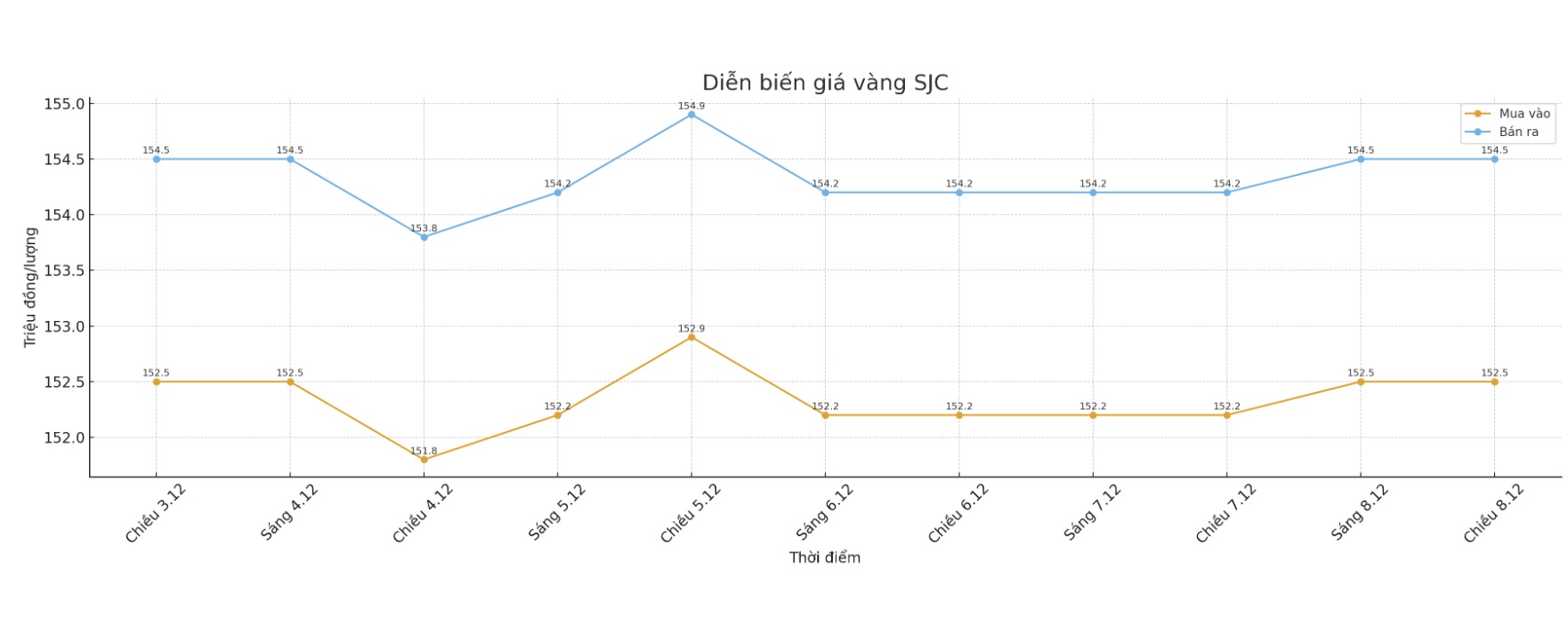

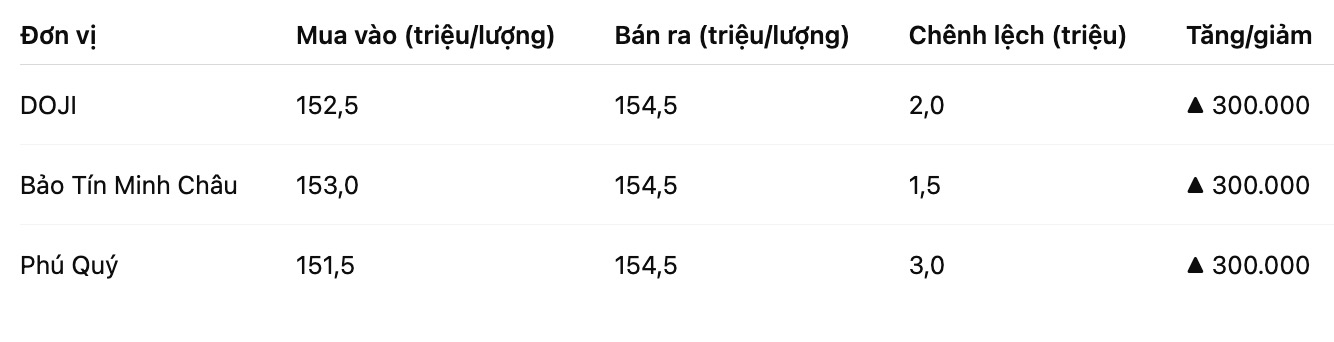

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND152.5-154.5 million/tael (buy in - sell out), an increase of VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153-154.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.5-154.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

