Economic data released this week continues to reinforce expectations of a US monetary policy easing. Meanwhile, the precious metals market has mixed developments: Silver is approaching a record high, while gold has adjusted after the previous hot increase.

The personal consumption expenditure (PCE) report released on Friday - an inflation measure prioritized by the US Federal Reserve (Fed) - showed a monthly increase of 0.3% and 2.8% over the same period, in line with analysts' forecasts. Core inflation (excluding energy and food prices) decreased slightly from 2.9% to 2.8%.

Although the decline is still slow, this data shows that the inflation trend continues to move closer to the Fed's 2% target.

Adding to the economic picture, the University of Michigan consumer sentiment index increased to 53.3 points. Notably, one-year inflation expectations fell to 4.1% and the five-year expectations remained steady at 3.2%. "This reflects people's belief that prices will cool down gradually - a factor that could directly affect the upcoming decision of the Fed," said Gary S. Wagner, a commodity brokerage and market analyst at Kitco.

The expert added that these data make the market more confident in the scenario of the Fed cutting interest rates at next week's meeting. According to CME's FedWatch tool, the possibility of the Fed cutting interest rates by 25 basis points is currently at 87.2% - although it has decreased slightly compared to the previous day.

"Remarkably, the market does not take into account the possibility of the Fed cutting sharply by 50 basis points, with a recorded probability of 0.00%. This is considered a somewhat cautious view, especially in the context of a clearly weakening labor market and continued signs of bearishness" - Gary S. Wagner added.

According to him, if the Fed suddenly "works harder" than this absolute expectation, the market could witness major fluctuations - something that has happened in many previous interest rate periods.

Regarding the price of precious metals, gold fell by 13.1 USD/ounce in the session on Friday, to 4,229.9 USD/ounce, bringing the total decrease of the week to 26.6 USD. Gold's adjustment after a new record high is considered a completely normal profit-taking and consolidation move.

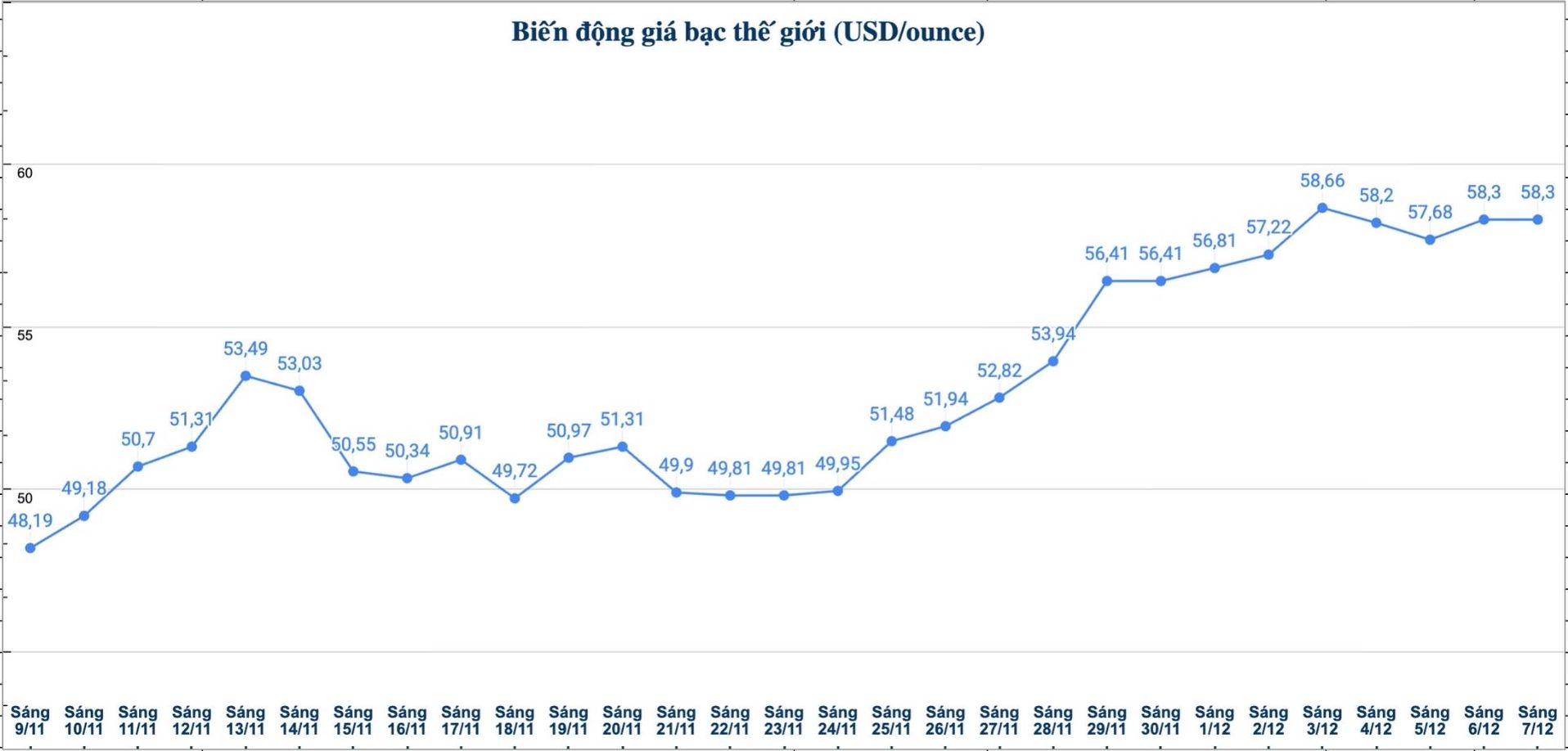

On the contrary, the silver market stood out with a strong uptrend. Despite a slight decrease, silver still increased by 1.43 USD per day (equivalent to 2.49%) and increased by nearly 2 USD for the whole week, trading around 58.93 USD/ounce.

