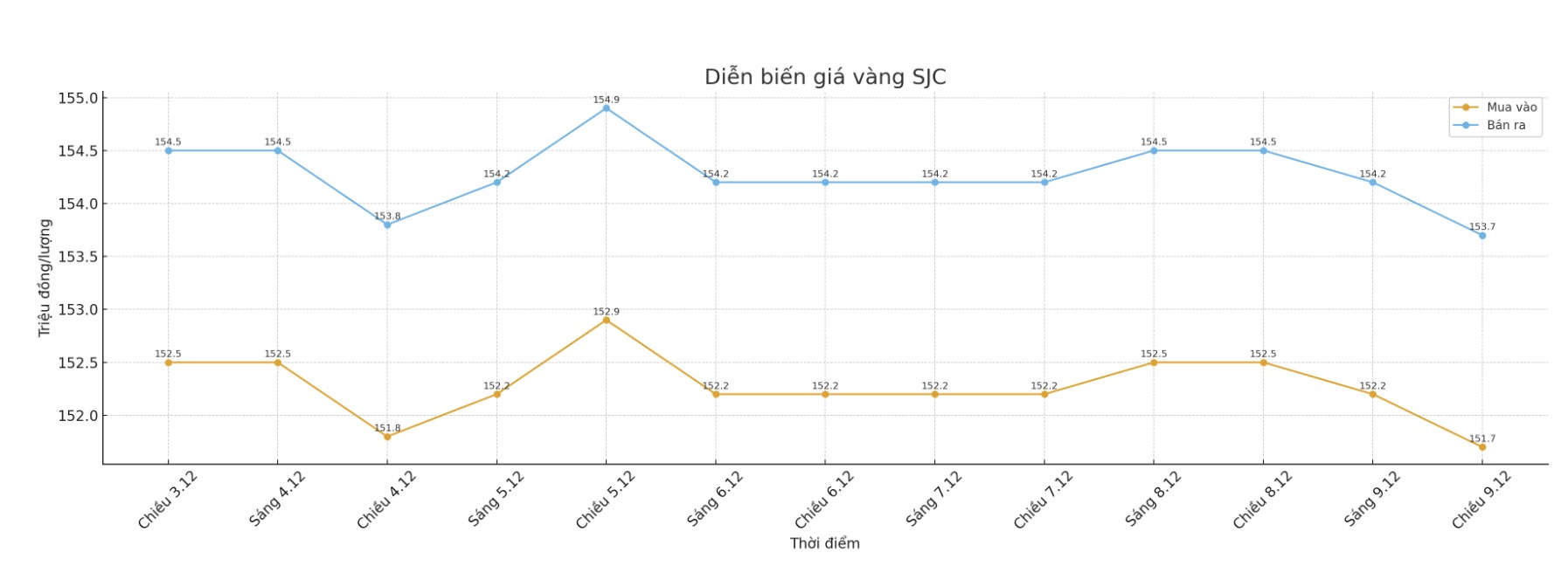

SJC gold bar price

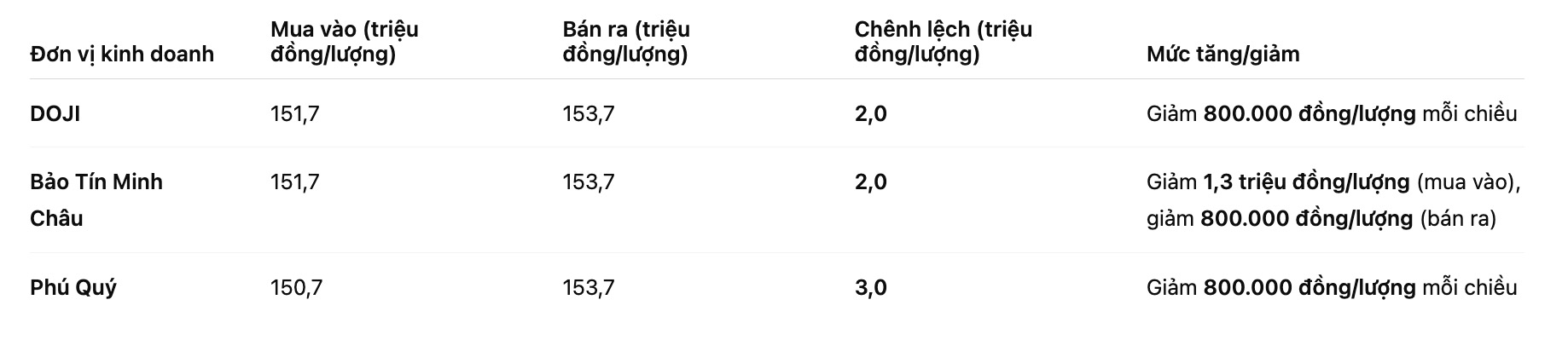

As of 5:45 p.m., DOJI Group listed the price of SJC gold bars at 151.7-153.7 million VND/tael (buy in - sell out), down 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 151.7-153.7 million VND/tael (buy - sell), down 1.3 million VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.7-153.7 million VND/tael (buy - sell), down 800,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

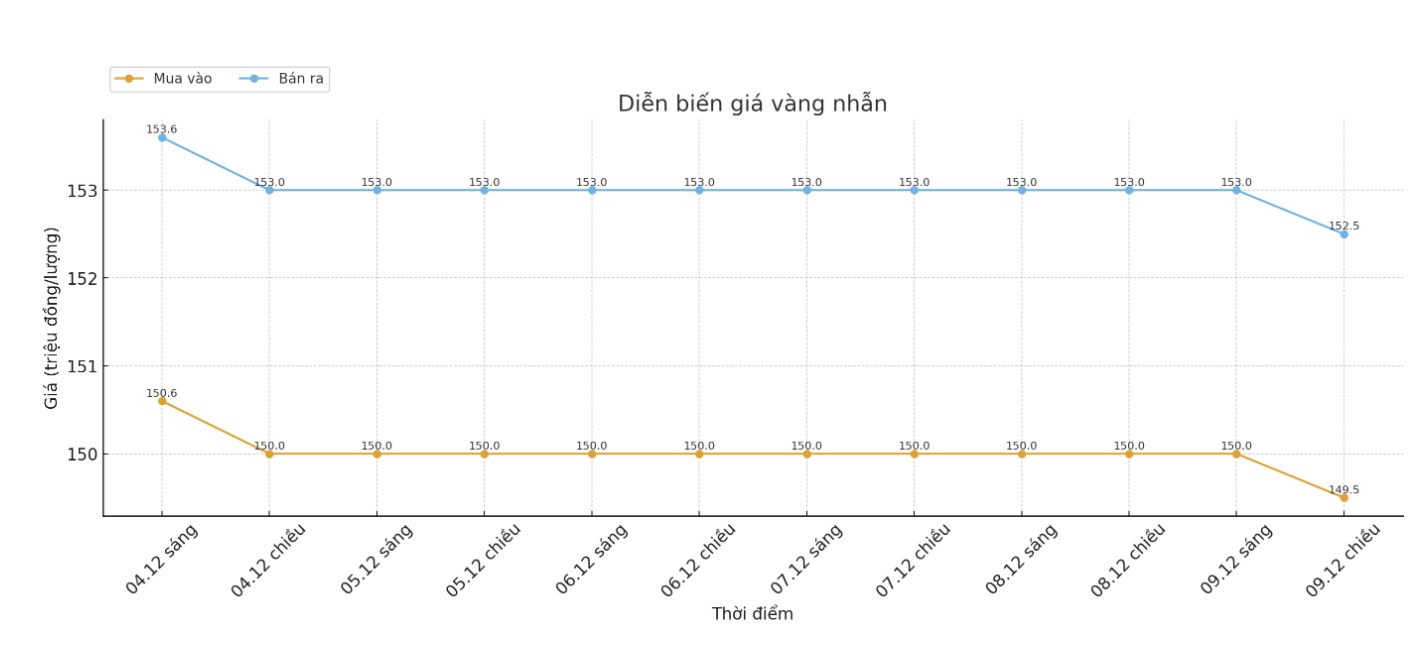

9999 gold ring price

As of 7:45 p.m., DOJI Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.5-153.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