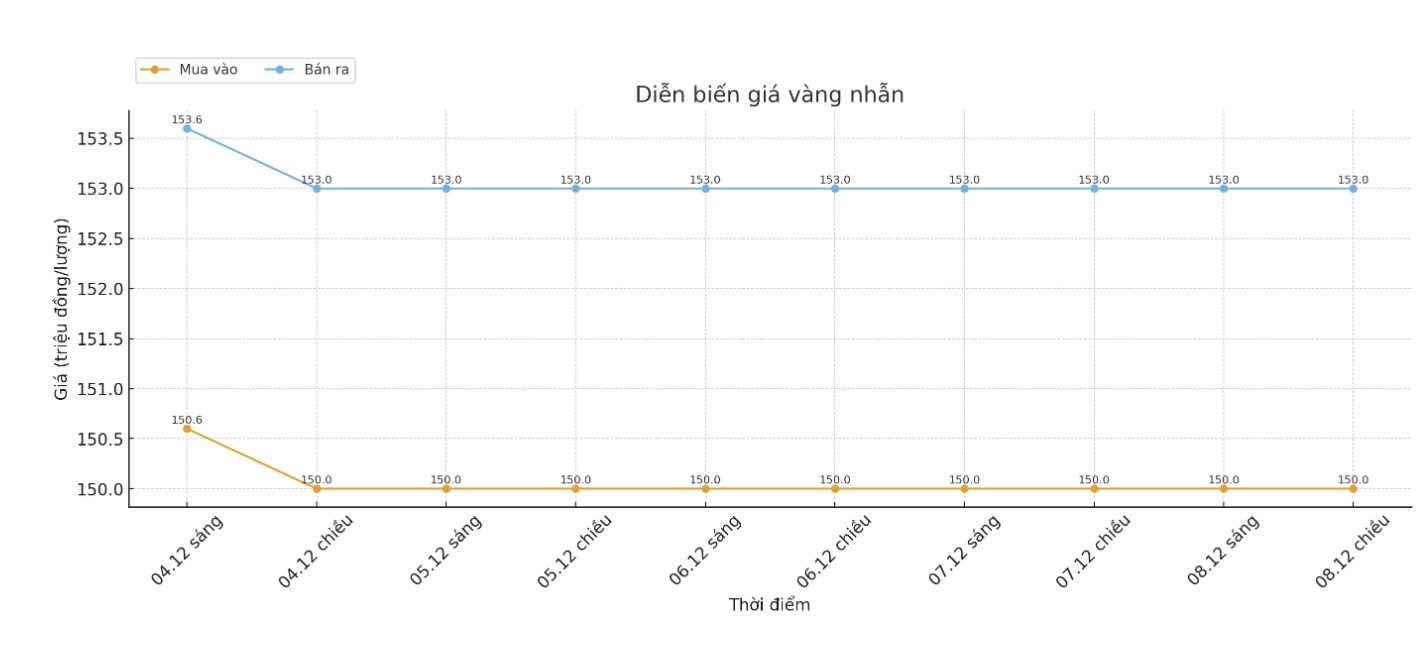

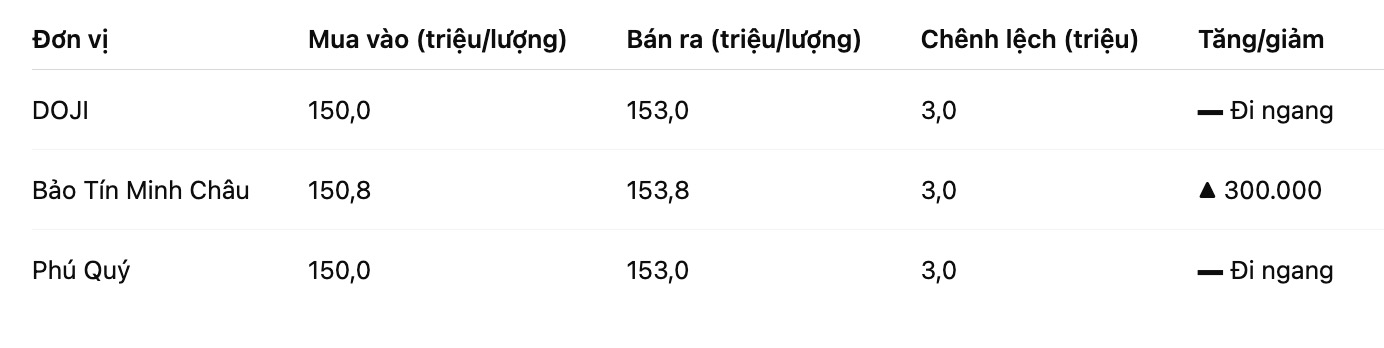

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.8-153.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

