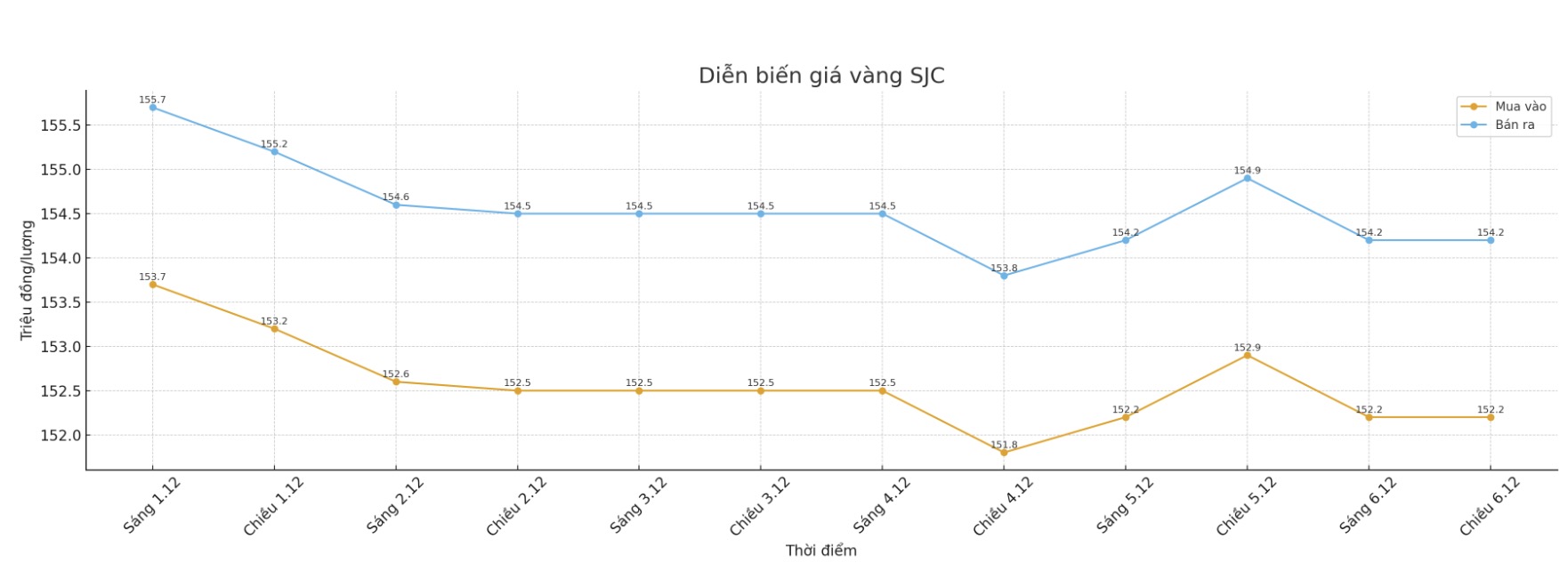

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND152.2-154.2 million/tael (buy in - sell out), down VND700,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.7-154.2 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.2-154.2 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

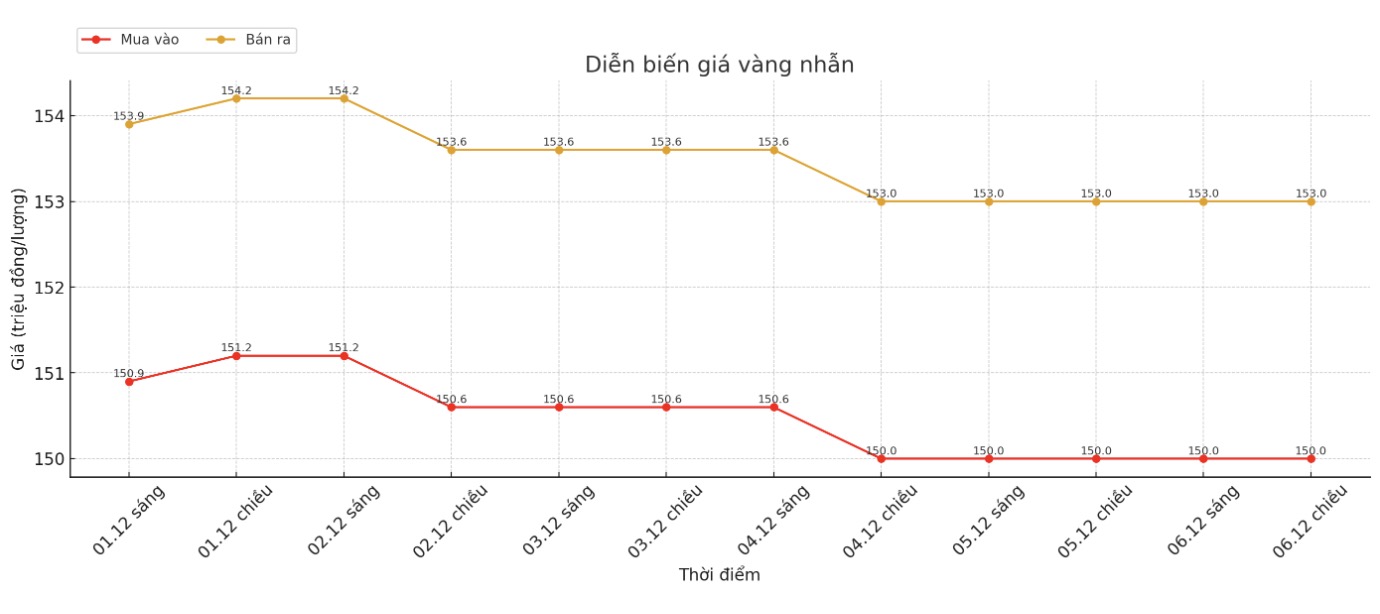

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.5-153.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

