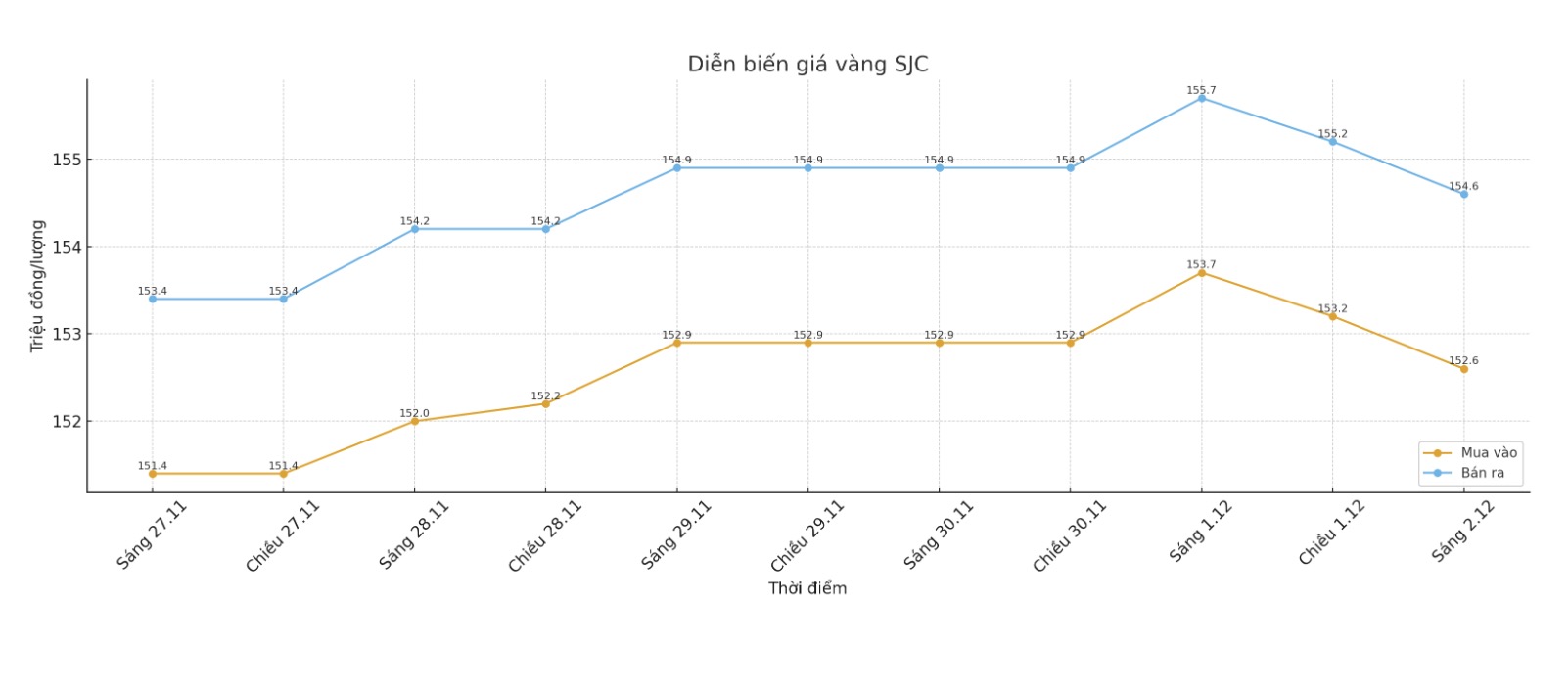

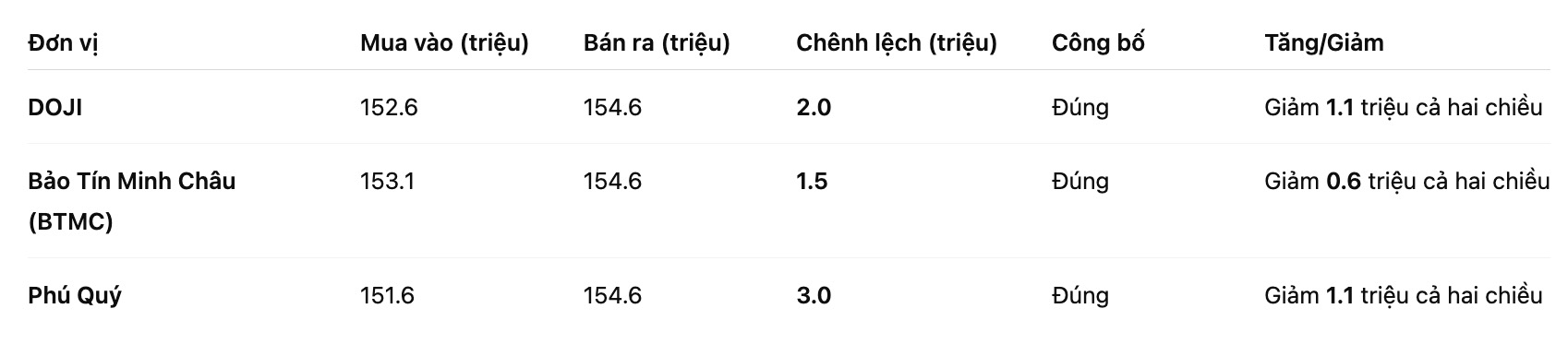

Updated SJC gold price

As of 9:15 a.m., DOJI Group listed the price of SJC gold bars at VND152.6-154.6 million/tael (buy in - sell out), down VND1.1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153.1-154.6 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.6-154.6 million VND/tael (buy - sell), down 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

