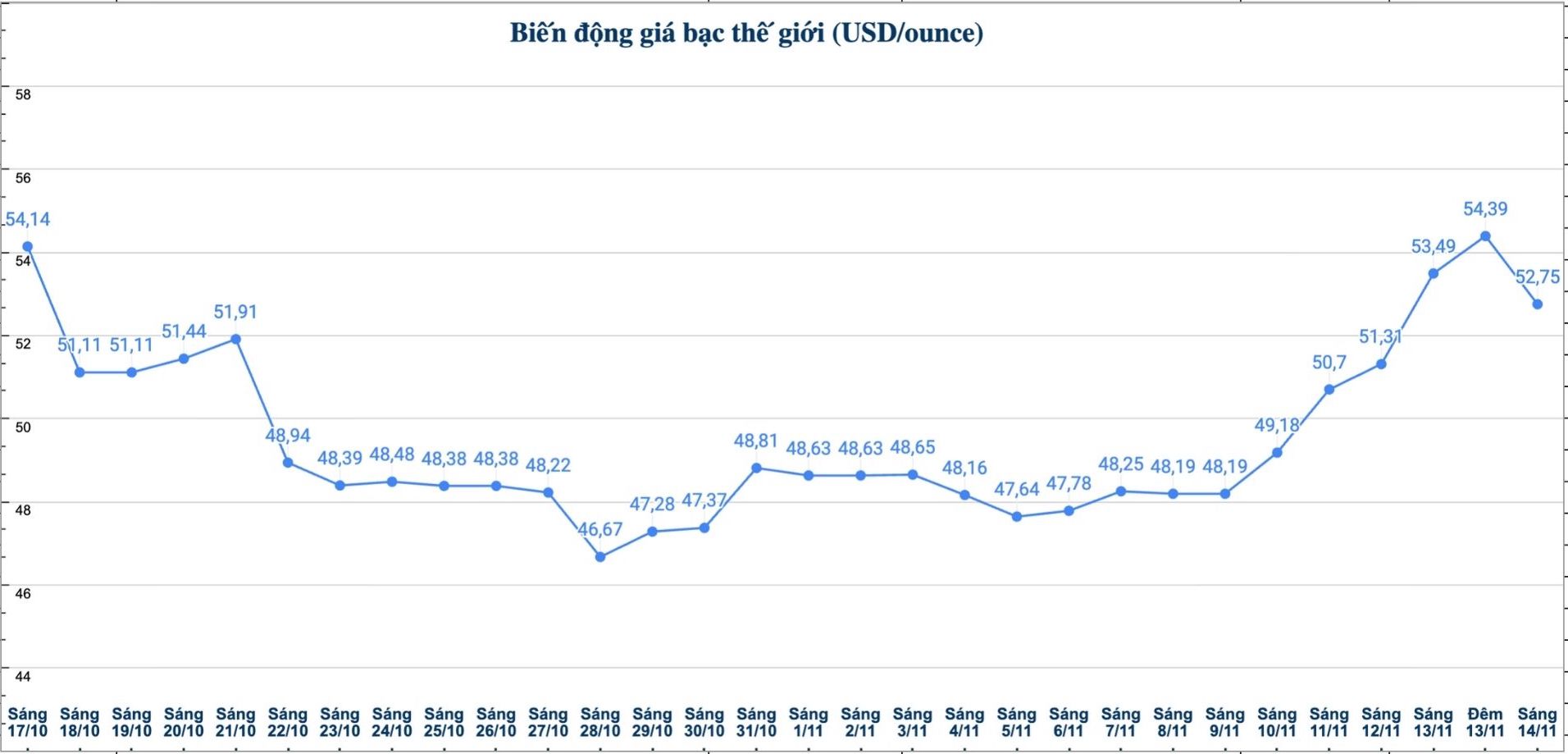

Silver prices have just experienced a volatile trading session as the market witnessed new selling pressure after reaching the important resistance level of 54 USD/ounce overnight. In the past 7 sessions, silver prices have recovered all their losses after a strong sell-off last month, causing prices to fall 16% in two weeks.

Overnight, spot silver prices increased to 54.39 USD/ounce; however, the market could not maintain the increase and was affected by the wave of North American sell-offs. As of 8:40 a.m. on November 14, the world silver price was listed at 52.75 USD/ounce, down nearly 1% after a day.

Although silver prices form an important double peak model on the technical chart, market sentiment is still quite optimistic. Jim Wyckoff - senior market analyst at Kitco - said that the recent sell-off was mainly normal profit-taking activities.

Meanwhile, Fawad Razaqzada - market analyst at FOREX.com - commented that silver will be bought when prices drop, but be careful with technical signals.

"This signal may not be accurate, so we should not rush to conclude that silver prices will fall sharply. Silver prices need to fall below $50/ounce to confirm a clear downtrend," said Mr. Razaqzada.

Analysts say the entire precious metals industry will benefit from expectations that the slowing economy will cause the US Federal Reserve (FED) to cut interest rates next month and last until the end of 2026.

Ole Hansen - Head of Commodity Strategy at Saxo Bank - commented: "Investors seek tangible assets supported by tight supply, especially in the US, when the focus of public debt returns when the government reopens".

He added that the recent recovery of silver has outperformed gold, with the gold-cement ratio falling to a five-year low of 79.59. In fact, in addition to the positive element of a monetary metal, silver is also benefiting as an important industrial metal, according to the US Geological Survey (USGS) classification in 2025.

Matthew piggott - Director of Gold and Silver at Metals Focus - said: "Even as the global economy slows, industrial demand continues to support silver. The situation of supply shortages that has lasted for the past year is unlikely to change in a short time. Only when the world economy is seriously recessioned will industrial demand decrease enough to balance the market".

Meanwhile, David Morrison - an analyst at Trade Nation - noted that although silver still has room for price increase, investors need to be cautious with its volatility. "The recent increase in scale and speed has raised concerns about the possibility of a downward correction. Silver continues to show unpredictable volatility, similar to gold" - David Morrison expressed his opinion.

As of 9:10 a.m. on November 14, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2.022 - 2.064 million/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 53,010 - 54.590 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.032 - 2.095 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at VND54.186 - 55.866 million/kg (buy - sell).

See more news related to silver prices HERE...