Update SJC gold price

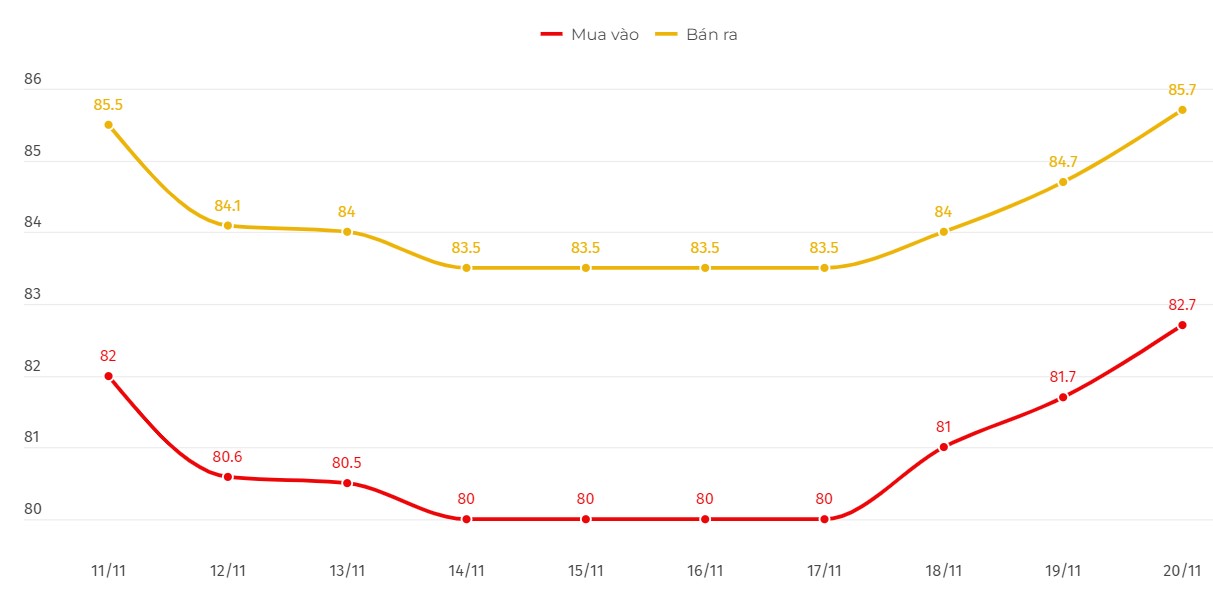

As of 9:30 a.m., the price of SJC gold bars was listed by DOJI Group at 82.7-85.7 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at DOJI increased by 700,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 3 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82.7-85.7 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC increased by 700,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83-85 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 3 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 3 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

