The US dollar has just fallen to a four-month low, making gold and silver more attractive to investors holding other currencies.

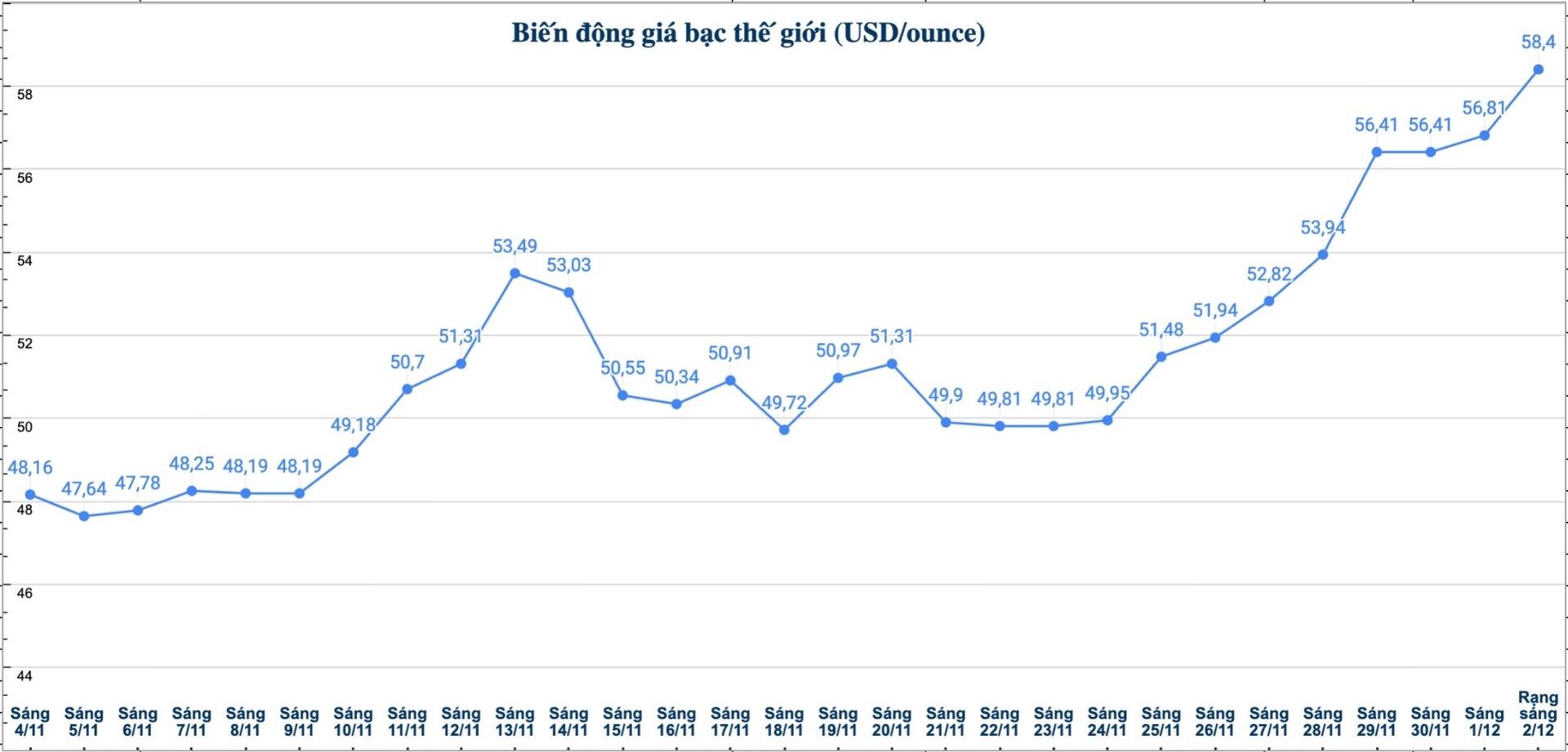

March delivery silver price increased by 0.597 USD to 57.77 USD/ounce after reaching a record high of 58.61 USD/ounce.

Expectations for the US Federal Reserve (Fed) to continue cutting interest rates, while inflation remains above target, said David Meger, director of metals trading at High Ridge Futures.

According to him, the prospect of monetary easing policies is still an important fulcrum for the precious metals market.

"We still believe that gold and silver will continue to move sideways within a wide range but there is an upward trend," said Mr. Meger.

David Meger said traders have now raised the possibility of a December rate cut to 87%, after the US released weaker-than-expected economic data and many Fed officials, such as Governor Christopher Waller and New York Fed Chairman John Williams, signaled a dovish stance.

"Reduced interest rates are typically beneficial for non-yielding assets like gold and silver," he said.

David Meger noted that investors need to closely monitor a series of important US data this week, including the ADP jobs report for November on Wednesday and the personal consumption expenditure price index (PCE) - the Fed's preferred inflation measure - due on Friday.

