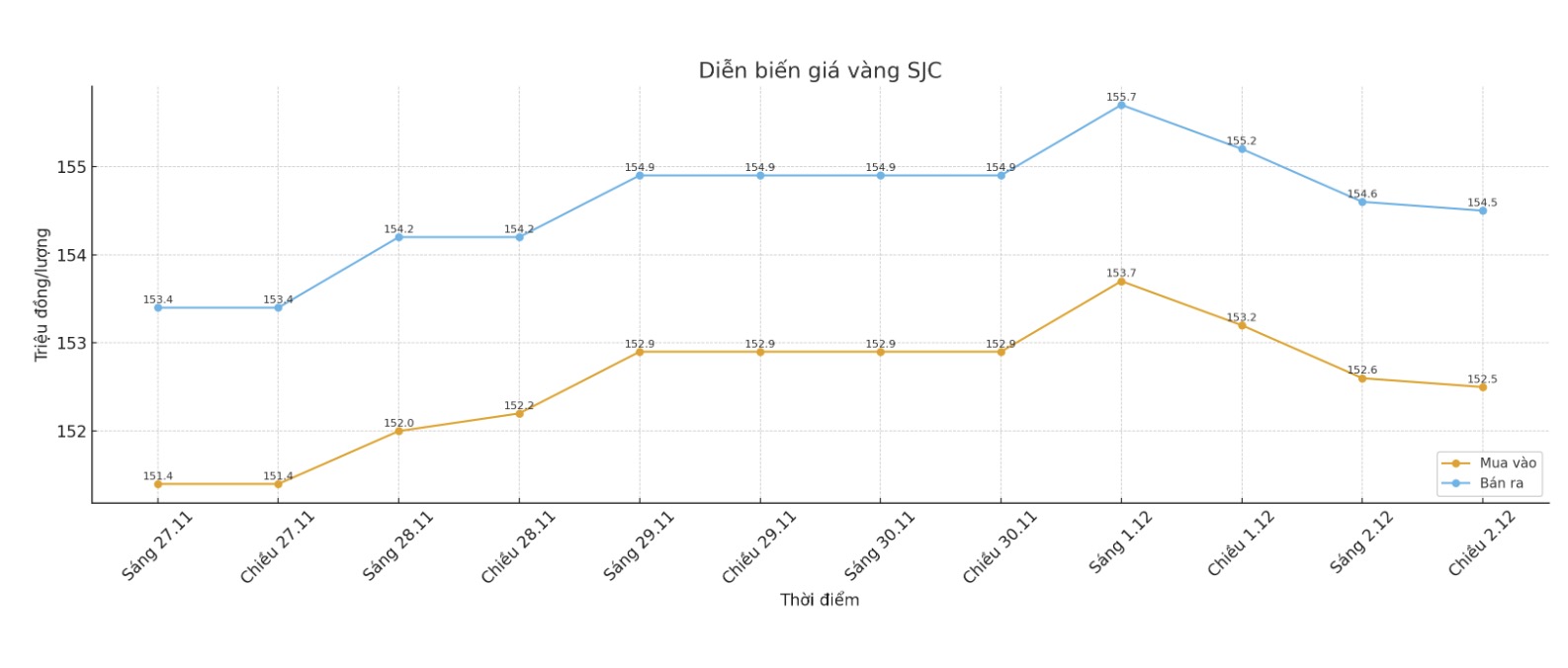

SJC gold bar price

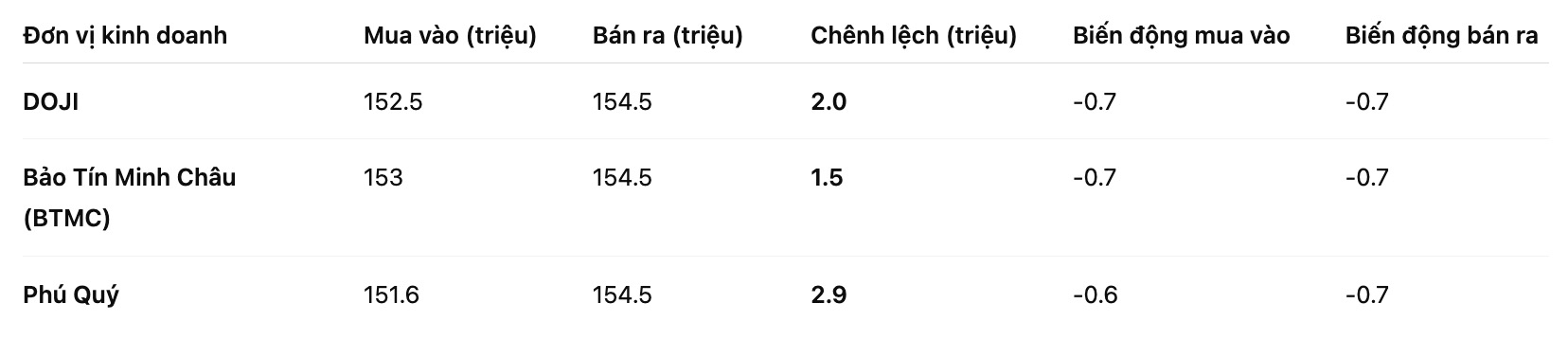

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at 152.5-154.5 million VND/tael (buy in - sell out), down 700,000 VND/tael for both. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153-154.5 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.6-154.5 million VND/tael (buy - sell), down 600,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling prices is at 2.9 million VND/tael.

