Gold price developments last week

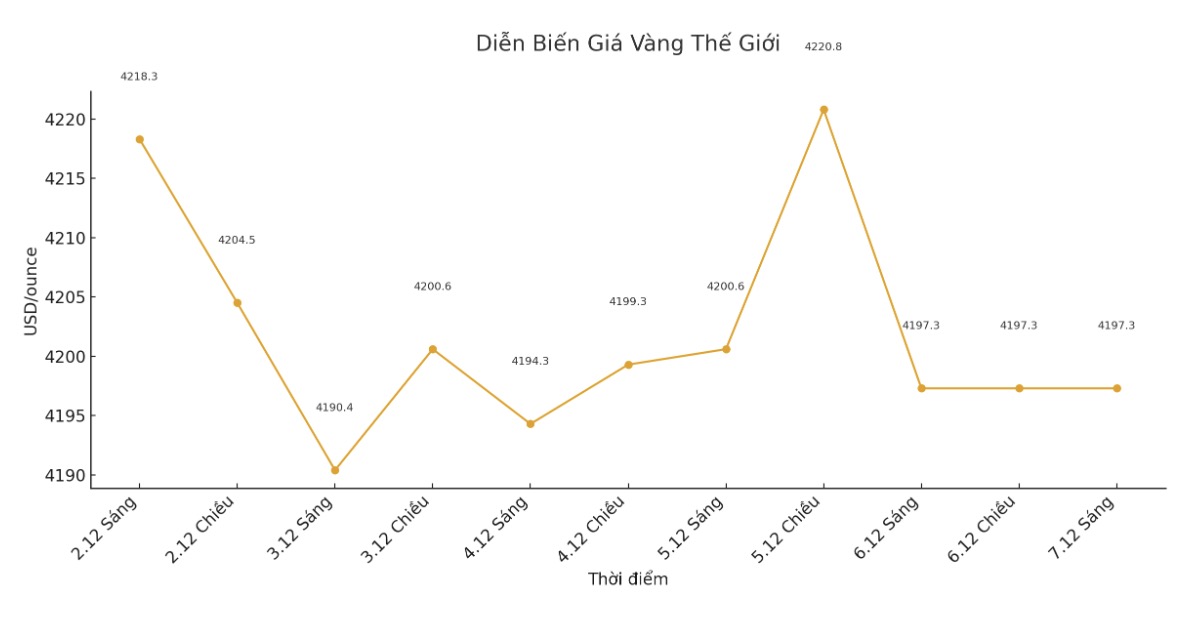

After many weeks of increasing and decreasing in a clear trend, gold prices last week have mainly remained flat in the high price range, as investors temporarily ignored economic information to wait for the interest rate decision of the US Federal Reserve (Fed) next week.

World spot gold opened the week at 4,217.34 USD/ounce. The precious metal quickly moved closer to the upper limit of the recent trading range. By 8:45 a.m. on Sunday (US Eastern time), gold prices had risen to $4,255 an ounce, and by 8:30 a.m. on Monday, gold had peaked for the week at $4,262/ounce.

However, the market still has many dramatic developments as gold prices quickly turned down to 4,225 USD/ounce at the opening time of the North American session. This price plays a solid support zone, until the opening Asia session pulls gold prices down to 4,205 USD/ounce.

The decline continued in the European session, when gold hit a bottom of 4,185 USD/ounce just before 6 am (according to Eastern time of the US).

Then there was the first strong increase of the week: just 15 minutes before the North American market opened, spot gold prices increased by nearly 250 USD, to 4,228 USD/ounce. But immediately after that, traders simultaneously sold again, causing prices to fall straight to the bottom of the week, close to below the 4,170 USD/ounce mark at 10:45 am (Eastern time).

With the weekly range established, gold spent much of the following days trading in the 4,185 - 4,225 USD/ounce range, only occasionally going above or below this price channel.

Thursday evening saw the last notable fluctuations of the week, as Asian traders steadily pushed gold prices above $4,200/ounce to $4,230/ounce.