Gary S. Wagner said that a question is being raised about whether silver will slow down when it reaches $60/ounce or continue to break out. Gold-siver ratio analysis shows a favorable trend for silver.

This rate has just broken the important support level at 72 - the level that has been a mainstay for many years. The nearest support areas are currently around 70 and 68 - 69, but it is likely that the rate will assess deeper areas, such as 65 or even 62" - Wagner commented.

Comparing the correlation with gold, Wagner said that silver is still priced lower. This shows that silver may have room to continue to increase, especially when prices are moving into areas that have never appeared before.

"As the market enters the final weeks of the year, as the Fed's decision is approaching and the prices of precious metals are at unprecedented highs, the volatility is expected to increase. This opens up both opportunities and risks for both traditional assets and alternative assets such as gold and silver, Gary S. Wagner stressed.

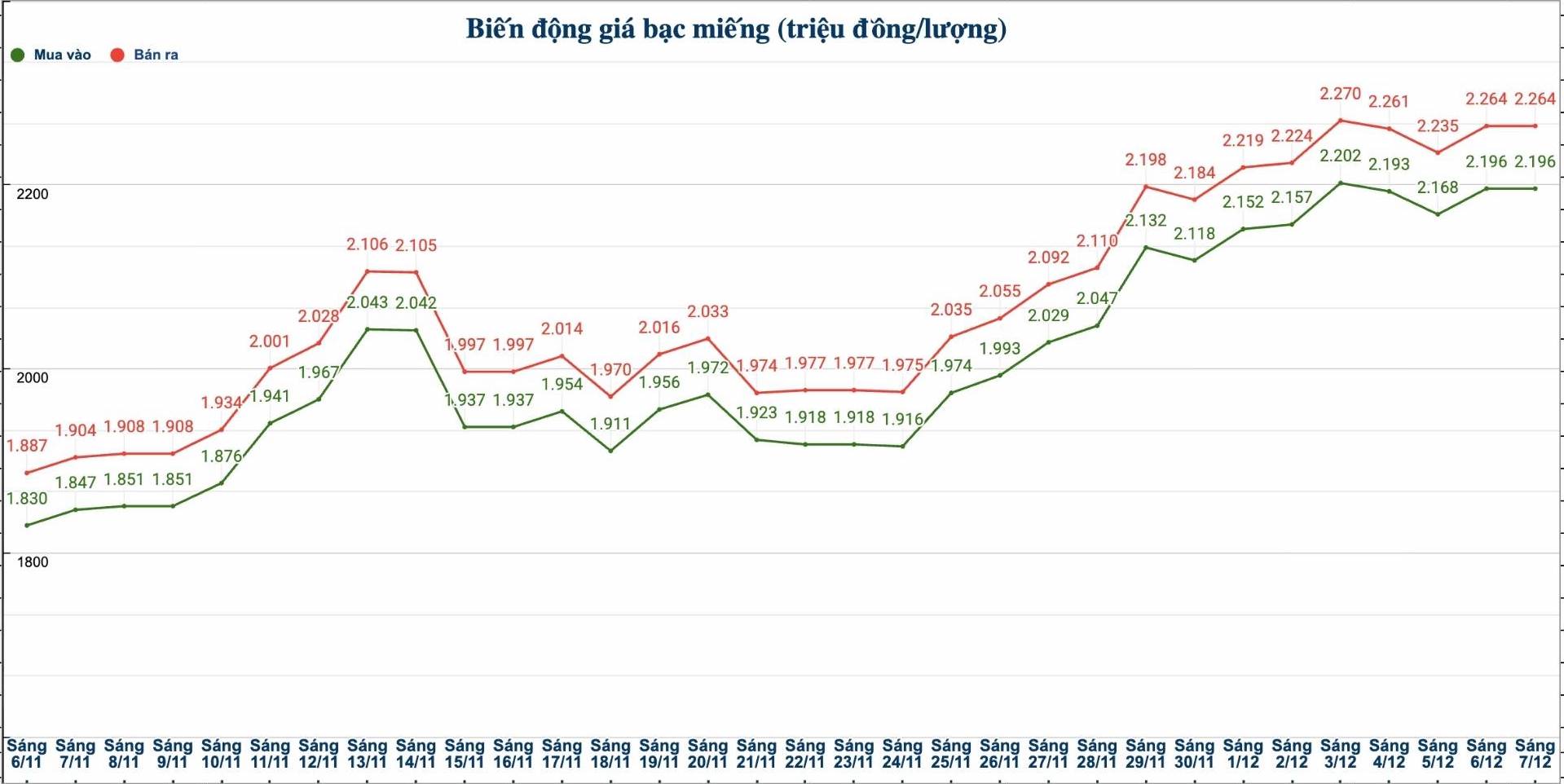

Updated silver price

As of 8:20 a.m. on December 7, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2.194 - 2.244 million/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 57.590 - 59.340 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND2.196 - 2.264 million/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 58.559 - 60.373 million VND/kg (buy - sell).

See more news related to silver prices HERE...