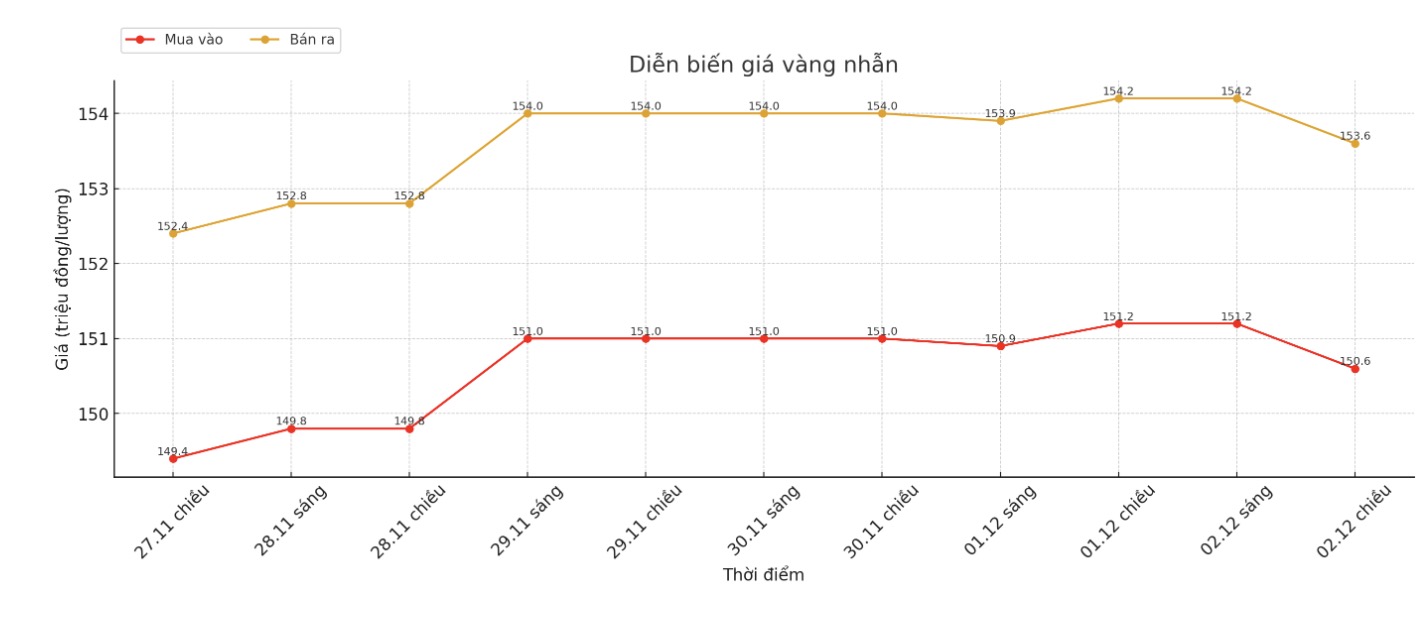

9999 gold ring price

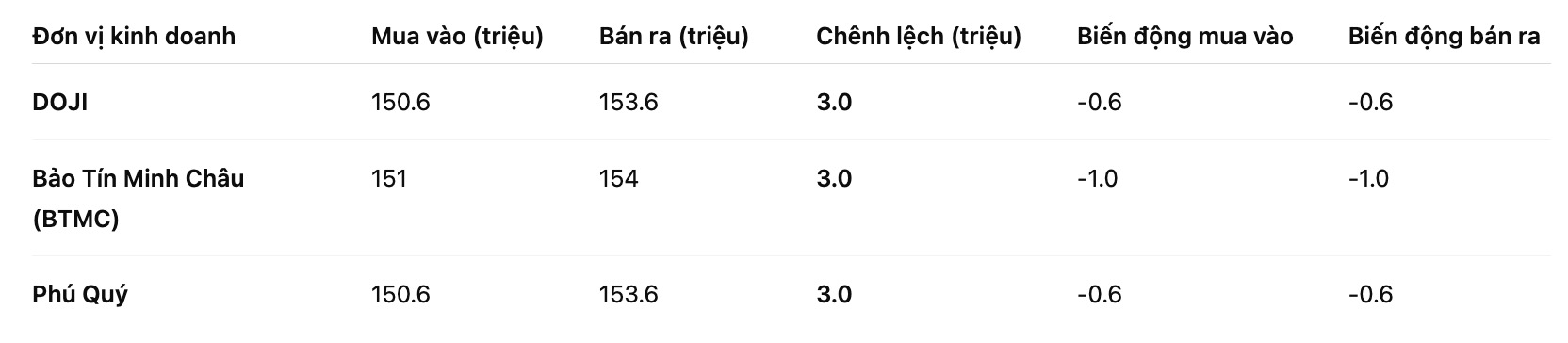

As of 7:05 p.m., DOJI Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151-154 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