After a short correction to retest the 4,220 USD mark, the precious metal continued to increase strongly, with the push from the North American opening session bringing the price to 4,254 USD/ounce at around 10:30 am (east of the US time).

However, there was a more intense reversal than Tuesday, when gold lost more than $50 in just a few minutes after 11 a.m. After three failed attempts to return to $4.220 an ounce, gold continued to slide for the rest of the session and ended the trading week below the key support level of $4,200 an ounce.

Gold price forecast for next week

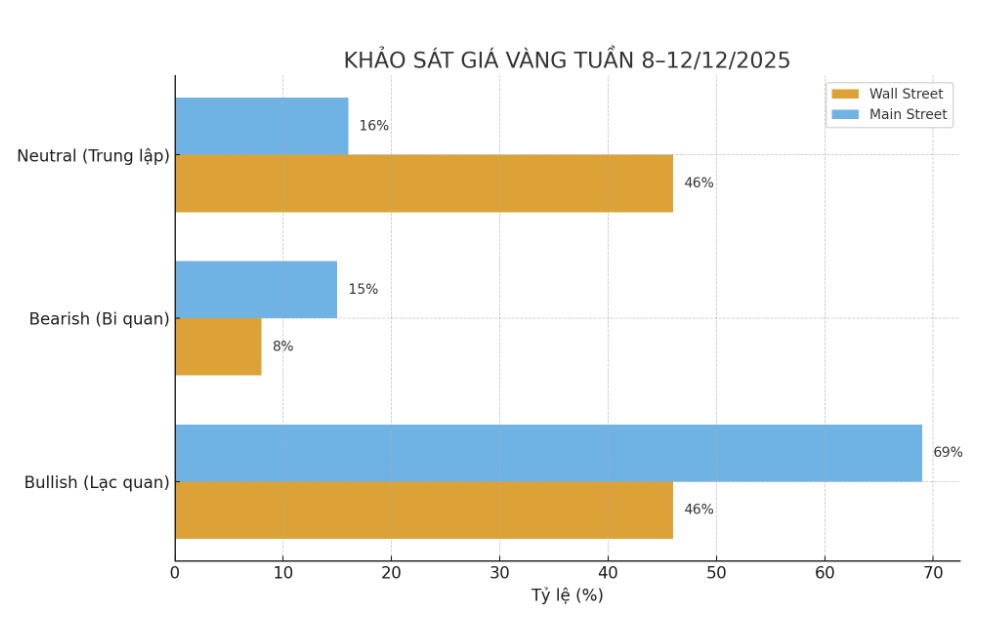

The latest weekly gold survey by an international financial information platform shows that the sentiment on Wall Street is divided between bullish and neutral viewpoints, while individual investors on Main Street still maintain a mostly bullish ratio.

This week, there were 13 analysts participating in the survey. 6 experts (46%) expect gold prices to rise next week. Meanwhile, 6 others predict that this precious metal will fluctuate sideways. The remaining experts (accounting for 8% of the total) predict that gold prices will decrease.

On the other hand, Kitco's online survey recorded 163 votes from individual investors, with optimism continuing to be maintained.

113 retail traders, or 69%, see gold prices rising next week; 24 see gold prices falling.

Meanwhile, the remaining 26 investors, or 16%, expect prices to move sideways and accumulate in the coming time.

Economic data to watch next week

The economic news calendar next week will revolve around central banks, as Australia, Canada, the US and Switzerland simultaneously make interest rate decisions. However, the market only expects the US to adjust key interest rates.

On Monday, the Reserve Bank of Australia (RBA) will announce its monetary policy decision. On Tuesday morning, the market will receive the US job search report (JOLTS) in November.

Investors will watch the central bank of Canada's monetary policy decision on Wednesday morning, before all eyes turn to Washington, where the US Federal Reserve (Fed) is expected to cut interest rates by 25 basis points. More notably, the Fed will also release an updated dot plot chart and new economic forecasts.

Key economic events of the week will concluded on Thursday, with the Swiss Central Bank's monetary policy decision and the US weekly jobless claims report.

See more news related to gold prices HERE...