Sharing the same view, Giovanni Staunovo, an analyst at UBS (one of the world's largest financial and banking services groups, based in Switzerland), said that expectations for a more dovish Fed policy, combined with strong industrial demand, are helping silver prices increase along with gold.

He added that the market is even more vibrant as the White House signals that a potential candidate for the Fed Chairman could be announced before Christmas, increasing speculation about monetary policy in the coming time.

"Investors expect the Fed to ease. Silver benefits from gold-like factors, and is also expected to see improved industrial demand next year," said Giovanni Staunovo.

Updated silver price

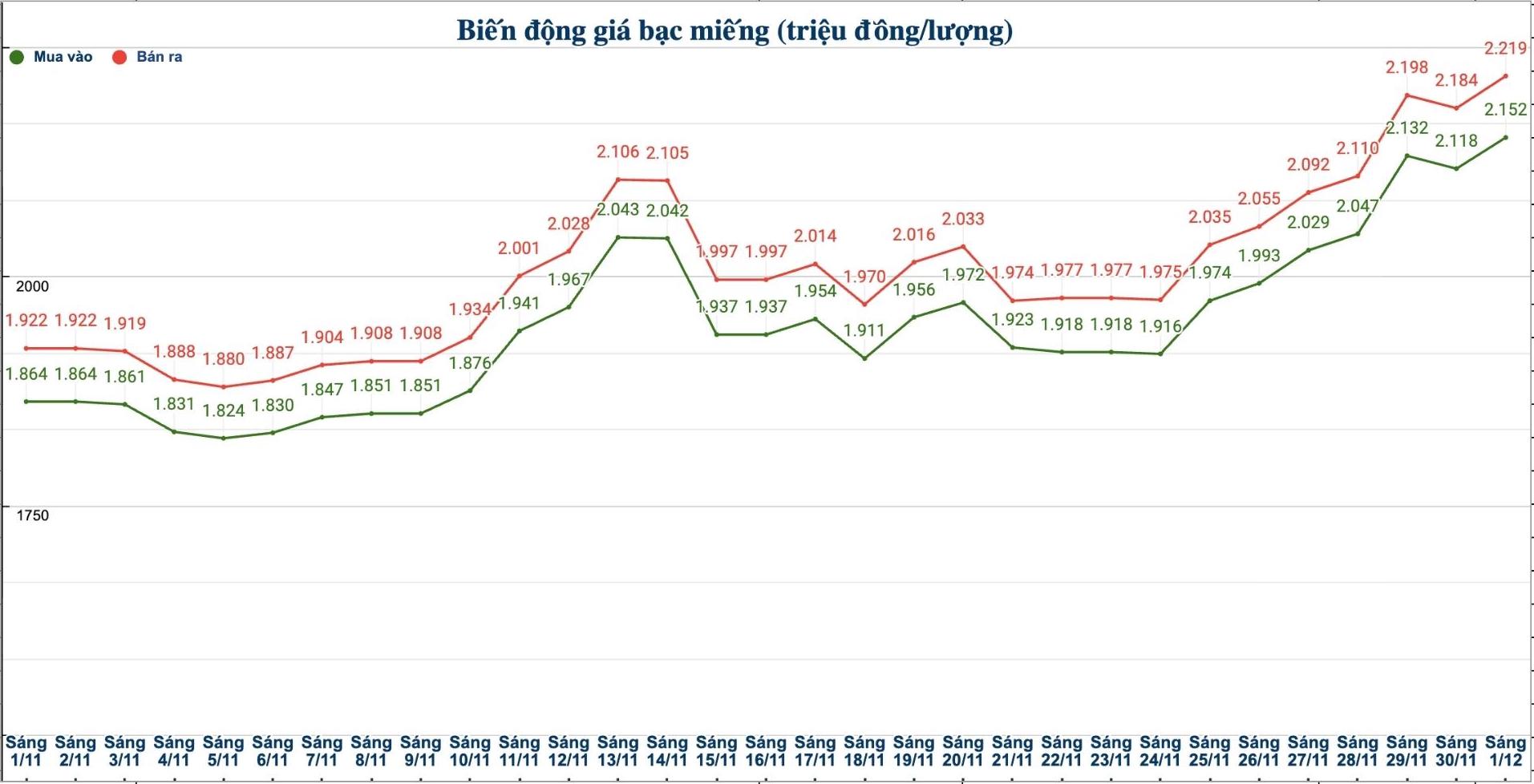

As of 6:00 a.m. on December 2, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2.161 - 2.211 million/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 56.740 - 58.460 million VND/kg (buy - sell).

The price of 999 gold bars of the Golden Rooster Bank of Saigon - SBJ Limited (1 tael) is listed at 2.115 - 2.166 million VND/tael (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND2.160 - 2.227 million/tael (buy - sell)

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 57.599 - 59.386 million VND/kg (buy - sell).

See more news related to silver prices HERE...