The US Commerce Department said on Wednesday that its core personal consumption expenditures (PCE) index rose 0.3% last month, matching September's increase. The data was in line with market expectations.

The report showed that over the past 12 months, core inflation increased by 2.8%, higher than the previously announced 2.7%.

The report also said headline inflation rose 0.2%, in line with expectations. On a year-on-year basis, inflation rose 2.3%, up from 2.1% in September.

Despite rising inflationary pressures, the report also noted that consumers saw significant wage gains. Personal income rose 0.6%, up from September's 0.2% gain and beating economists' expectations of a 0.4% gain.

Stephen Brown, Deputy Director of North American Economics at Capital Economics, said that the US Federal Reserve's (FED) interest rate policy is in a delicate balance, and attention should be paid to upcoming economic data.

“With the minutes of the Fed’s early November meeting suggesting some members may favor a pause if inflation remains high, upcoming CPI and PPI data will be key to the Fed’s decision next month,” said Mr. Brown.

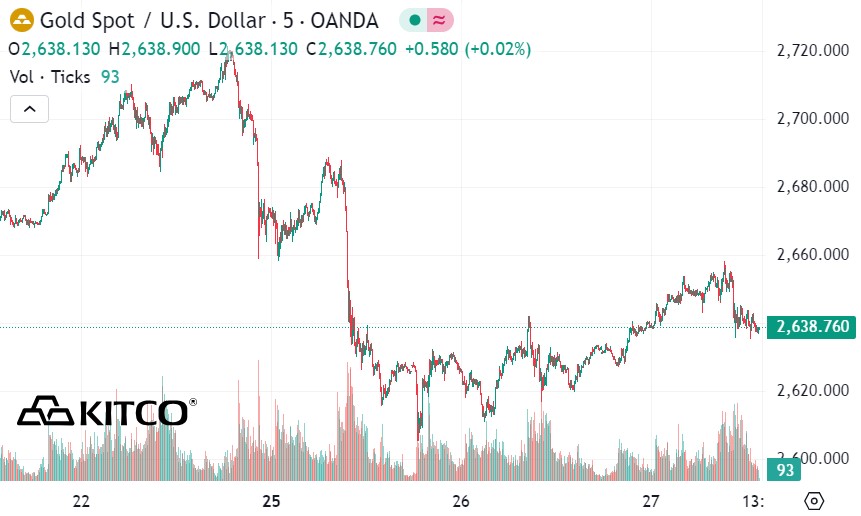

When inflation remains high, investors often choose gold as a safe haven asset, leading to an increase in gold prices. However, the current situation shows that gold prices have fallen as the market welcomes the US home sales report. This is due to expectations of a stable US economy and the possibility of the Fed keeping interest rates unchanged next month.

U.S. pending home sales rose 2% in October, putting pressure on the precious metals market. Hopes for stability in the U.S. housing market were bolstered as the number of prospective homebuyers rose more than expected last month, according to the latest data from the National Association of Realtors (NAR). The data far exceeded economists' forecasts.

“Momentum for homebuying is building after nearly two years of weak home sales,” said Lawrence Yun, NAR’s chief economist. “Although mortgage rates are rising slightly, despite the Fed’s decision to cut short-term lending rates in September, continued job growth and rising housing inventory are attracting more consumers to the market.”

Spot gold prices fell sharply immediately after the housing data was released. At the time of writing (1:00 a.m. on November 28 - Vietnam time), the world gold price listed on Kitco was at $2,638.7/ounce.

Economists pay special attention to pending home sales because the report is an important indicator of existing home sales, since contracts are often signed several months before a transaction is completed.