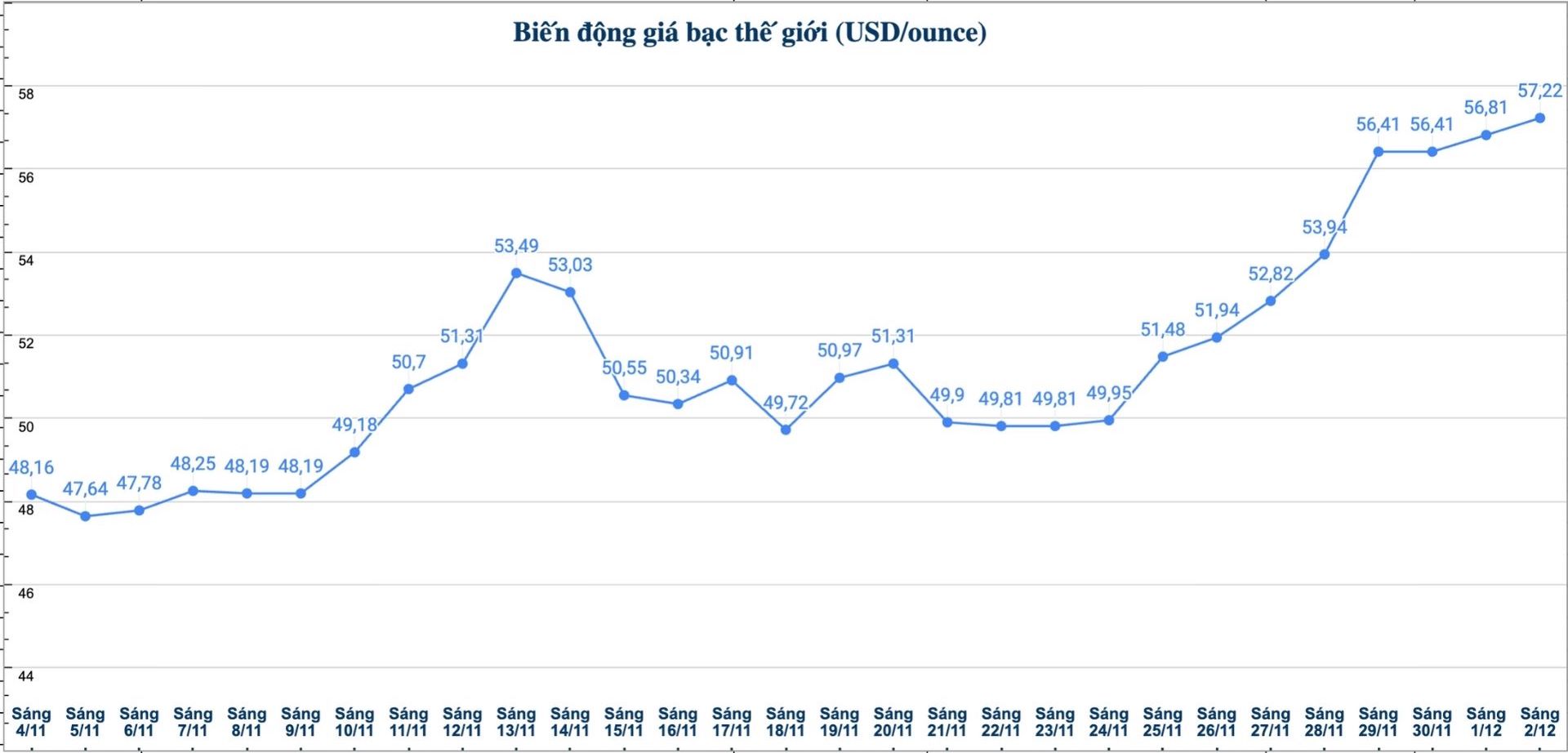

Silver prices soared above $58 an ounce on Monday, hitting a record high due to reduced inventories, increased investor demand and supply concerns. With this increase, silver prices have doubled since the beginning of the year, surpassing gold - which has increased by about 60% since the beginning of the year.

According to Kitco, this increase appeared when the Chicago Commodity Exchange (CME Group) temporarily suspended trading last week due to a cooling system failure at Aurora data center, Illinois.

However, Clem Chambers - CEO of Online Blockchain PLC (a British company specializing in investing in the information technology sector) - said that this incident is only a temporary disruption compared to the fundamental changes taking place in the global silver market.

"This is not real pressure. Silver prices may increase even more. For me, $95/ounce is the price to lock in future profits. People thought it was a big leap, but it wasn't. The real change is still coming," Chambers said.

His view is based on emerging pressure in the supply chain. Inventory on the Shanghai futures Exchange is currently at nearly a decade's low, while China exported about 660 tons of silver to London in October 2025 - an unusual volume to help reduce the shortage.

In the US, demand for December silver on COMEX also increased sharply. Chambers warned that even if only a few contracts require money delivery, the market could face difficulties due to limited supply of money.

While industrial demand from solar energy, electronics and green applications remains stable, he emphasized that the main driver for the current price increase comes from individual investors. " Countries don't care about silver, but retailers do. When they decide to own silver, this strong purchasing power is unlikely to be held back," Chambers said.

