Update SJC gold price

As of 8:45 a.m., the price of SJC gold bars was listed by DOJI Group at 83.7-86.2 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at DOJI increased by 1 million VND/tael for buying and increased by 500,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83.7-86.2 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC increased by 1 million VND/tael for buying and increased by 500,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83-85 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 3 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

Price of round gold ring 9999

As of 8:45 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.6-85.6 million VND/tael (buy - sell); an increase of 500,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 84.33-85.28 million VND/tael (buy - sell), an increase of 450,000 VND/tael for buying and 500,000 VND/tael for selling compared to early this morning.

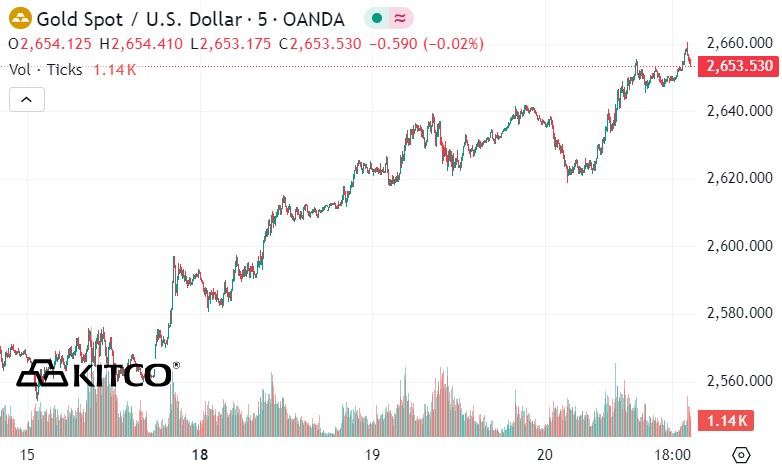

World gold price

As of 8:25 a.m., the world gold price listed on Kitco was at 2,653.5 USD/ounce, up 12.6 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices jumped strongly as the USD fell. Recorded at 8:30 a.m. on November 21, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.527 points (down 0.06%).

Gold prices rose due to increased demand for buying at the bottom amid rising tensions between Russia and Ukraine. President-elect Donald Trump is unlikely to end the Ukraine conflict soon after taking office on January 20.

According to Kitco - Gold's recovery after a significant sell-off last week has been fueled by a growing number of analysts asserting that the precious metal's rally is not over yet.

Earlier this week, Goldman Sachs reiterated its forecast for gold prices to hit $3,000 an ounce. Notably, they are not the only ones predicting record highs by 2025.

“The recent decline in gold prices is just a correction, not a reason to adjust the forecast,” Julia Khandoshko, CEO of European brokerage Mind Money, said in a comment to Kitco News.

Khandoshko said it was “just a matter of time” before gold prices returned to their all-time high of $2,800 an ounce last month. She said she expected gold prices to hit $3,000 an ounce by 2025.

Investors are also focused on a number of Federal Reserve officials scheduled to speak this week. Market expectations for a December rate cut have fallen sharply, with the odds now at 55.7%, down from 82.5% just a week ago.

ANZ said the Fed's pause in rate cuts in December could keep gold prices in check in the short term, but the loose monetary cycle, macroeconomic and geopolitical uncertainty, and physical demand will maintain bullish sentiment in the gold market.

See more news related to gold prices HERE...