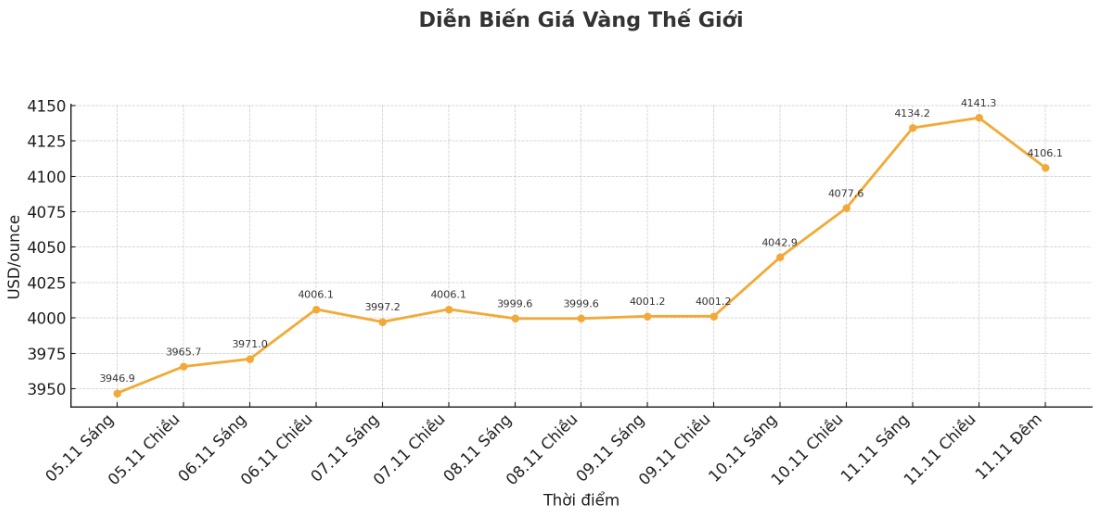

The gold market continues to maintain its upward momentum, with prices holding above $4,100/ounce, even as political tensions in the US cool down after the Senate passed a new budget bill to end the longest government shutdown in the country's history.

Although the National Assembly has partly resolved political instability, analysts say there are still many uncertainties that are enough to maintain gold's appeal as a safe-haven asset. The Senate bill is now being moved to the House of Representatives for voting and is expected to be approved.

Carsten Fritsch - commodity analyst at Commerzbank - commented that the government's reopening may not happen at a time favorable for the economy. The US government has been sparingly releasing official economic data for the past two months, while private sector data showed a weakening labor market and rising inflationary pressures.

He added that US consumer confidence has fallen to a three-and-a-half-year low.

It is predicted that when economic data is released again, signs of a clear slowdown in the US economy will emerge. This could force the Federal Reserve to cut interest rates more aggressively," he said.

According to the latest data from private payroll processing company ADP, the US job market is stagnant, with only 42,000 more jobs created in October. Meanwhile, a report by consulting firm Challenger, Gray & Christmas said that US businesses had cut more than 150,000 jobs in the same month - the largest monthly cut in more than 20 years.

Fritsch said that Commerzbank still predicts that the FED will be forced to cut interest rates more strongly than expected, thereby continuing to support gold prices in the coming period.

We expect gold prices to hit $4,200 an ounce next year. Silver prices are likely to hit $50 an ounce," he said.

Commerzbank is not the only organization to make this optimistic forecast, as global geopolitical and economic uncertainties still exist.

Experts from the Central Investment Office (CIO) under UBS also predict that gold prices will reach 4,200 USD/ounce by 2026.

They noted that, although the US government has reopened, the Congress has only approved a temporary budget until January.

The government could partly close after January 30 as a possibility if the National Assembly does not pass a resolution to continue spending or has not made progress in allocating funds to other federal agencies. In addition, uncertainties related to the Supreme Court's ruling on the legality of taxes based on the International Emergency Economic Powers Act (IEEPA) will also continue to support gold prices, said analysts.

At the same time, UBS maintains an optimistic view on gold as global public debt is increasing to an uncontrollable level.

The rising government debt around the world has raised investors' concerns about fiscal sustainability, as well as the risk of inflation or currency depreciation. Since gold is often seen as a place to store value, helping to protect assets against these risks, demand for this precious metal continues to increase steadily" - UBS commented.

See more news related to gold prices HERE...