USD Index

On November 14, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies decreased by 0.26%, down to 99.21 points.

The US dollar fell slightly in yesterday's trading session after US President Donald Trump signed a bill to end the longest government shutdown ever, boosting risk appetite.

The greenback weakened after the US President signed the bill at a ceremony at the Oval Office late Wednesday (November 12), unlocking funding for the government after the bill passed a vote in the House of Representatives.

The bill comes just hours before the closure comes into its 43rd consecutive day. This is also the longest closure in history.

The closure has caused widespread disruptions to federal services, most notably air traffic control and tourism safety personnel. At the same time, preventing the release of important economic data helps notify the Federal Reserve about the health status of the US economy before the policy meeting next month.

The reopening will result in a series of economic data publications delayed due to the closure, including a closely monitored monthly jobs report.

Analysts at ING informed that the White House said that data on the October salary table and CPI is unlikely to be published, meaning that fluctuations will take time to increase.

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 13, the State Bank announced that the central exchange rate of the Vietnamese Dong decreased by 4 VND, currently at 25,125 VND.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office is currently at: VND 23,919 - VND 26,331.

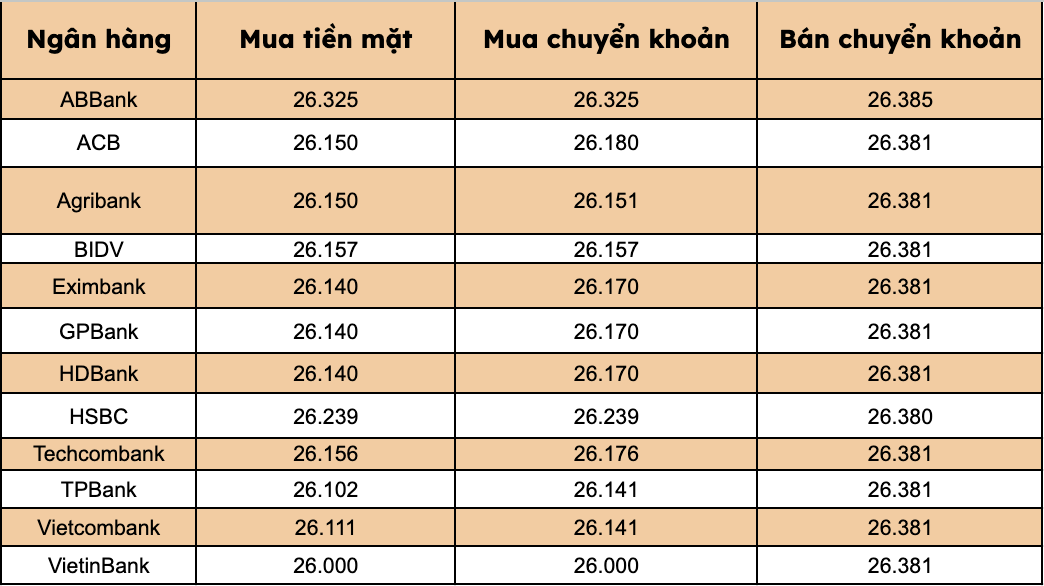

At commercial banks, the USD price has been adjusted down.

Most banks listed USD selling prices at VND26,381/USD, down VND4/USD.

Bank with the highest cash and bank transfer price: ABBank (26,325 VND/USD, up 4 VND/USD).

The difference between buying and selling prices at banks ranges from 56-381 VND/USD.