Gold price developments last week

World gold prices continued to fall this week, but even as the interest rate cutting cycle was threatened and US-China trade talks eased somewhat, the precious metal was not pushed too far down to $3,900/ounce.

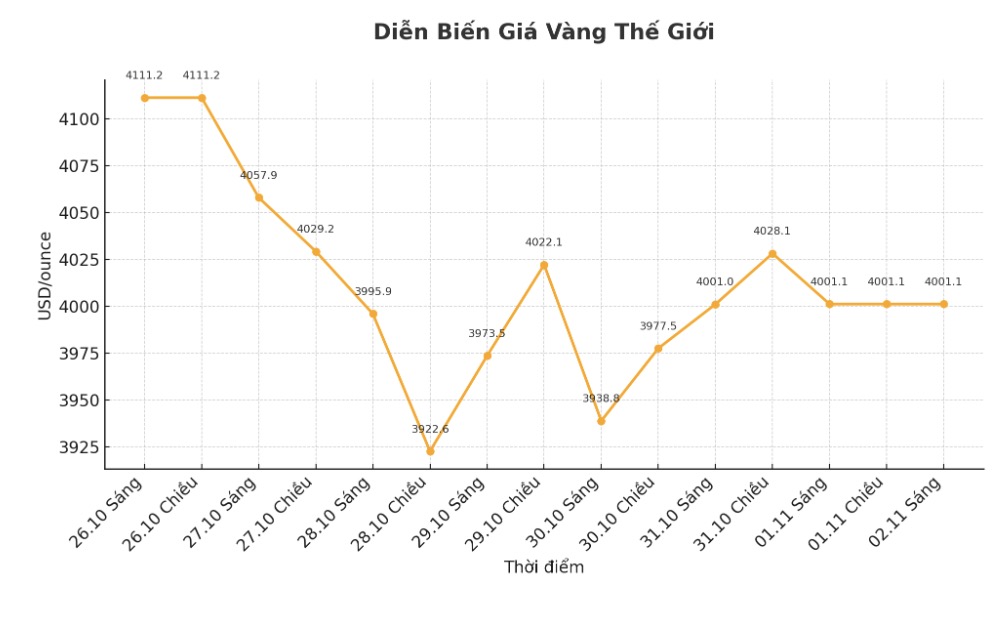

At the beginning of the week, spot gold prices were at 4,104.84 USD/ounce, quickly increasing to a weekly peak of 4,110 USD/ounce, but then slid. In the North American trading session, gold tested the threshold of 4,020 USD/ounce, then quickly broke through the 4,000 USD/ounce mark and fell to 3,978 USD/ounce at 11:00 a.m. on Monday.

This bottom was held until gold failed in its bid to surpass $4,018 an ounce at 9:00 p.m., triggering the second plunge in just two days. This time, prices fell sharply to a weekly low of $3,886 an ounce just before 5:00 a.m. (Eastern time).

However, gold has recovered strongly from this bottom, reaching $3,969/ounce early Tuesday afternoon, and continued to increase to $4,026/ounce early Wednesday morning.

But the double model just below $4,030 an ounce has triggered a new wave of sell-offs. After Federal Reserve Chairman Jerome Powell warned that a December rate cut was not certain, gold prices fell back to $3,929/ounce in the mid-afternoon.

After re-evaluating the $3,920/ounce threshold in the overnight session, gold began to recover steadily. By Thursday's North American session, spot prices reached $3,975/ounce, then quickly surpassed $4,000/ounce, peaking at $4,037/ounce just before 7:00 p.m.

Since then, gold has fluctuated quite comfortably in the range of about $60 around $4,000/ounce, and closed the trading week at almost this level as it entered the weekend break.

