Gold price developments last week

Last week, gold prices were largely unaffected by tariff discussions this week, as the threat of political intervention in the US Federal Reserve (FED) kept investors eye on the market monitoring screen.

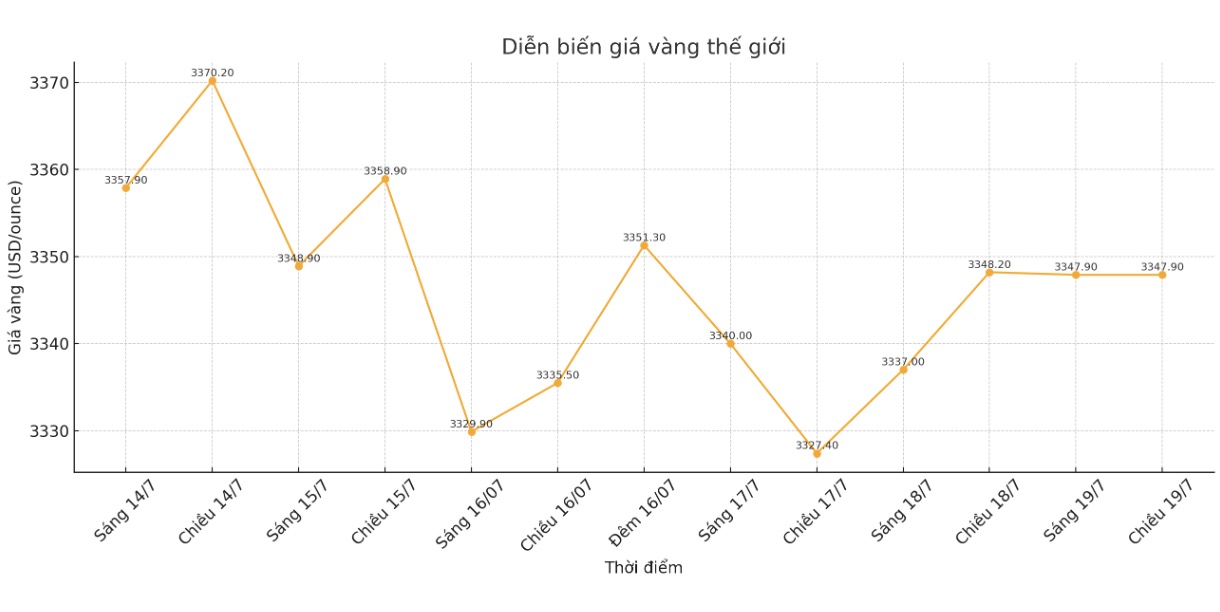

Spot gold opened the week at $3,366.6 an ounce and the precious metal has repeatedly tried to surpass resistance around $3,375 an ounce.

After a failed fourth attempt shortly after 6:00 a.m. Eastern time (EDT) on Monday, gold prices had their first correction of the week, falling to the short-term support zone of $3,342/ounce at around 10:30.

The Asian trading session recorded a rebound to $3,365, but gold prices continued to create a three-peak pattern and plummeted to $3,322/ounce at noon on Tuesday.

The market then entered a rare sideways period of the week, with prices ranging in a narrow range from $3,320 to $3,342/ounce.

However, rumors that the Trump administration is pressuring Fed Chairman Jerome Powell to resign caused gold prices to rebound on Wednesday morning, with prices rising from $3,325/ounce to $3,363/ounce in just 45 minutes, starting at 10:30.

After Donald Trump and other officials reassured that there would be no changes to the central bank, gold prices gradually declined, hitting a weekly low of $3,312/ounce at 8:30 a.m. on Thursday. However, this price is attractive to buyers, helping spot gold recover to above 3,340 USD/ounce in the early afternoon.

In trading sessions in Asia and Europe on Friday, gold had another final increase, peaking slightly above 3,360 USD/ounce at 8:30 am Eastern time.

However, as North American investors received positive data on inflation expectations late in the morning, gold prices have sluggishly slid to $3,350/ounce as they entered the weekend.