The expert added that investment flows in silver-backed ETFs increased again in the last quarter of the year, reversing the previous withdrawal trend.

"Selling of coins and small silver bars also increased, while global mining supply increased slowly, even decreasing in some places. The combination of strong capital flows and limited supply could increase future price shocks," said Clem Chambers.

Chambers stressed that the silver market is entering a new bullish adjustment phase.

As the market looks ahead to the Federal Reserve's decision in December, he stressed the growing gap between assets that benefit from material scarcity and assets that are vulnerable to liquidation. "The increase in silver has not stopped. This is the beginning of a much larger price adjustment," Chambers concluded.

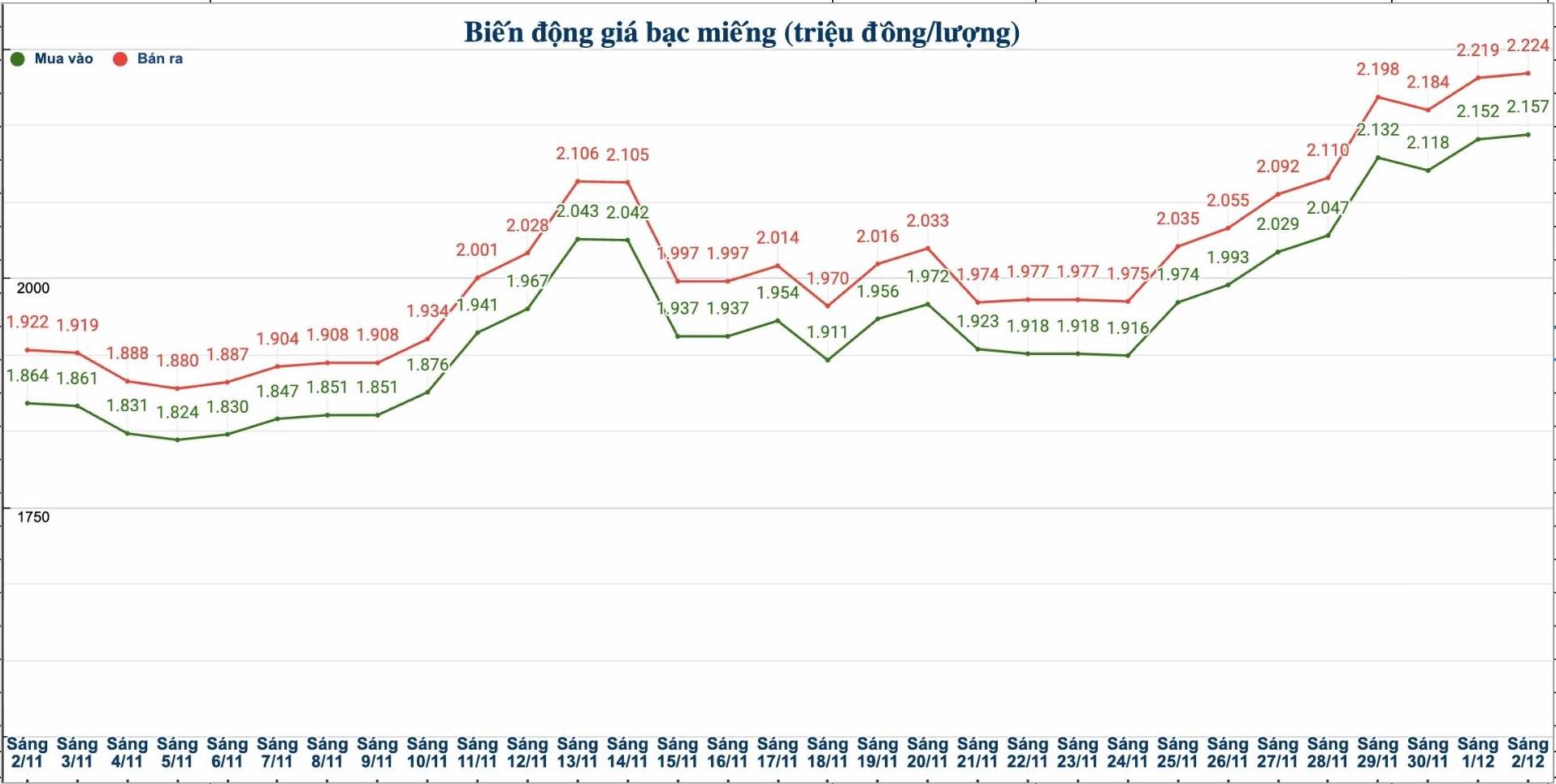

Updated silver price

As of 14:35 on December 2, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2.152 - 2.202 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 56.500 - 58.220 million VND/kg (buy - sell).

The price of 999 gold bars of the Golden Rooster Bank Limited (Sacombank-SBJ) is listed at VND 2.106 - 2.157 million/tael (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2.155 - 2.222 million/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 57.466 - 59.253 million VND/kg (buy - sell).

See more news related to silver prices HERE...