USD Index

On November 12, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies decreased by 0.22%, down to 99.23 points.

The US dollar weakened against the Euro and the Japanese Yen yesterday due to concerns about the deterioration of the US labor market, after a report showed that private enterprises cut jobs last month.

According to ADP Research, preliminary estimates show that US private enterprises have cut an average of 11,250 jobs per week in the four weeks ended October 25.

This development comes as the US federal government moves closer to reopening, which could lead to a series of new economic data showing signs of slowing growth.

Marc Chandler - Chief Market Strategist at Bannockburn Global Forex in New York - commented: "When the government is closed, the news is almost non-existent. As the government looks to reopen, I think we will start to see more cracks in the economy.

The US Senate on Monday approved a Compromise to end the longest government shutdown in the country's history, ending a multi-week deadlock that has left millions of people without food rights, hundreds of thousands of federal employees unpaid and disrupted air travel.

The bill is now being moved to the Republican-controlled House of Representatives, where House Speaker Mike Johnson said he would like to pass it as early as Wednesday to send to President Donald Trump for signature.

The US dollar has previously recovered in recent weeks as traders have reduced expectations for the number of rate cuts, given the better outlook for US economic growth. Many officials of the Federal Reserve (Fed) are also cautious about further interest rate cuts, due to concerns about inflation.

According to Chandler, the Euro has returned to the downtrend against the USD, which has been maintained since September: "The basic sentiment towards the USD remains negative," he said.

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 12, the State Bank announced that the central exchange rate of the Vietnamese Dong increased by 12 VND, currently at 25,118 VND.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office is currently at: VND 23,913 - VND 26,323.

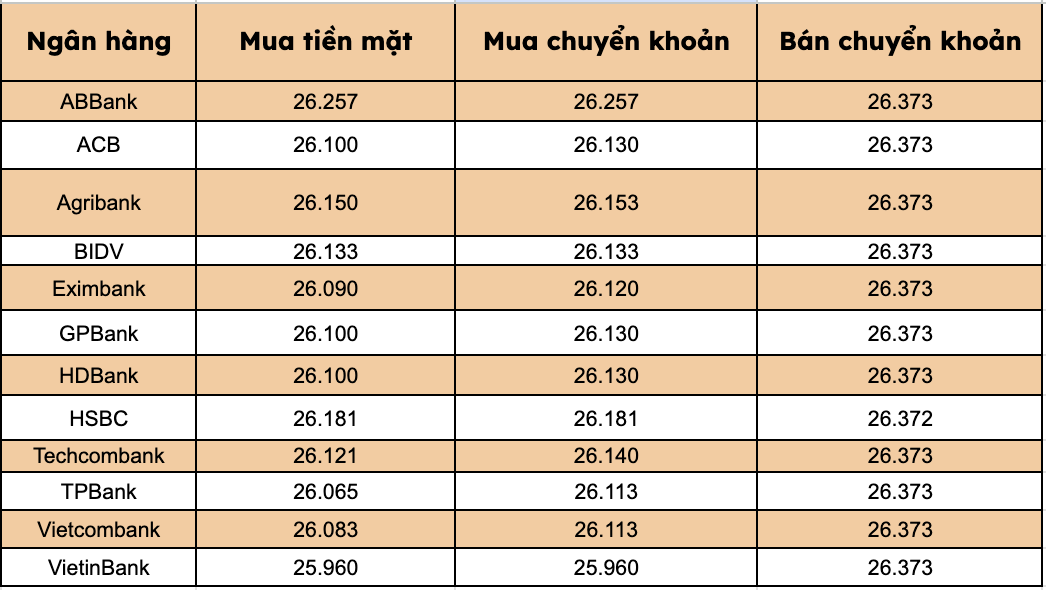

At commercial banks, USD prices have been adjusted in opposite directions at brands.

Banks listed USD selling prices at VND26,373/USD.

Bank with the highest cash and bank transfer price: ABBank (26,257 VND/USD).

The difference between buying and selling prices at banks ranges from 116-413 VND/USD.