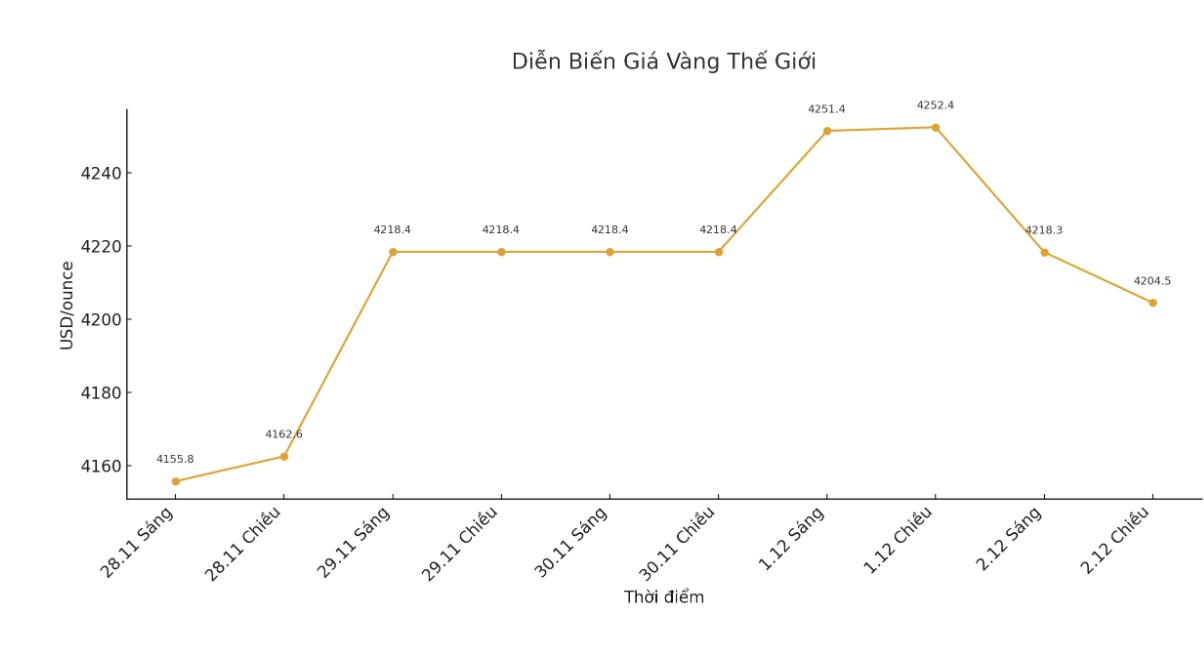

World gold price

The world gold price listed at 7:10 p.m. was at 4,204.5 USD/ounce, down 47.9 USD compared to a day ago.

Gold price forecast

Gold prices fell on Tuesday after hitting a six-week high in the previous session, due to rising US Treasury yields and profit-taking activities causing pressure, as investors awaited US economic data to assess the Federal Reserve's (Fed) policy roadmap.

The yield on the 10-year US Treasury note hovered near a two-week high set in the previous session, reducing the appeal of non-yielding gold.

Gold is having a weak performance today, but the picture is basically unchanged a picture including expectations of a Fed rate cut, which is a support for gold in terms of yield factors, said Mr. Tim Waterer - Head of Market Analysis at KCM Trade.

The market is cautious as Fed Chairman Jerome Powell is expected to not give a dovish view like some of his colleagues, and the core personal consumption price index (PCE core) - the Fed's preferred inflation measure - released on Friday is expected to remain relatively "tedent", Mr. Waterer added.

In Kitco's online survey, 260 individual investors made forecasts. There were 183 votes, or 70%, believing that gold prices will continue to increase this week. The forecast rate decreased by 11% and neutrality accounted for 19%.

Rich Checkan - Chairman of Asset Strategies International believes that gold prices still have room to increase as the Ukrainian conflict has not shown any signs of cooling down and the expectation of the Fed cutting interest rates for the third time is becoming increasingly clear.

Forex strategist James Stanley warned investors not to "hunt", as gold prices have risen for many consecutive weeks and a number of long-term investors may take profits before the end of the fiscal year.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...