US inflation cools down as expected

According to the US Department of Commerce, the personal consumption expenditure (PCE) index - the Federal Reserve's preferred inflation measure in the latest month increased by 0.3% compared to the previous month and increased by 2.8% compared to the same period last year.

Core PCE decreased slightly from 2.9% to 2.8%, showing that inflationary pressures continued to cool down as expected by the market.

Meanwhile, the consumer confidence index published by the University of Michigan increased to 53.3 points. People's inflation expectations have also decreased, with 1-year inflation expectations at 4.1% and 5-year expectations at 3.2%.

The market is almost certain that the Fed will cut interest rates

From the above data, the market continues to bet strongly on the possibility of the Fed cutting interest rates by 25 basis points at the upcoming meeting. According to the CME FedWatch tool, the probability of this scenario is currently up to 87.2%, while the possibility of a 50 basis point cut is 0.

Analysts said that the market's failure to take into account the possibility of the Fed taking more drastic action is quite subjective, in the context of the labor market showing signs of weakening and inflation going down. If the Fed suddenly goes one step ahead, the financial market is likely to fluctuate strongly.

Gold Adjusts, Silver Sts New Peak

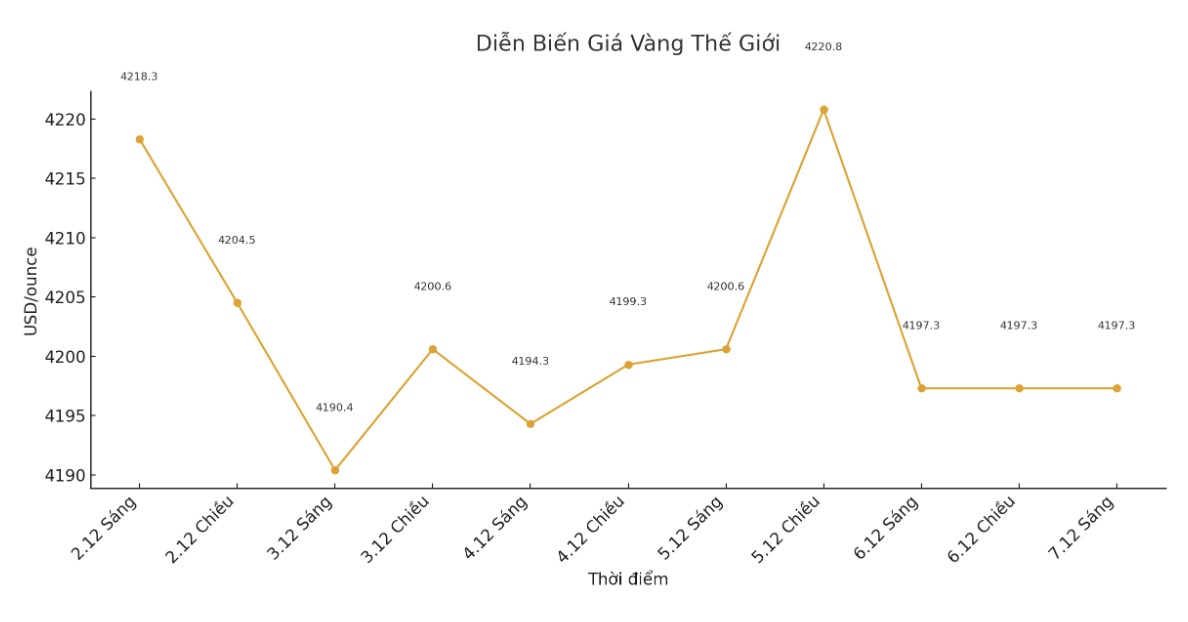

In the precious metals market, gold futures on Friday fell $13.1 or 0.31%, down to $4,229.9/ounce, bringing the total down last week to $26.6. This move is seen as a profit-taking activity after gold consecutively hit historical peaks.