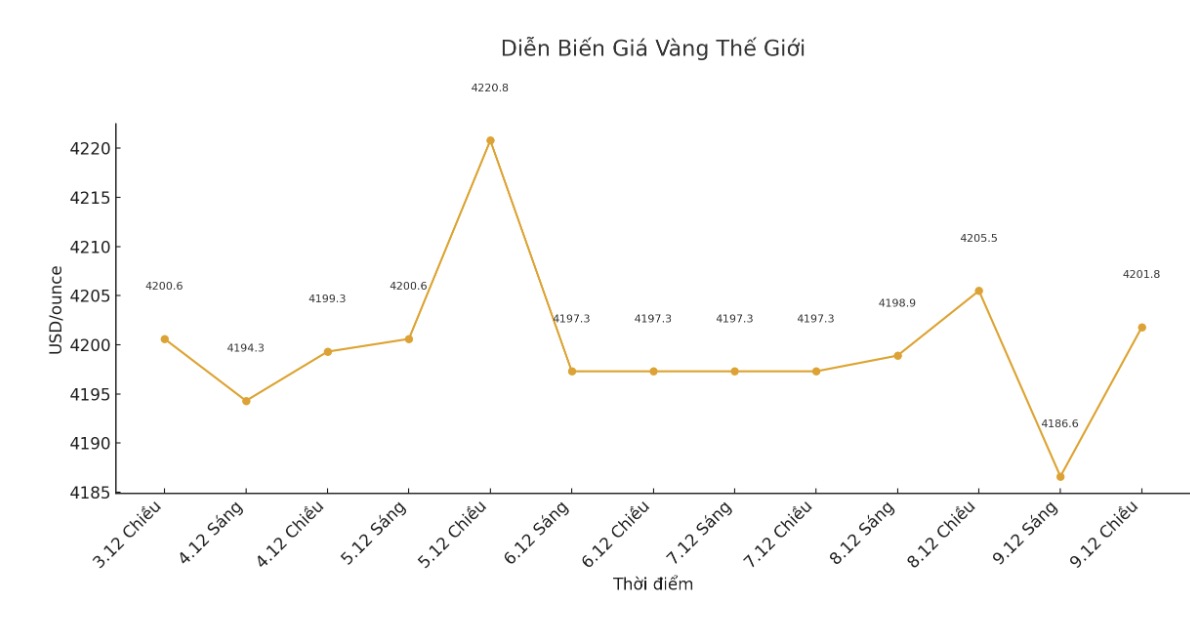

World gold price

The world gold price was listed at 5:45 p.m., at 4,201.8 USD/ounce, down 1.8 USD compared to a day ago.

Gold price forecast

World gold prices are struggling as they await the interest rate decision of the US Federal Reserve (Fed).

Mr. Aaron Hill - Head of Market Analysis at FP Markets - commented: "The outlook for gold in the coming time will depend on whether the Fed continues to loosen, as well as macroeconomic factors such as weak growth or escalating geopolitical risks.

To reach new record highs, gold needs a combination of strong interest rate cuts, a weaker US dollar and increased safe-haven demand. Breaking into unprecedented price zones before the end of the year will require more than just a rate cut an economic shock or more obvious dovish signals from the Fed could be a catalyst.

Senior market analyst Kelvin Wong at OANDA said that investors are mainly restructuring their positions ahead of the Fed's policy meeting.

Previously this month, Jerome Powell gave a hawkish signal about the direction of interest rate cuts at a press conference. Therefore, investors in the US Treasury bond market are adjusting their position," he said.

Gold is benefiting from the weakening of the US dollar and the market expecting the Fed to cut interest rates this week, said Giovanni Staunovo, an analyst at UBS.

According to CME's FedWatch tool, the market is pricing in the possibility of an 87% chance that the Fed will cut interest rates by 25 basis points at the policy meeting on December 9-10, after weak economic data were released and many Fed officials signaled a dovish stance.

See more news related to gold prices HERE...