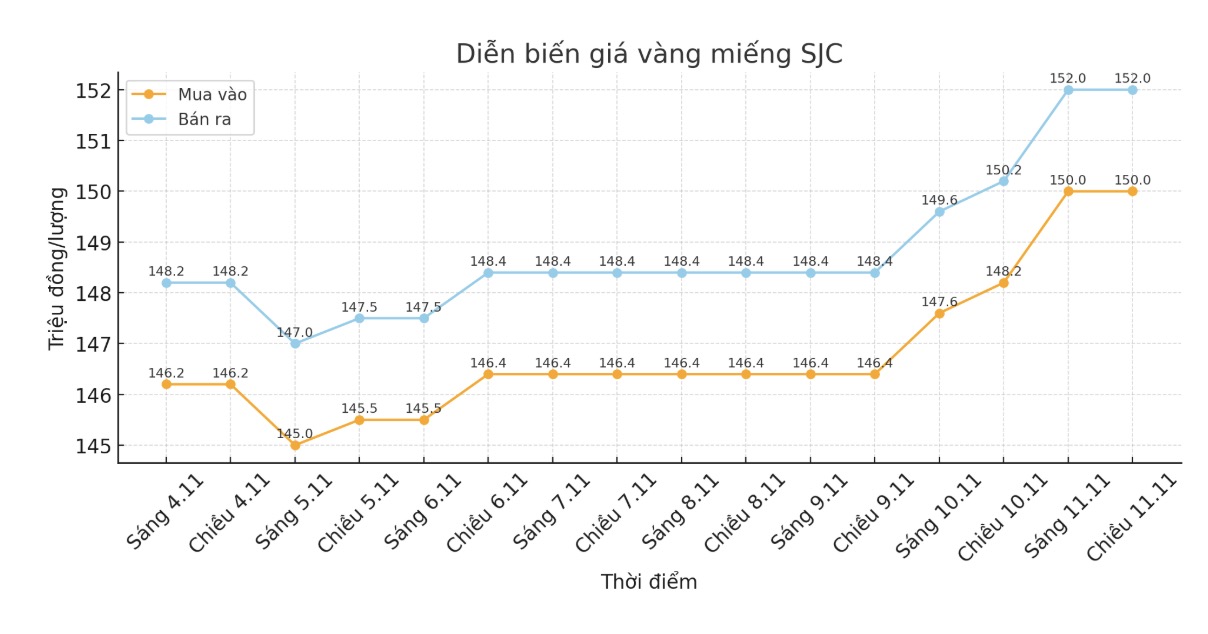

SJC gold bar price

As of 6:00 a.m. on November 12, the price of SJC gold bars was listed by DOJI Group at 150-152 million VND/tael (buy in - sell out), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 150.5-152 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 149-152 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

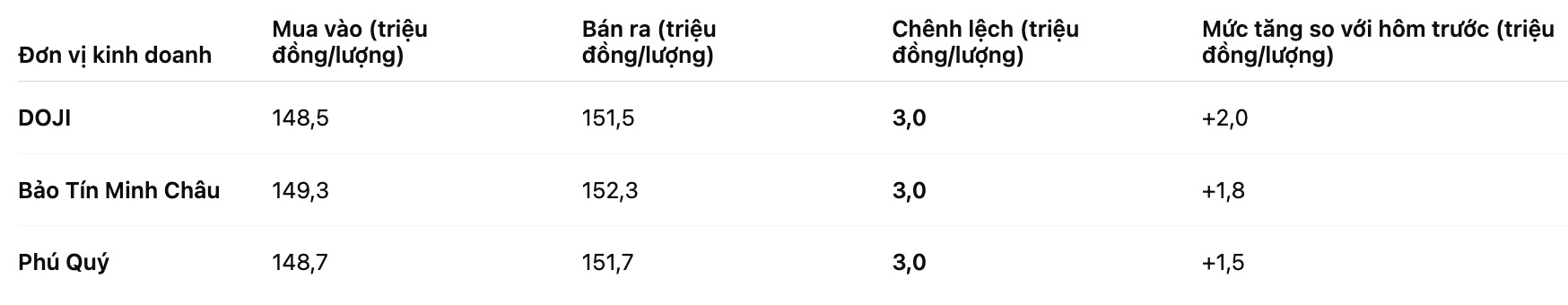

9999 gold ring price

As of 6:00 a.m. on November 12, DOJI Group listed the price of gold rings at 148.5-151.5 million VND/tael (buy - sell), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 149.3-152.3 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 148.7-151.7 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