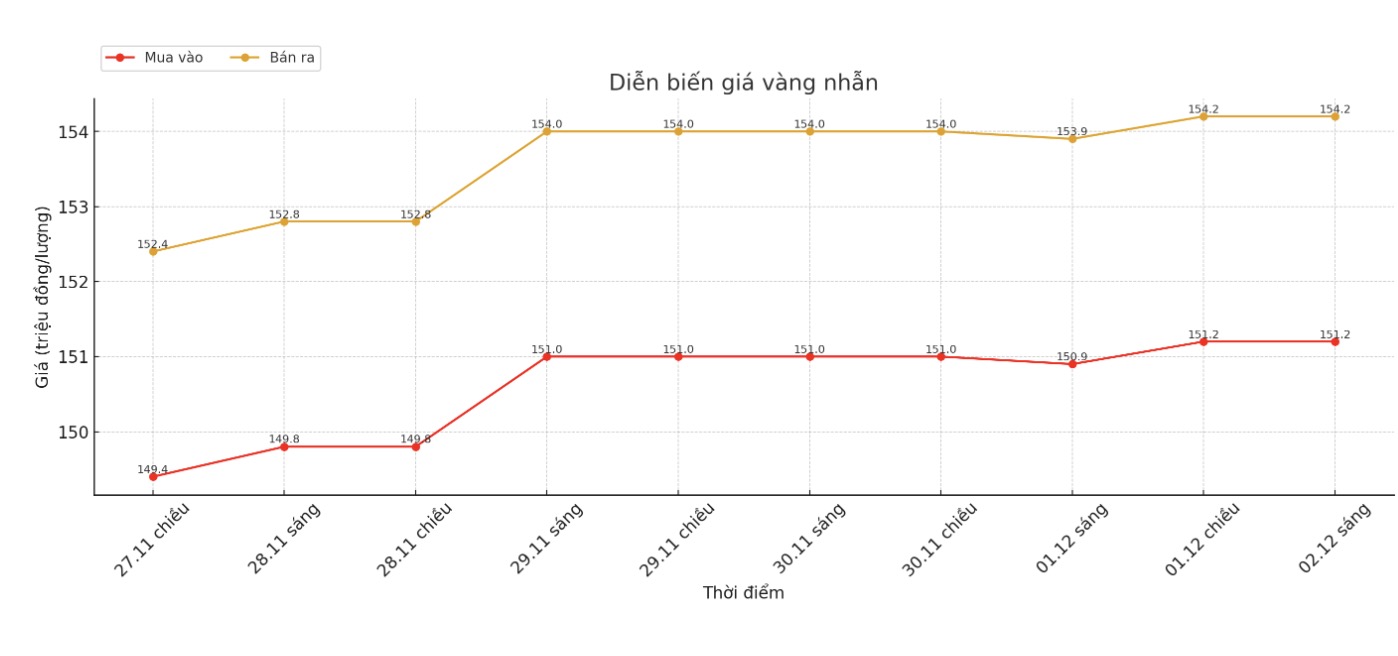

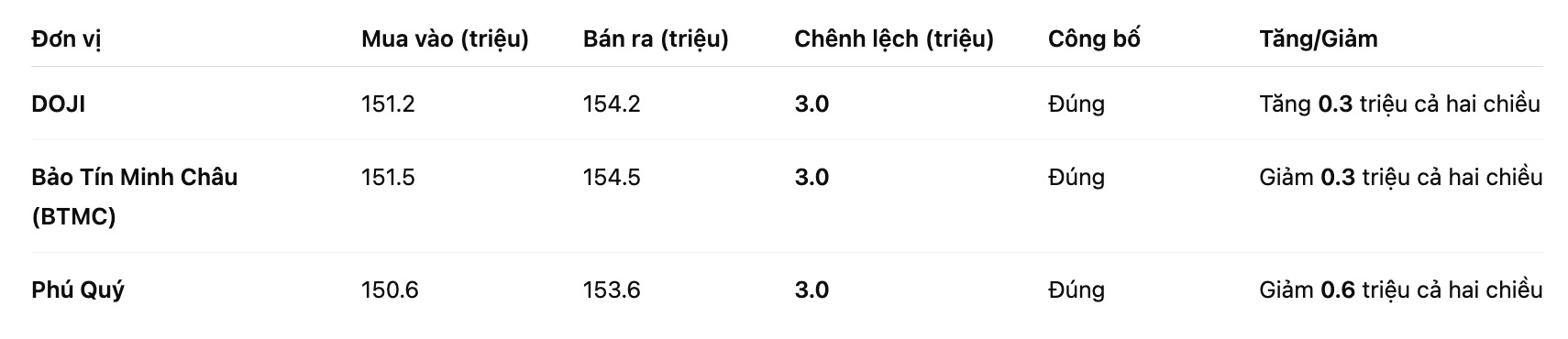

9999 round gold ring price

As of 9:15 a.m., DOJI Group listed the price of gold rings at 151.2-154.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151.5-154.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