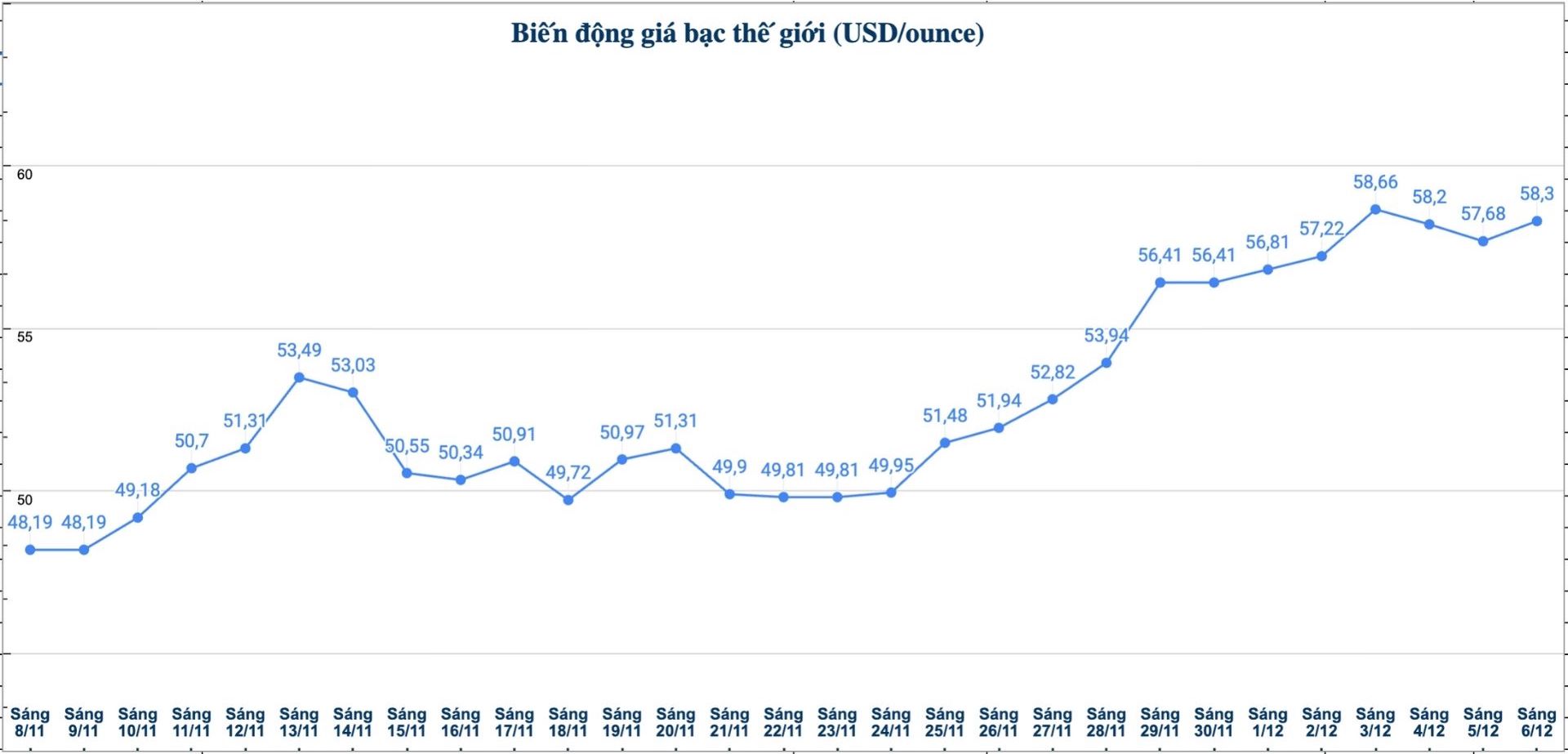

In contrast, silver prices continued to break out strongly, at one point setting a record of 69.9 USD/ounce. At the end of the trading session of the week, silver traded around 58.27 USD/ounce.

The ratio of gold - silver signaling is still in place to increase

According to technical analysis, the gold/ silwer price ratio has broken the important support level of 72, opening the possibility of continuing to decline to the 65-62 zone. This development shows that silver is still priced lower than gold, meaning there is still room for price increases.

Experts say that the continued narrowing of the gold- silk ratio could push silver prices to unprecedented price zones in history, especially in the context of global monetary policy gradually reversing towards easing.

The world gold - silver market operates through two main pricing mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.