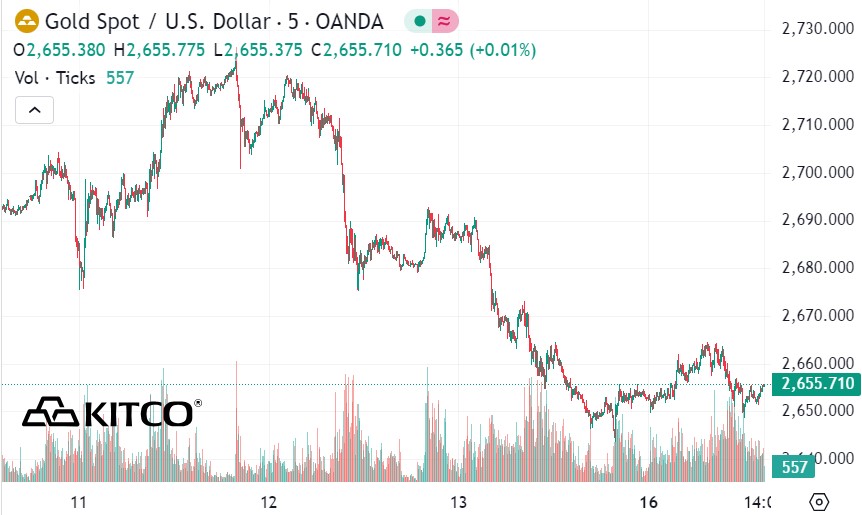

According to Kitco - the gold market is cautious as investors prepare to receive the decision of the US Federal Reserve (FED), expected to have a cut in interest rates with a "hawkish" message after the last monetary policy meeting of the year.

While gold prices remained sideways ahead of Wednesday's decision, one analyst said the Fed's message could lead to a larger correction in the precious metals market.

In a recent report, Kelvin Wong, senior market analyst at OANDA, said gold is still struggling to reach the resistance zone above $2,700/ounce. According to him, gold is facing great pressure as bond yields rise and inflation concerns continue to rise.

Financial instruments in the market have already reflected rising inflation expectations in the US, according to Wong. This is based on the volatility of the 5-year and 10-year breakeven inflation rates, which have increased since the Fed began its current rate-cutting cycle.

This medium-term uptrend is largely driven by new economic policies, including deeper corporate tax cuts and higher tariffs on imports into the US, which could lead to higher inflation in 2025 and beyond.

Wong also noted that the real yield on the 10-year bond has rebounded sharply after testing the 1.9% support level last week. If it rises to 2.29%, the opportunity cost of holding gold will increase, making it less attractive for investors.

Despite the rising medium-term risks, Wong said gold remains in a clear long-term uptrend.

"Gold could be supported by the long-term impact of US President-elect Donald Trump's tariff hikes, which could lead to a deglobalization trend. This trend could hinder global economic growth, thereby increasing demand for gold as a hedge against risk," he said.

Gold has been trading sideways in a consolidation pattern since hitting a record high of $2,716 on October 31, with the potential for a multi-week decline. The decline could see gold retest its 200-day moving average, but it remains within a broader uptrend that has been in place since October 6, 2023.

Technically, Wong said that gold needs to hold its mid-term support level at $2,537 an ounce. A drop to this level could trigger a new rally. However, if this level is broken, the next support zone is between $2,484–$2,415 an ounce.

“On the other hand, if gold breaks above $2,716, the correction scenario will be invalidated and the bullish momentum will be restored, with the next medium-term resistance target at $2,850-2,886,” Wong said.