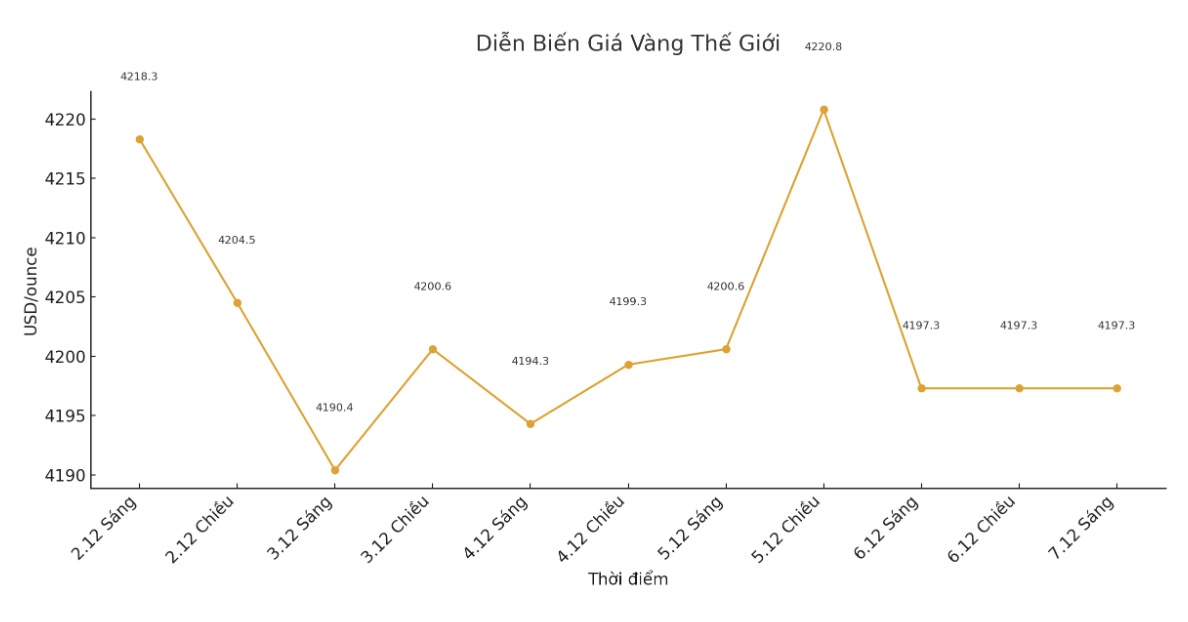

World gold price

The world gold price was listed at 6:00 a.m., at 4,197.3 USD/ounce, down 47.1 USD compared to a day ago.

Gold price forecast

Mr. Aaron Hill - Head of Market Analysis at FP Markets - commented: "The outlook for gold in the coming time will depend on whether the US Federal Reserve (Fed) continues to loosen, as well as macroeconomic factors such as weak growth or escalating geopolitical risks.

To reach new record highs, gold needs a combination of strong interest rate cuts, a weaker US dollar and increased safe-haven demand. Breaking into unprecedented price zones before the end of the year will require more than just a rate cut an economic shock or more obvious dovish signals from the Fed could be a catalyst.

In addition to the interest rate decision, Ms. Barbara Lambrecht - commodity analyst at Commerzbank - said that she is particularly interested in the Fed's policy orientation and future interest rate forecast, also known as the " dot plot chart".

In the September Economic Forecast Summary (SEP), the Fed signaled that there will be two interest rate cuts next year. However, concerns about a weak economy and expectations of increased pressure and political impact are raising speculation that the Fed may cut interest rates more strongly next year.

If FOMC members expect more rate cuts than expected in September, it could push gold prices higher, especially as the market has barely priced in the possibility of a rate cut at its meetings early next year, said Lambrecht.

Mr. Lukman Otunuga - senior market analyst at FXTM - said that gold prices will fluctuate strongly due to uncertainties surrounding the Fed's monetary policy orientation.

Its worth noting that the market is expecting the US to cut interest rates for the third time this year, but the outlook for 2026 is much more unpredictable. The lack of the latest data on the non-farm payrolls (NFP) in October and CPI has forced officials to make decisions in the context of incomplete information, in the context of the FOMC being more divided than in recent years.

Therefore, any surprise can cause gold to fluctuate strongly. Technically, if gold breaks above $4,240, prices could head toward $4,300 an ounce. Conversely, if weaken below $4,200, prices could fall to $4,180/ounce or $4,160/ounce," he said.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...