Gold price forecast for next week

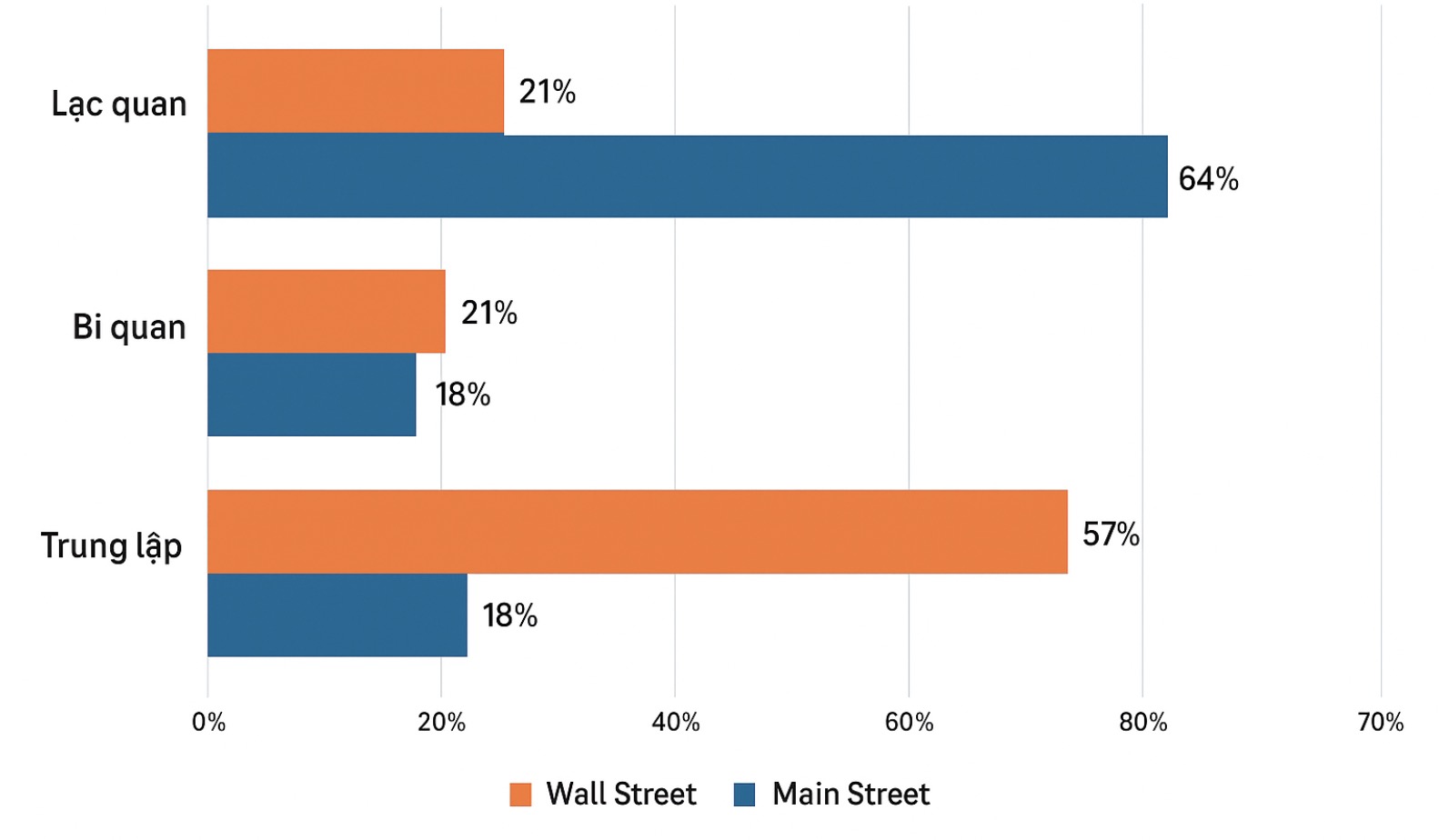

The latest weekly gold survey by an international financial information platform shows that industry experts are in a rare state of neutrality and balance. Meanwhile, individual investors are more optimistic after gold showed significant resilience.

This week, 14 analysts participated in the Kitco News survey. Wall Street generally maintains a neutral stance after the fluctuations in precious metal prices narrowed. Of these, 3 experts (equivalent to 21%) predict gold prices will increase next week, 3 others (21%) predict prices will decrease, while the remaining 8 people (57%) believe that gold will continue to fluctuate sideways within a narrow range.

Meanwhile, the survey results with 282 retail investors are reinforcing optimism. 180 individual traders (64%) expect gold prices to increase next week, 51 people (18%) expect prices to decrease, and 51 others (18%) expect gold to continue moving sideways in the coming time.

Economic data to watch next week

Although the US government is still in a state of closure after a month, next week will still see a series of notable economic reports released.

On Monday, the Institute for Supply Management (ISM) will release the manufacturing PMI, followed by the service PMI on Wednesday, along with private sector employment data provided by ADP.

The Bank of England (BoE) will make a decision on monetary policy on Thursday morning, and the working week will end with a preliminary survey on consumer confidence by the University of Michigan, released on Friday.

See more news related to gold prices HERE...