Updated SJC gold price

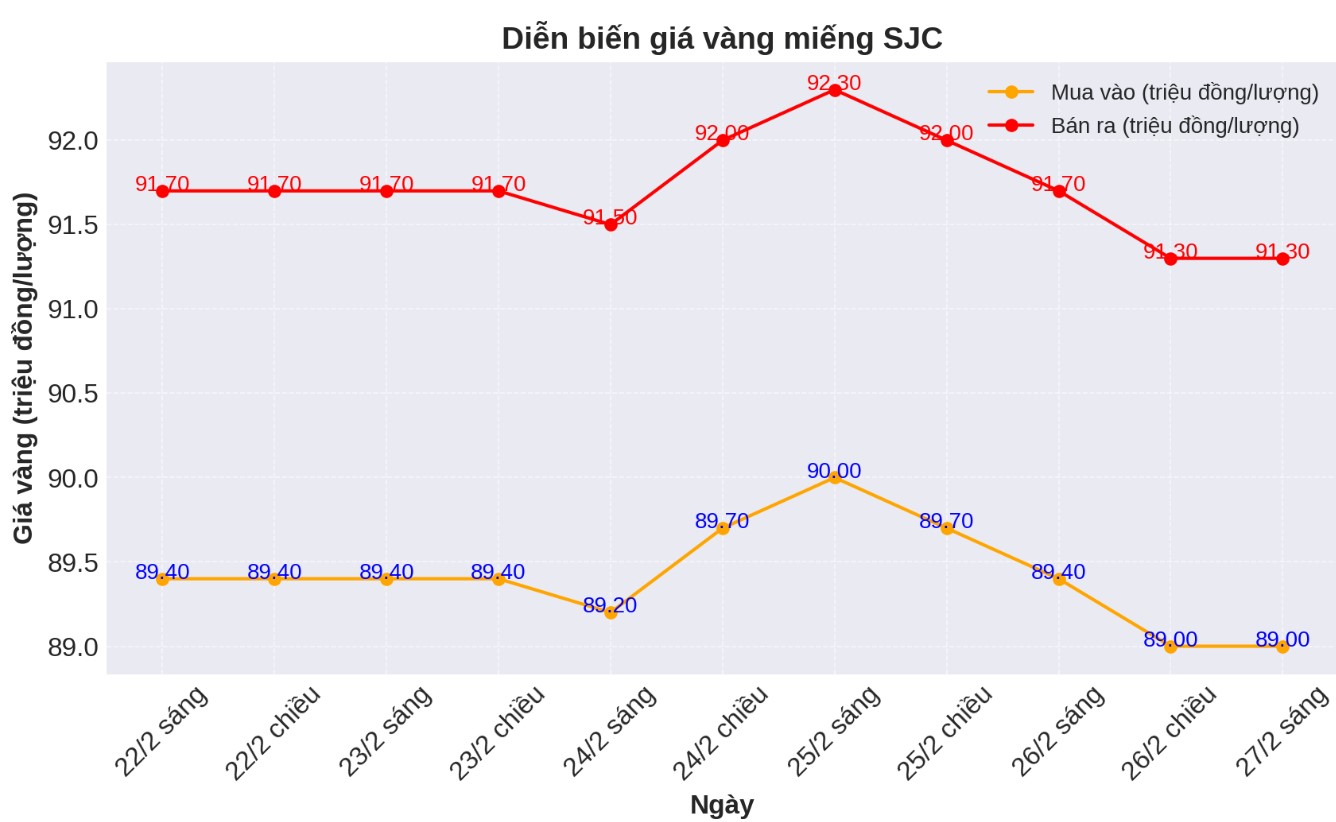

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND89.2-91.5 million/tael (buy in - sell out), unchanged in both buying and selling directions.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 89-91.3 million VND/tael (buy - sell), down 400,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at 89.5-91.5 million VND/tael (buy - sell); down 200,000 VND/tael for both buying and selling.

The difference between buying and selling SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

