Bitcoin price: Decreased

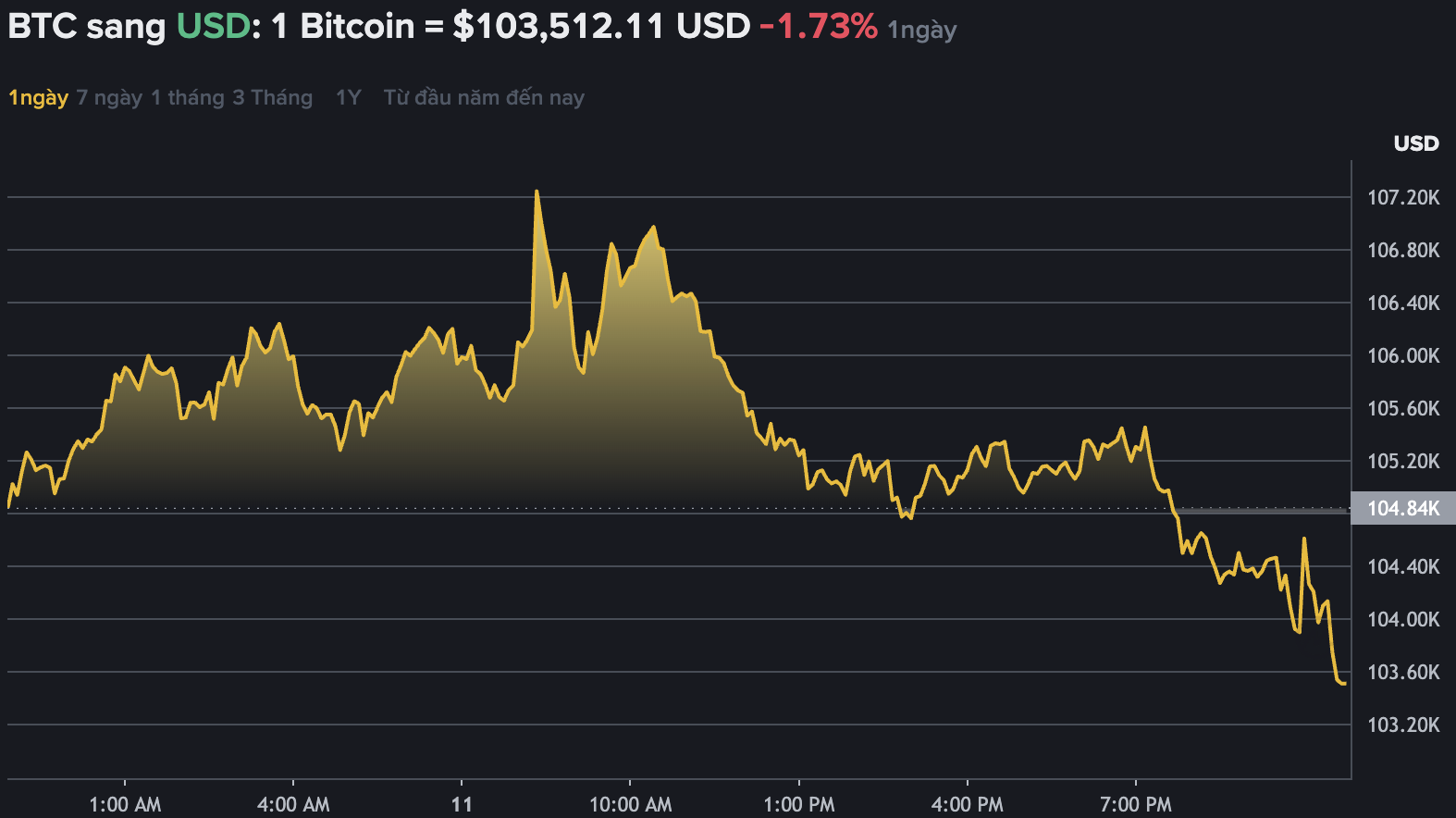

This morning (November 12), Bitcoin (BTC) - the world's largest cryptocurrency in terms of market value decreased by 1.73%, reaching 103,512.11 USD.

This new price contributes to bringing market capitalization to 2,064 billion USD, down 46 billion USD. In contrast, trading volume in the 24-hour reversal increased by 2.23 billion USD, reaching 71.41 billion USD.

Assessment and forecast

For any cryptocurrency, predicting developments in the next 4 weeks is already risky, not to mention 4 months or 4 years. But for Bitcoin, it is a different story.

Bitcoin typically follows a fixed 4-year cycle, marked by periods of extremely strong explosions and deep collapse. For more than a decade, this cycle has remained quite stable, so predicting Bitcoin's position based on theory in the next 4 years is entirely possible.

Every 4 years, Bitcoin goes through a halving event (half-cutting the block reward), which is the rate at which the new Bitcoin supply is created is cut by 50%. This increases the scarcity of Bitcoin and often leads to a strong price increase cycle lasting 12-18 months.

After that, prices collapsed deeply, then gradually recovered before entering the next halving cycle. This phenomenon has been clearly recorded and has almost become a "legend" in the Bitcoin community.

According to investment firm 21Shares, each halving cycle in the past has the same model:

Halving November 2012: Bitcoin price increased from 12 USD to 1,150 USD, then lost 85% of its value.

Halving July 2016: Increased from 650 USD to 20,000 USD, then decreased by 80%.

Halving May 2020: Increased from $700 to $69,000, then decreased by 75%.

After each explosive stage, there is a period of strong decline, accompanied by severe fluctuations.

After the halving event in April 2024, Bitcoin had an impressive increase, reaching 126,000 USD in October 2025.

It has been more than 18 months since the last halving, meaning the growth period may be coming to an end. Therefore, the recent sharp decline in Bitcoin prices to the 100,000 USD mark has many investors worried when recalling the three previous cycles, the price had lost 75-85% of its value.

Optimistics say Bitcoin will not collapse as strongly as before, as many reasons for the platform have changed:

Long-term investment from financial institutions into the market helps prices have a more solid foundation.

Short-term individual investors have given way to long-term cash flow, helping to reduce selling pressure.

The US presidential administration is pursuing a strong policy of supporting Bitcoin, leading to the possibility that this administration will turn its back on Bitcoin in the next few years being almost unlikely.

The next halving event is scheduled for in March 2028. If according to the old rules, the increase after halving will last 12-18 months, meaning that in 2029, Bitcoin could set a new historical peak. However, the road will not be flat, and there may still be a sharp decline before recovery.