The US dollar started the new week with a slight increase compared to most major currencies, in the context of the global market entering a key week of central banks, focusing on the US Federal Reserve (Fed).

Investors are almost certain that the Fed will cut interest rates at the base this week, but are also preparing for a more cautious easing cycle than expected. In contrast, the Japanese yen weakened sharply after a 7.6-magnitude richter shook the northeastern region of the country on the evening of December 9, forcing the government to issue a Tsunami warning and evacuate residents.

In addition to the Fed meeting on Wednesday, the central banks of Australia, Brazil, Canada and Switzerland will also hold a policy meeting this week, although neither agency is expected to change current monetary policy.

Analysts say the Fed is likely to make a hawlish rate cut meaning that, despite the rate cut, the language in statements, forecasts of central rates and Chairman Jerome Powells statements will show that the Fed will continue to be cautious and not rush to cut interest rates further.

The Federal Open Market Committee (FOMC) is expected to cut interest rates by another 25 basis points, bringing the range to 3.53.75%, marking the third consecutive decline since mid-year.

Investors believe that this move could support the USD if the Fed signals not to rush to cut further in 2026. In an economy that has not yet seriously weakened and inflation remains stable, the Fed can rest assured to lower interest rates without needing to promise any new steps, said Juan Perez, trading director at Monex USA.

Mr. Perez said that the Fed is still watching back at the past to accurately assess the current position of the economy - which is in a state of near inflation, causing members views to not be completely consistent.

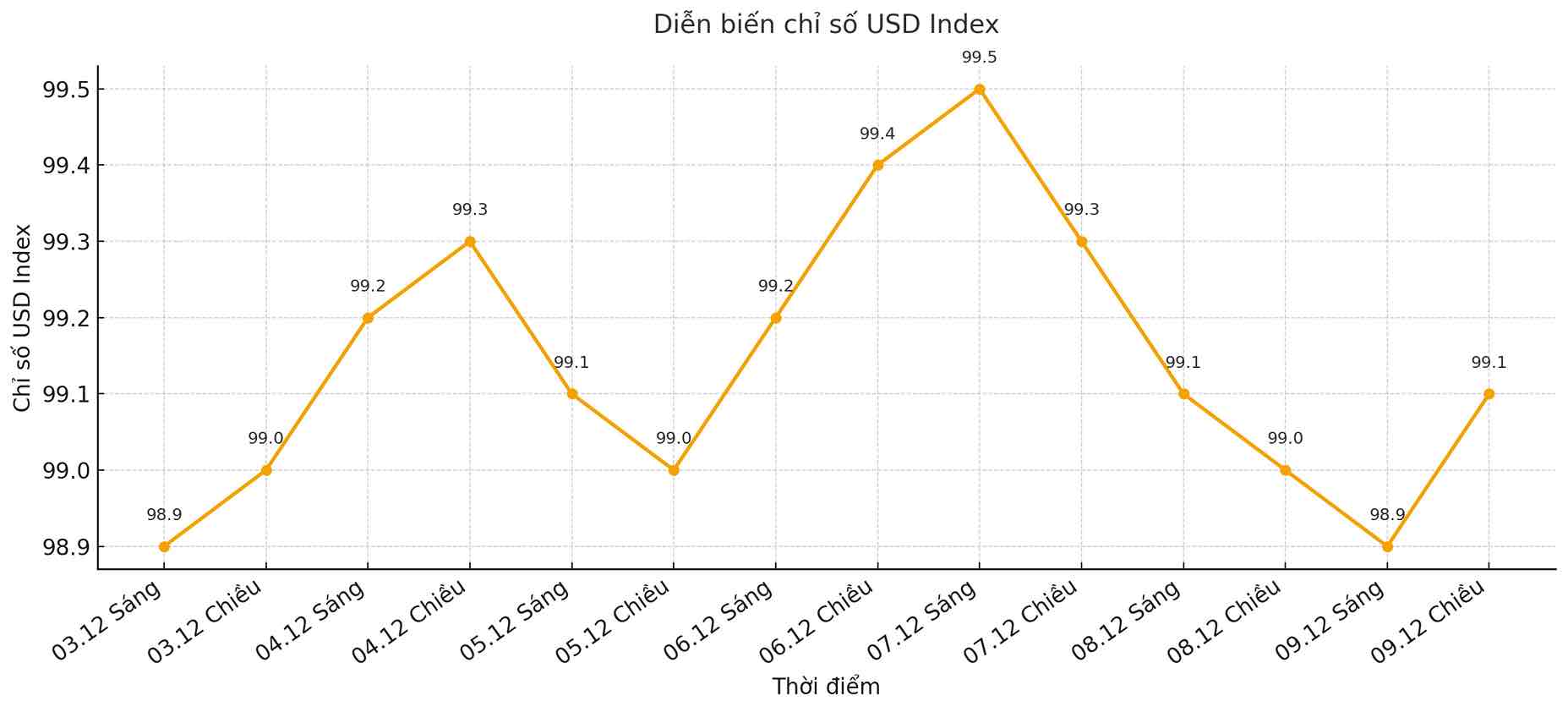

USD Index Measuring the strength of the greenback against a basket of 6 major currencies increased by 0.1%, to 99.07. Compared to the Swiss French, the USD increased by 0.2%, to 0.8066 French.

Fed faces the risk of disagreement before the policy meeting

Mr. Bob Savage, Chief Market Strategist of BNY, predicted that the upcoming meeting could record opposing opinions from both the hawk and the gentle side - something rarely seen since 2019. Although the USD has weakened over the past three weeks, bulls are returning to the market, with the largest USD purchase position since the beginning of the year.

Experts say the US labor market is slowing, but overall growth remains stable. In addition, the Trump administration's "One Big Beautiful Bill" fiscal stimulus package is expected to be effective in the coming time, while inflation remains above the Fed's 2% target.

According to the general assessment, the Fed will continue to cut interest rates this week, but will maintain a cautious tone and avoid strong easing commitments. This could help the US dollar maintain its short-term strength, before the market shifts to policy expectations in 2026.