9999 round gold ring price

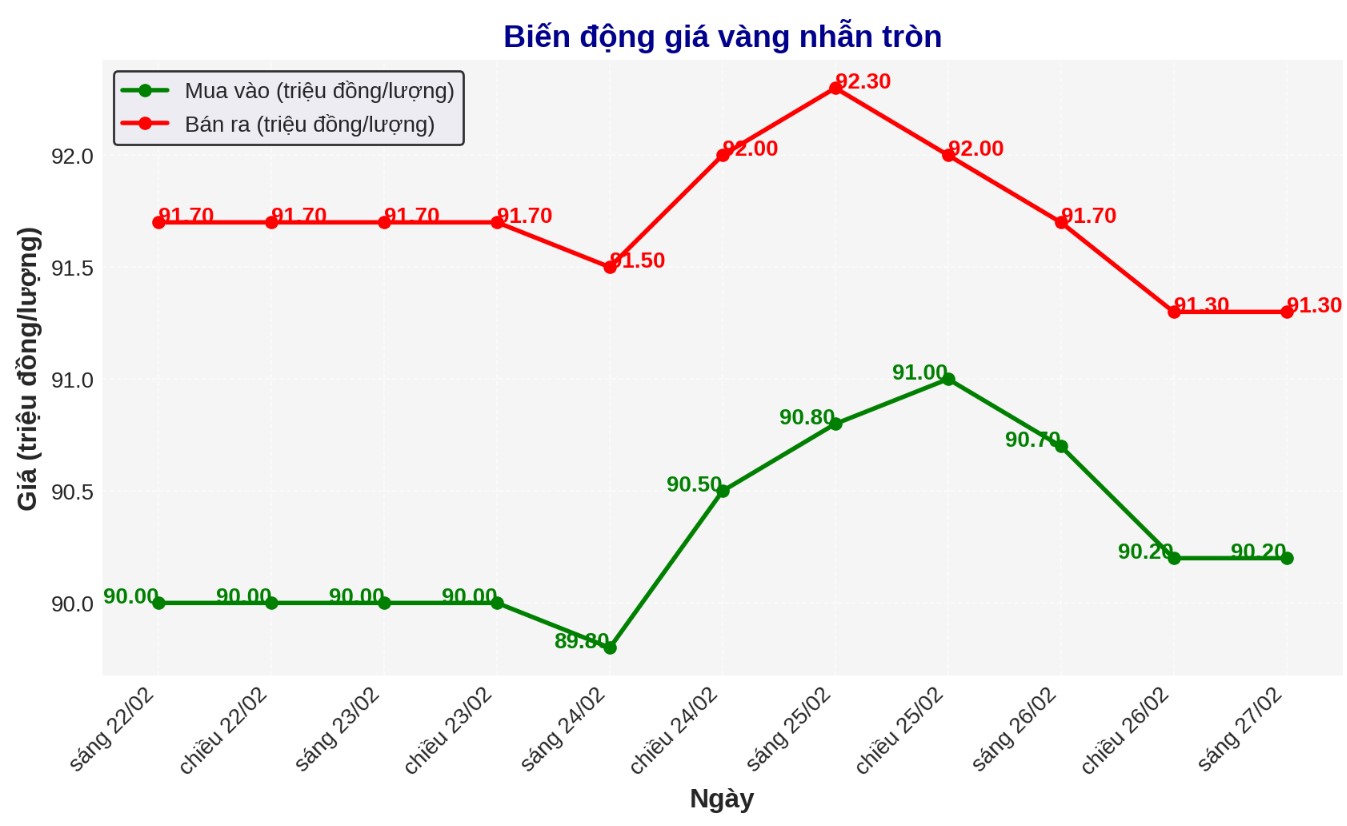

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 90.2-91.3 million VND/tael (buy - sell); down 500,000 VND/tael for buying and down 400,000 VND/tael for selling compared to early this morning.

The difference between buying and selling is at 1.1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.3-92 million VND/tael (buy - sell), keeping the same for buying and increasing 200,000 VND/tael for selling compared to early this morning.

The difference between buying and selling is at 1.7 million VND/tael.

World gold price

As of 9:00 a.m., the world gold price listed on Kitco was at 2,912.6 USD/ounce, down 4.7 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices fell amid an increase in the USD. Recorded at 9:00 a.m. on February 27, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.510 points (up 0.09%).

The precious metal has fallen due to the unpredictable tariff policies of US President Donald Trump but is still anchored at a high level for this reason.

On February 25, Mr. Trump directed research on the possibility of applying new tariffs on imports to rebuild the production of important US metals for electric vehicles, military equipment, power grids and many other consumer goods. He also said he would soon expand his trade war to include a 25% tariff on goods from the European Union (EU)...

Investors are waiting for the US personal consumption expenditure (PCE) report, a favorite inflation measure of the Federal Reserve (FED), due on February 28. How can inflation affect the Fed's interest rate policy this year and impact the trend of precious metals?

According to David Meger, Director of Metals Trading at High Ridge Futures, the upward trend in gold prices is still occurring. We are not surprised that prices tend to stabilize ahead of some important data, Meger said.

Higher-than-expected inflation could strengthen the likelihood that the US Central Bank will continue to delay further interest rate cuts. Meger added that, as one of the key hedge against inflationary pressures, gold will increase in price more.

Frank Watson, market analyst at Kinesis Money, said that the recent rally, bringing gold closer to the $3,000/ounce mark, seems to have stagnated, showing that some traders have seized the opportunity to take profits.

He also stressed that central bank behavior will be key to gold's growth, as it has been a key factor driving demand in recent years.

See more news related to gold prices HERE...