Gold prices fell slightly on Tuesday as investors, after almost reflecting the possibility of the US Federal Reserve (Fed) cutting interest rates, continued to wait for signals that the central bank may implement a "smoother" easing cycle than expected when the two-day policy meeting began on the day.

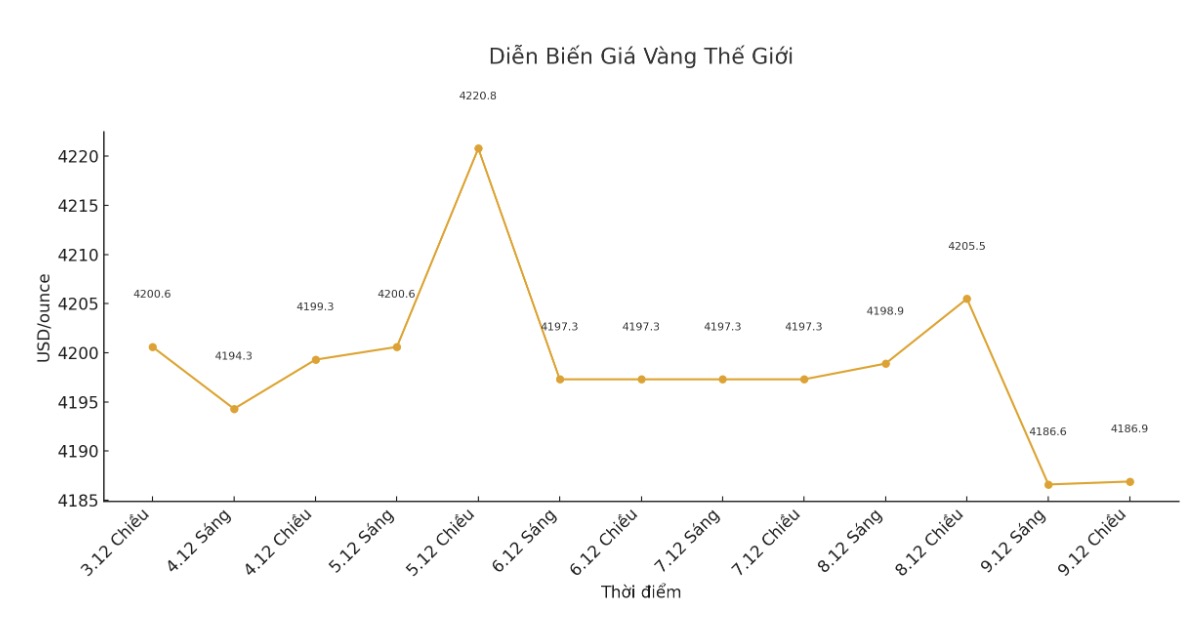

Spot gold prices fell 0.3% to $4,174.91/ounce as of 6:09 a.m. GMT. The December US gold futures fell 0.4% to $4,202.7 an ounce.

Senior market analyst Kelvin Wong at OANDA said that investors are mainly restructuring their positions ahead of the Fed's policy meeting.

Previously this month, Jerome Powell gave a hawkish signal about the direction of interest rate cuts at a press conference. Therefore, investors in the US Treasury bond market are adjusting their position," he said.

The yield on the 10-year US Treasury note remained near the 2-and-a-half-month peak reached on Monday.

Analysts widely expect a "tailgate rate cut" this week, along with orientations and forecasts that the Fed will set a very high standard before continuing to ease further next year.

Last week, data showed that the personal consumption expenditure (PCE) index - the Fed's preferred inflation measure - was in line with forecasts, while consumer sentiment improved in December.

Private sector employment in November recorded the sharpest decline in more than 2 and a half years, but the number of unemployment claims fell to a three-year low as of the week ending November 28.

According to CME's FedWatch tool, the market is currently pricing in an 89% chance that the Fed will cut interest rates by 0.25 percentage points at the December 9-10 meeting.

Low interest rates are often beneficial for non-yielding assets such as gold.

Meanwhile, silver prices fell 0.6% to $27.76/ounce, after hitting a record high of $29.32 on Friday.

Currently, silver is like a high beta asset in the precious metals group, Wong said, adding that low inventories, strong industrial demand and expectations of a Fed rate cut are fueling the metals rally, pushing it into a state of high risk and superiority over gold.

platinum fell 0.2% to $1,638.35, while palladium fell 0.4% to $1,459.78.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.