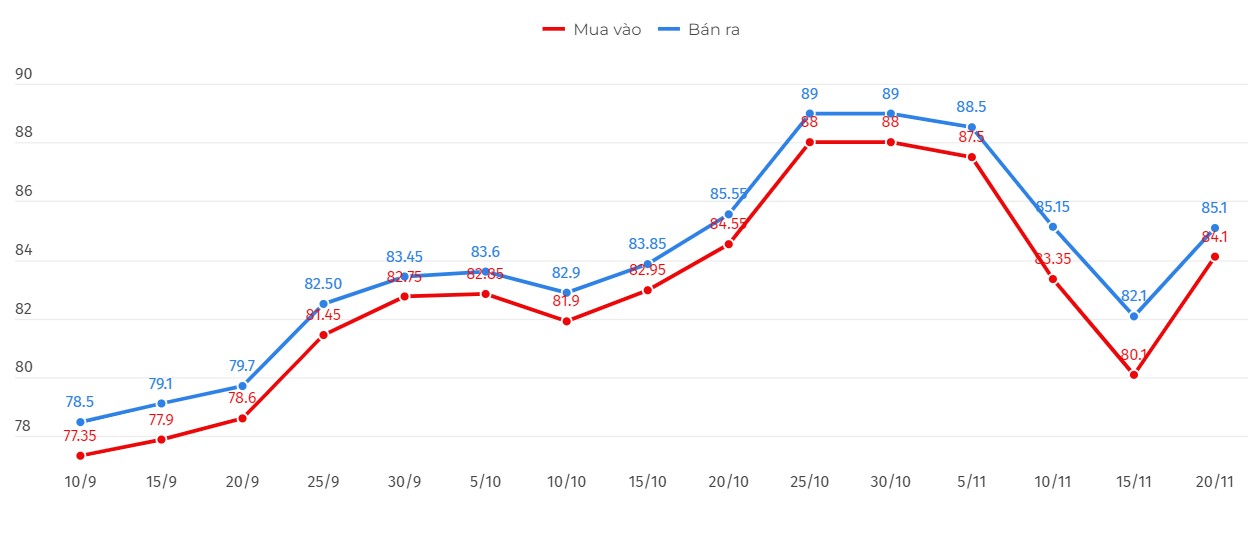

Price of round gold ring 9999

As of 9:35 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.1-85.1 million VND/tael (buy - sell); an increase of 1.4 million VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.88-84.78 million VND/tael (buy - sell), an increase of 1.65 million VND/tael for buying and 1.1 million VND/tael for selling compared to early this morning.

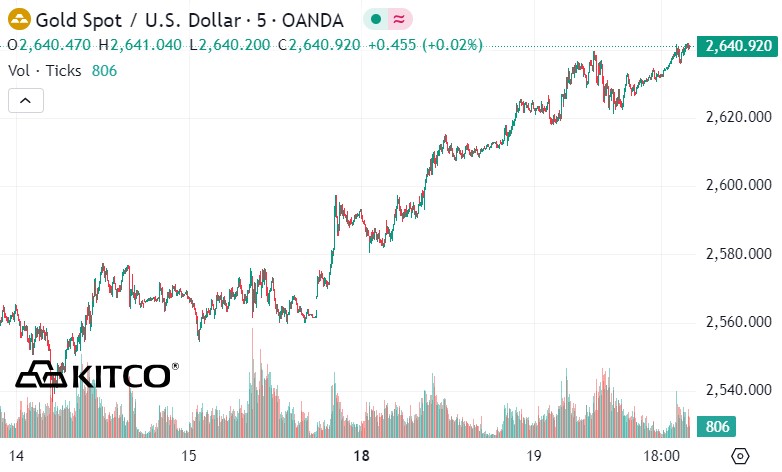

World gold price

As of 9:48 a.m., the world gold price listed on Kitco was at 2,640.9 USD/ounce, up 25 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices jumped strongly as the USD fell. Recorded at 9:48 a.m. on November 20, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106,120 points.

After 6 days of sell-off, the gold market seems to be finding its footing again as prices rise back above 2,600 USD/ounce.

Gold prices rose to a multi-session high after the latest U.S. housing construction data fell more than expected last month, according to Kitco.

The Commerce Department reported Tuesday that housing starts fell 3.1% in October to a seasonally adjusted annual rate of 1.311 million units. The data was worse than expected, with economists predicting a smaller decline to a seasonally adjusted annual rate of 1.330 million units.

In addition to US economic data, geopolitical tensions tend to escalate in some regions, which is driving money flows into gold. The focus this time is the information that US President Joe Biden for the first time allows Ukraine to use long-range missiles provided by the US to attack Russian territory - according to the New York Times.

In response to this information, Russia has issued a stern warning to the US and its allies, stating that any use of long-range missiles by Ukraine to strike deep into Russian territory would mean that Western powers are directly involved in the conflict - according to Reuters.

Although the White House neither confirmed nor denied this information, the possibility of such a policy change has caused a strong reaction from Moscow.

With geopolitical tensions on the rise, Kitco senior analyst Jim Wyckoff said that safe-haven demand is increasing, driving buying of precious metals. Strong risk-off sentiment is benefiting gold prices.

Even after a lengthy sell-off, the gold market remains in a solid uptrend and is still on track to end the year in his bullish scenario, said George Milling-Stanley, chief gold strategist at State Street Global Advisors.

Earlier this summer, Milling-Stanley raised its year-end gold price forecast to between 2,500 USD/ounce and 2,700 USD/ounce.

“I was a little shocked by the severity of the gold sell-off, but I don’t think it’s sustainable. After seeing a 33% gain this year, I don’t think investors should be too worried about this sell-off,” he said.

See more news related to gold prices HERE...