Technical buying dominated this week as short-term technical signals from gold and silver all showed a clear uptrend.

The US government's reopening today also supports the precious metals market. The resumption of US economic data releases could create conditions for the Federal Reserve to make a decision to cut interest rates in December.

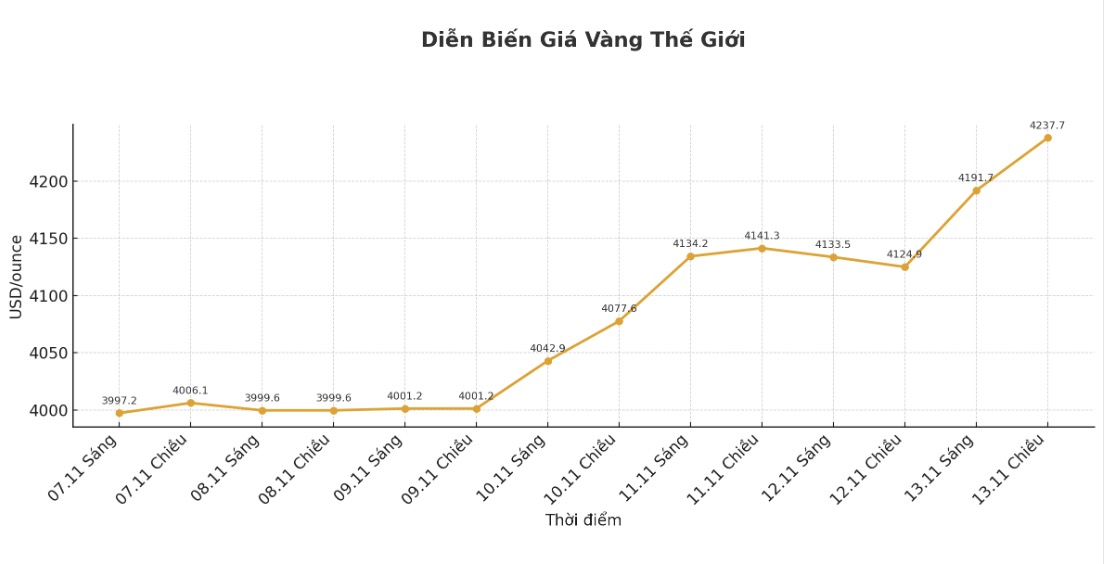

December gold contract increased by 27.8 USD, to 4,241.5 USD/ounce. December delivery silver price increased by 0.453 USD, to 53.91 USD/ounce.

Silver's gains this week are around 12%. Concerns about supply have also contributed to supporting silver prices, as the Indian wedding season is underway and fears of a possible US silver tax.

Last week, the US Department of Home Affairs added silver, copper and metals to its list of strategic minerals, emphasizing their importance to the economy and national security.

The global stock market moved in opposite directions overnight. The US stock index is expected to open slightly down in New York.

In the news last night, US President Donald Trump signed a bill to end the longest government shutdown in history, ending a 43-day streak of paralysis. Trump's signature allows the government to resume normal operations, with federal employees expected to return to work from today. However, it may take a few days, even a few weeks for all activities to return to normal, when the staff has to handle the backlog of work from October 1.

US Transportation Secretary Sean Duffy told reporters on Wednesday that it could take up to a week to start lifting flight restrictions at major airports. The confrontation leading to the government shutdown has negatively affected the US economy, as the Office of the National Assembly's Budget Office estimates that a six-week closure could reduce real GDP growth in the current quarter by 1.5 percentage points. The newly approved temporary spending package will maintain the operation of much of the government apparatus until January 30, creating the risk of a repeat confrontation at that time.

More evidence of global crude oil supply. The world crude oil market is falling into a surplus, most clearly in the American region, especially the US, according to Bloomberg.

Signs of abundant supply in the US are reflected in high export volumes. US crude oil exports in October hit their highest level since July 2024. Meanwhile, the price curve of Brent oil - the global oil standard - has almost moved sideways in the months after March, reflecting different supply surpluses between regions.

Oil market observers generally expect supply to increase next year. OPEC which has long predicted a solid oil demand reversed its forecast for the third quarter, shifting from shortages to surplus due to rising US production.

The International Energy Agency forecasts that the world will have a record supply glut in 2026. The market will be in a slight surplus from one quarter to the next, Vandana Hari, founder of Singapore-based analysis firm Vanda Insights, told Bloomberg TV. This is bad news for the oil industry but good news for American consumers when buying petroleum.

The latest downside target for the bears is to push prices below the solid support level of $4,000. The first resistance level was at $4,250/ounce, then $4,300. The first support was at the bottom of the night at $4,183.2 an ounce and then $4,104.4 an ounce.

For December futures, buyers have a strong short-term technical advantage. The next upside target is to close above a solid resistance zone at $55/ounce. The target for the bears to sell below the support level of 50 USD/ounce is to close.

The first resistance level was at a record peak for the night of 54.415 USD/ounce and then 55 USD/ounce. Support is at the night low of 52.885 USD and then 52 USD/ounce.

In outside markets, the USD index decreased slightly. Crude oil prices increased slightly, trading around 59 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.079%.

Note: The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are for immediate sales and delivery transactions. Second is the futures contract market, where future delivery prices are determined. Due to liquidity factors and year-end position adjustments, December gold contracts are currently the most actively traded product on CME.