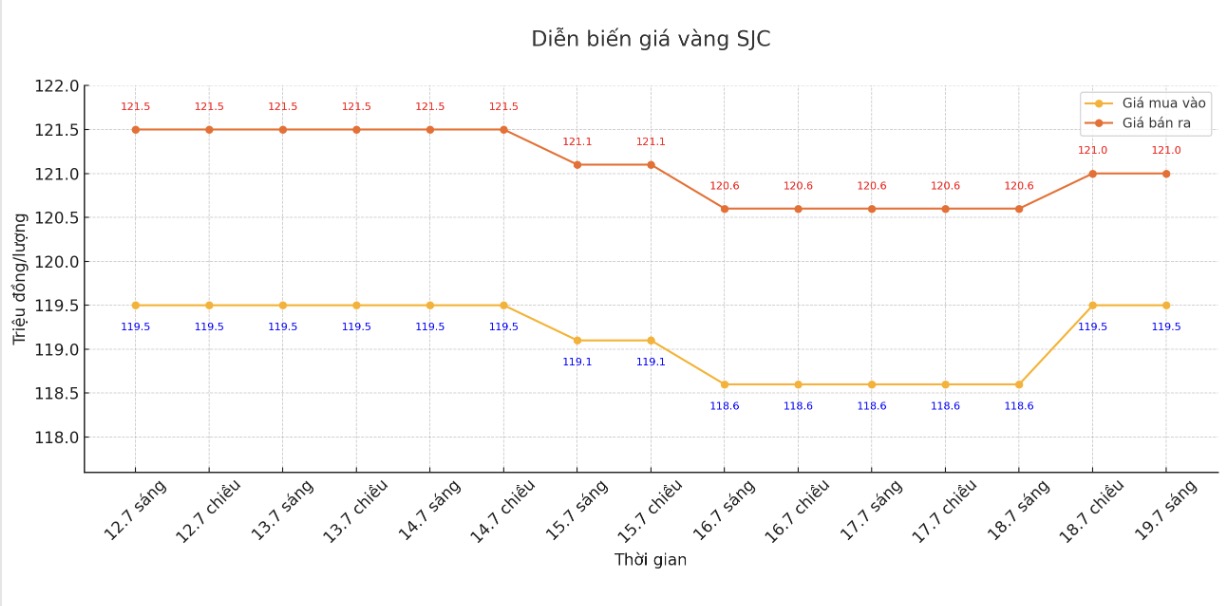

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND 119.5-121 million/tael (buy - sell), an increase of VND 900,000/tael for buying and an increase of VND 400,000/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.5-121 million/tael (buy - sell), an increase of VND 900,000/tael for buying and an increase of VND 400,000/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 118.721 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 400,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

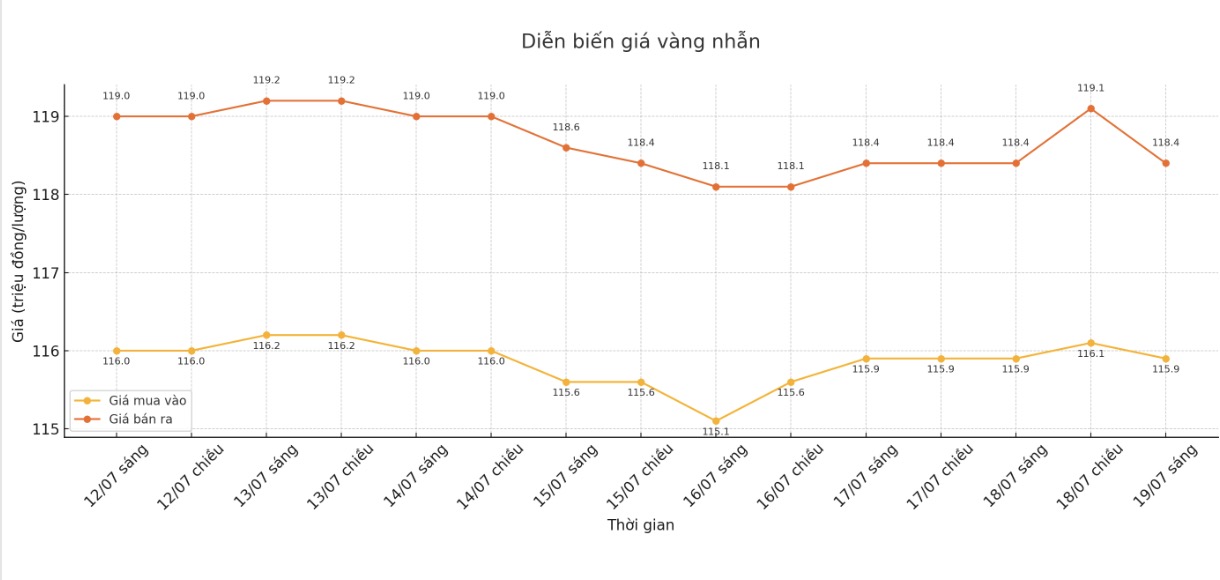

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 115.9-118.4 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.1-119.1 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.8-117.8 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