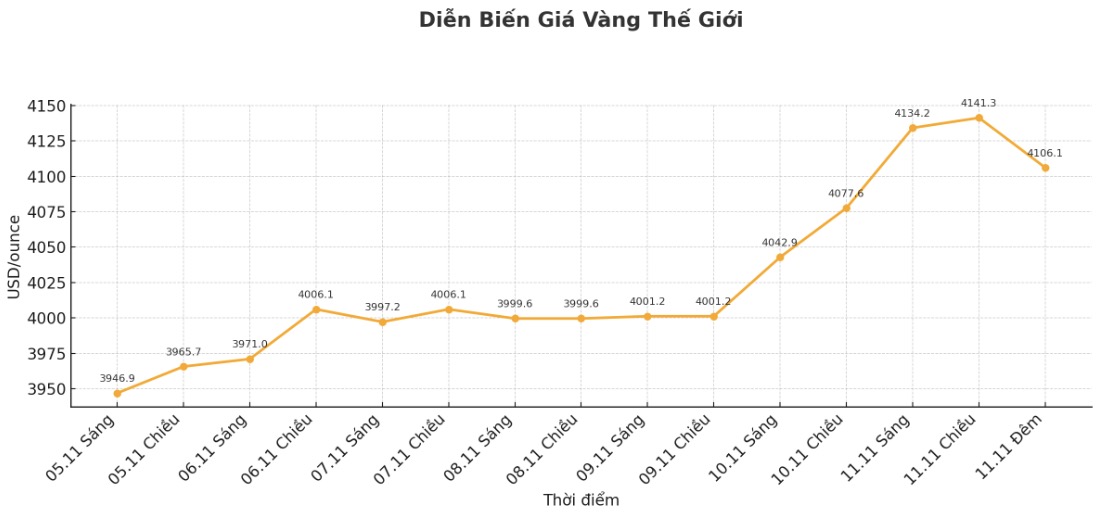

World gold price

The world gold price was listed at 11:33 p.m. on November 11 (Vietnam time) at 4,106.1 USD/ounce, up 11.1 USD compared to a day ago.

Gold price forecast

Gold and silver prices continued to rise, reaching a three-week high in the US trading session on Tuesday morning, following the strong buying momentum from the first session of the week.

Expectations that the US Federal Reserve (FED) may cut interest rates in December, along with signals that the US Government is about to reopen, are supporting the precious metals market.

The upcoming release of US economic data could reflect the weakening of the economy, thereby prompting the Fed to loosen monetary policy.

US lawmakers appear to have reached a deal to end the longest government shutdown in the country's history. A resumption of government operations will allow the delay in releasing economic data, which is expected to show a weak outlook - a factor that could prompt the Fed to loosen policy at the December FOMC meeting.

Lower interest rates are often a positive factor for precious metals, due to increased global demand and downward pressure on the USD. Gold is now on track for its biggest year of gains since 1979, after hitting an all-time record in October.

Meanwhile, the global stock market moved in opposite directions overnight, and US stock indexes were forecast to open slightly down.

In overnight news, the US Senate passed a temporary funding bill to end a prolonged government shutdown, with a vote of 60-40, after a group of moderate Democratic Senators supported it.

The bill will maintain the operations of most government agencies through January 30 and some others through September 30, which are awaiting the Republican-controlled House of Representatives on Wednesday. The document also stipulates a payback to all federal employees who lost income during the closing period and prohibits employees from being laid off before January 30.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...