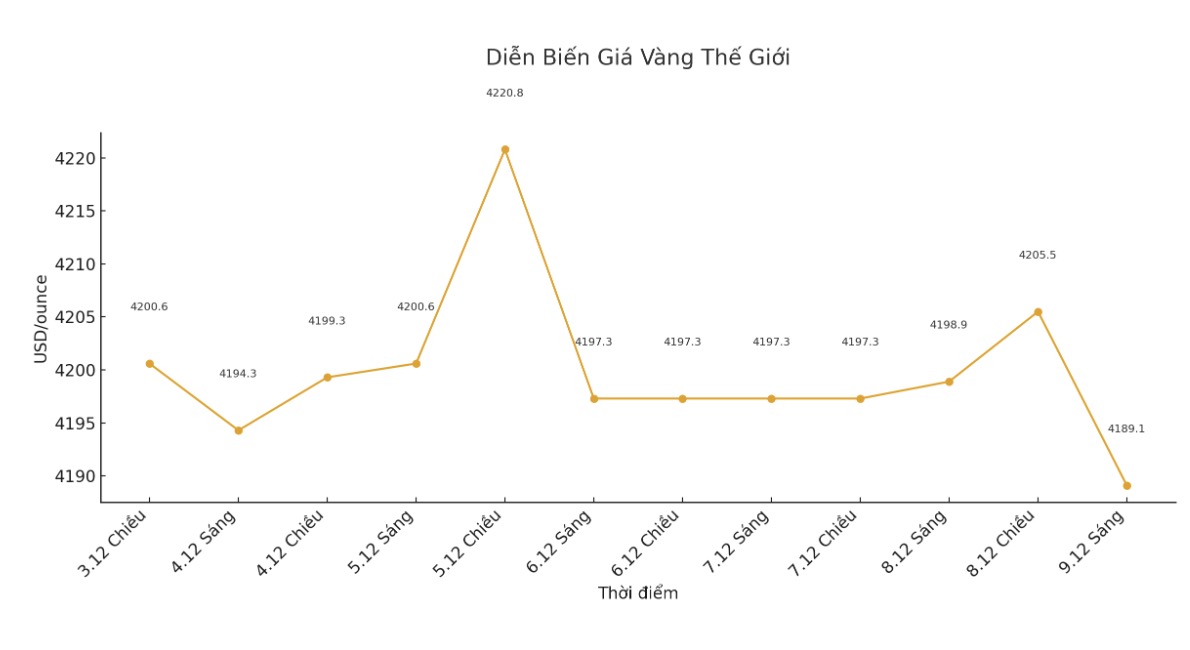

World gold price

The world gold price was listed at 0:00, at 4,189.1 USD/ounce, down 8.2 USD compared to a day ago.

Gold price forecast

Gold and silver prices fell as both precious metals markets were under selling pressure due to concerns that the US Federal Reserve (Fed) would maintain a "hawl" stance in its policy statement, although it is likely to continue cutting interest rates this week.

Selling pressure has increased after the US producer price inflation report for October and November, which was scheduled to be released this week, was postponed to January, raising further uncertainty about the inflation outlook.

The Federal Open Market Committee (FOMC) will start its monetary policy meeting on Tuesday morning and end on Wednesday afternoon with an official announcement and a press conference by Fed Chairman Jerome Powell.

The market currently rates a 90% chance that the Fed will cut interest rates by 0.25 percentage points in this session. However, growing expectations that the FOMC message and Mr. Powell's speech may be more hawl-ish, stemming from concerns that inflation will remain persistent at high levels.

In another development, the World Bank said that the Central Bank of China has added gold for the 13th consecutive month, according to data released on Sunday. Gold held by the People's Bank of China increased by 30,000 ounces last month, bringing total reserves to about 74.12 million ounces.

The current buying cycle starts from November 2024. According to the World Gold Council, central banks around the world have also stepped up gold purchases in October after a period of stagnation in the middle of the year.

Technically, buyers in the February gold futures market are aiming to get their closing price above the strong resistance zone at a record peak of $4,433/ounce. On the contrary, the sellers set a short-term target of pushing prices below the strong support zone of 4,100 USD/ounce.

In the short term, the nearest resistance zone is determined at 4,247.9 USD/ounce and then 4,285 USD/ounce, while the important support zones are at 4,200 USD/ounce and 4,150 USD/ounce.

Wyckoff's market trend assessment index is currently at 7.0 points, showing that the uptrend is still dominant.

In the international financial market, the USD index increased slightly, while crude oil prices weakened, fluctuating around 69.25 USD/barrel. The yield on the 10-year US government bond is currently around 4.15%.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...