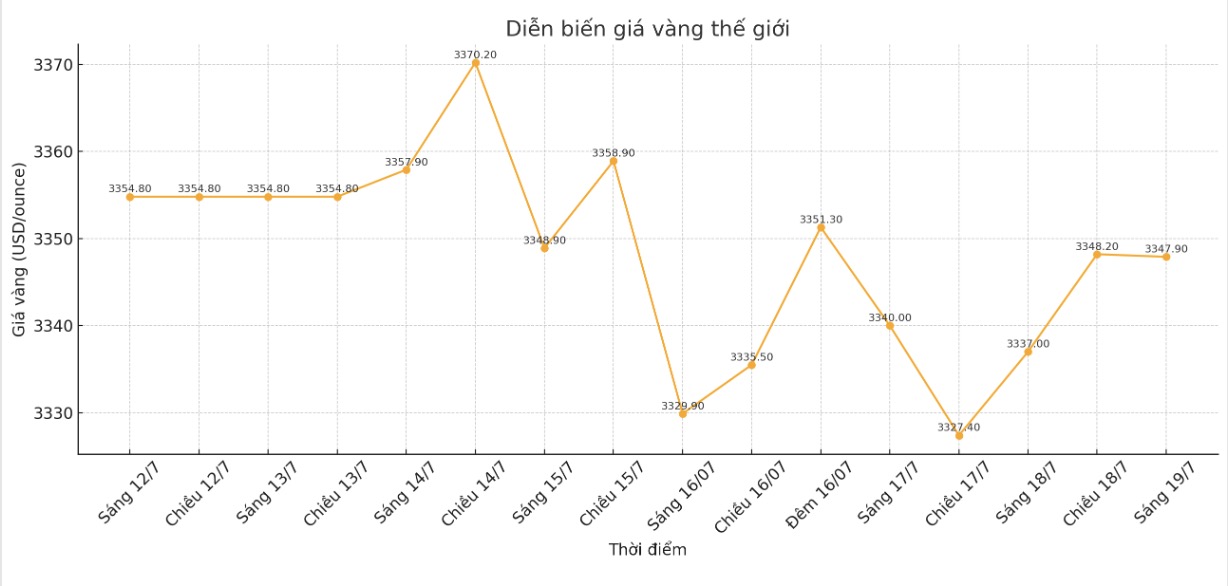

World gold price

At 9:05, the world gold price was listed around 3,347.9 USD/ounce, up 10.9 USD/ounce.

Gold price forecast

World gold prices tend to recover as two important US economic reports show positive signals.

According to a preliminary report from the University of Michigan, the US Consumer Psychology Index in July reached 61.8 points, higher than the forecast of 61.5 points and up from 60.7 points in June. This is the highest level in the past 5 months, but still 16% lower than December 2024 and below the historical average.

Ms. Joanne Hsu - Director of Consumer survey at the University of Michigan - commented: "Consular psychology has only increased slightly compared to last month. Although it reached a new high this year, consumers are still reserved and have not regained full confidence in the economy.

In another development, the US Department of Commerce also released data on the housing market, showing signs of recovery. The number of houses started in June increased by 4.6%, reaching a seasonal adjustment of 1.321 million units/year - 1.29 million units higher than the forecast. However, compared to the same period last year, housing construction activities still decreased by 0.5%.

The single-tension segment alone recorded a decrease of 4.6%, down to 883,000 units, lower than the 926,000 units in May after adjustment. Meanwhile, construction permits for future construction activities increased slightly by 0.2% to 1.397 million units, close to market forecasts.

Gold prices have increased after these two data were released.

Naeem Aslam - Investment Director of Zaye Capital Markets - commented that the current environment is especially favorable for gold prices, especially when confidence in the stability of US monetary policy is declining. According to him, if the US Federal Reserve (FED) begins to make a concession due to political pressure, gold prices could surpass the old peak and reach the $3,500/ounce mark in the short term.

In the first half of 2025, world gold prices have increased by 26% and set 26 new records, nearly approaching the 40-fold figure for the whole year of 2024.

Demand for gold across the market is rising strongly. Demand from exchanges and investment funds has skyrocketed, said the World Gold Council (WGC). The daily gold trading value in the first half of 2025 reached 329 billion USD, the second highest in history. Central banks continue to increase their gold reserves, although the buying price is not as high as in previous quarters.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...