Gold price forecast for next week

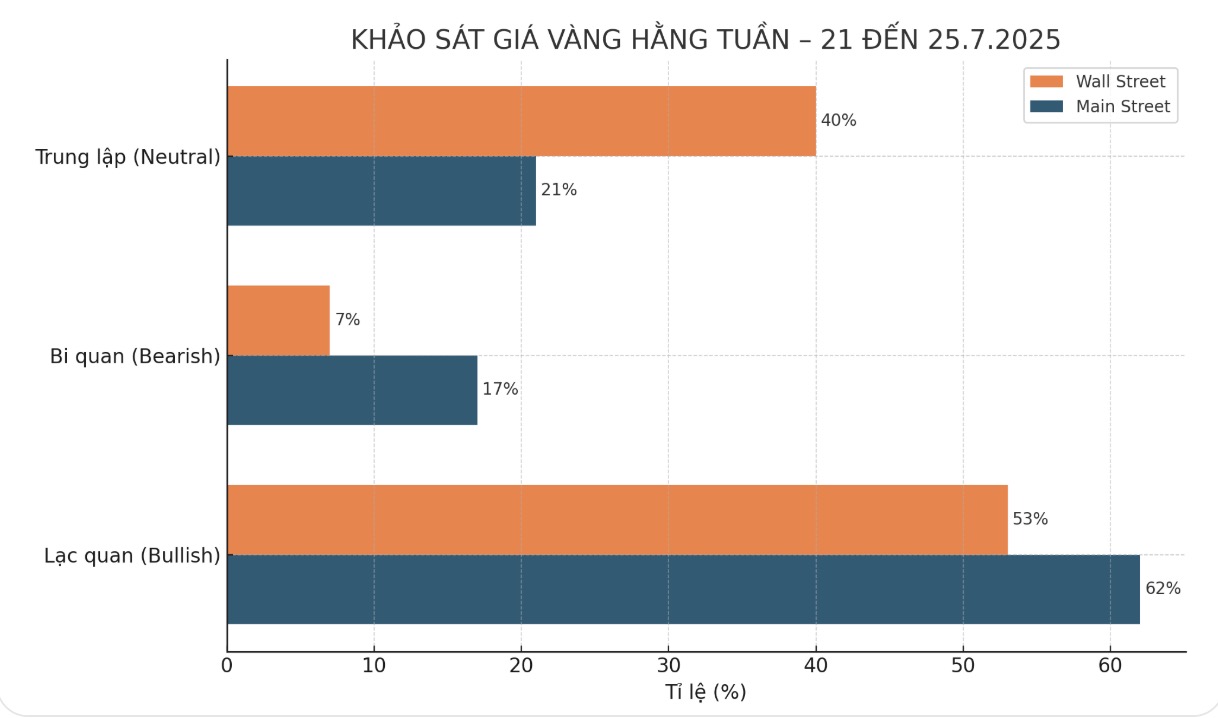

The weekly gold survey of an international financial information platform shows that industry experts are still divided between optimism and neutrality on the short-term outlook for gold. Meanwhile, retail investors have returned to the familiar optimistic trend.

Of the 15 analysts participating in the survey, 8 experts, accounting for 53%, predict gold prices will increase next week. One person (7%) predicted the price would decrease; the other 6 people (40%) thought that gold prices would be flat.

Meanwhile, Kitco's online survey attracted 223 individual investors to participate in the vote. After a week of skepticism, the majority of Main Street investors have returned to optimism, with 138 (62%) expecting gold prices to increase next week, 38 people (17%) predicting prices to decrease and the remaining 47 people (21%) saying that prices will continue to move sideways.

Notable US economic data next week

The economic calendar next week will revolve around the interest rate decision of the European Central Bank (ECB), along with a series of data on manufacturing and housing expected to be released.

Federal Reserve Chairman Jerome Powell will give an opening speech at an event in Washington, D.C. While he is uncertain to mention recent criticism from President Donald Trump, investors will still be watching closely.

There will be a report on existing US home sales in June on Wednesday. By Thursday, the market will receive a series of important information including the ECB's monetary policy decision, preliminary PMI data from S&P, US weekly jobless claims and new home sales.

The last notable data of the week is the US long-term orders report for June, released on Friday morning.

See more news related to gold prices HERE...