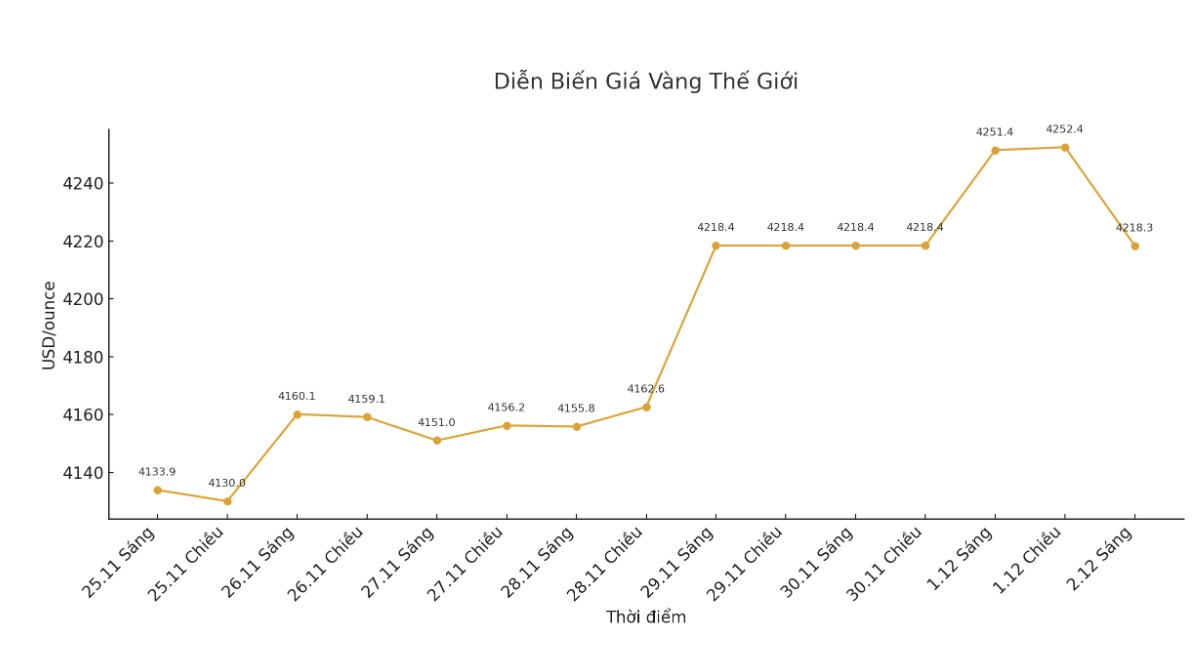

World gold price

At 9:15 a.m., the world gold price was listed around 4,218.3 USD/ounce, down 33.1 USD compared to a day ago.

Gold price forecast

Gold prices turned slightly down after reaching a six-week high. The precious metal is facing a profit-taking wave, but remains at a high level above $4,200/ounce.

Gold prices are anchored high as safe-haven demand appears amid a global bond market reeling originating from Japan. The global stock market mainly fell overnight. US stock indexes are expected to open sharply down when the trading session in New York begins. Concerns about the Japanese bond market make traders and investors cautious as they enter the new week and month.

The precious metals market received support when the latest data showed that the US manufacturing sector weakened last month. The Institute for Supply Management (ISM) announced on Monday that the manufacturing purchasing managers' index (PMI) fell to 48.2 in November, from 48.7 in October. This was lower than expected, as economists expected 48.6.

Ms. Susan Spence - Chairwoman of ISM's Business survey committee said: "In November, US manufacturing activity declined more rapidly, with a decline in supplier delivery speeds, new orders and employment leading to a 0.5 percentage point decrease in the Manufacturing PMI. Following the recent trend, the improvement of the index last month was reflected in another index this month.

This week, the market is waiting for a series of important information including the ADP jobs report for November on Thursday and the PCE index for September scheduled to be released on Friday. The speech of US Federal Reserve Chairman Jerome Powell attracted a lot of attention, expected to bring suggestions on the upcoming policy orientation. In addition, the possibility of the US having a new Fed Chairman with a more open mind is further reinforcing expectations for gold prices to maintain an upward trend.

Technically, the next target for buyers on February gold contracts is to close above the strong resistance level at a record $4,433/ounce. The target for the sellers is to pull the price below the solid support zone at 4,000 USD/ounce.

The first resistance level was at 4,300 USD/ounce, then 4,350 USD/ounce. The first support level was at the night bottom of $4,241.1 an ounce, followed by $4,200 an ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...